Investors Appear Satisfied With Eutelsat Communications S.A.'s (EPA:ETL) Prospects As Shares Rocket 30%

Eutelsat Communications S.A. (EPA:ETL) shares have had a really impressive month, gaining 30% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.9% over the last year.

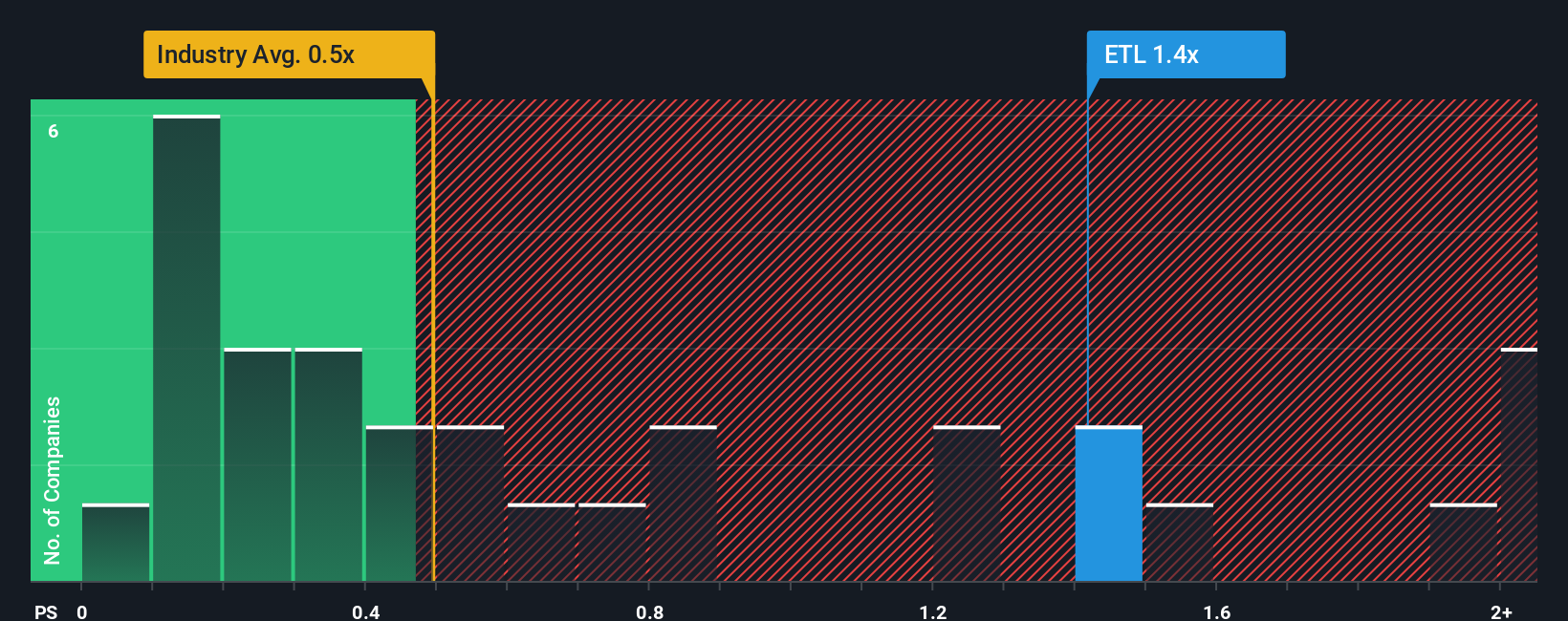

Following the firm bounce in price, you could be forgiven for thinking Eutelsat Communications is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.4x, considering almost half the companies in France's Media industry have P/S ratios below 0.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Eutelsat Communications

What Does Eutelsat Communications' Recent Performance Look Like?

Eutelsat Communications could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Eutelsat Communications' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Eutelsat Communications would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 2.5%. Revenue has also lifted 8.0% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue growth will show minor resilience over the next three years growing only by 2.6% per year. While this isn't a particularly impressive figure, it should be noted that the the industry is expected to decline by 0.1% each year.

With this information, we can understand why Eutelsat Communications is trading at such a high P/S compared to the industry. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

The Bottom Line On Eutelsat Communications' P/S

Eutelsat Communications' P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We can see that Eutelsat Communications maintains its high P/S on the strength of its forecast growth potentially beating a struggling industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Questions could still raised over whether this level of outperformance can continue in the context of a a tumultuous industry climate. Otherwise, it's hard to see the share price falling strongly in the near future under the current growth expectations.

Having said that, be aware Eutelsat Communications is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Eutelsat Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ETL

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives