- Italy

- /

- Real Estate

- /

- BIT:TCM

European Market Insights: Tecma Solutions And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

The European market has recently seen mixed performance, with the pan-European STOXX Europe 600 Index ending slightly lower amid global growth concerns. Despite these challenges, certain sectors continue to offer intriguing opportunities for investors willing to explore beyond traditional large-cap stocks. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies with potential for growth at attractive price points. In this article, we will explore three promising penny stocks in Europe that may present unique opportunities for those looking to capitalize on undervalued assets with strong financial foundations.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.188 | €1.45B | ✅ 5 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €241.45M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.07 | PLN107.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €5.00 | €40.54M | ✅ 3 ⚠️ 3 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.02 | €9.58M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.30 | €380.05M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.78 | €74.3M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.085 | €288.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.926 | €31.23M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 331 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Tecma Solutions (BIT:TCM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tecma Solutions S.p.A. is a tech company that develops technology and digital content for real estate businesses, with a market cap of €19.97 million.

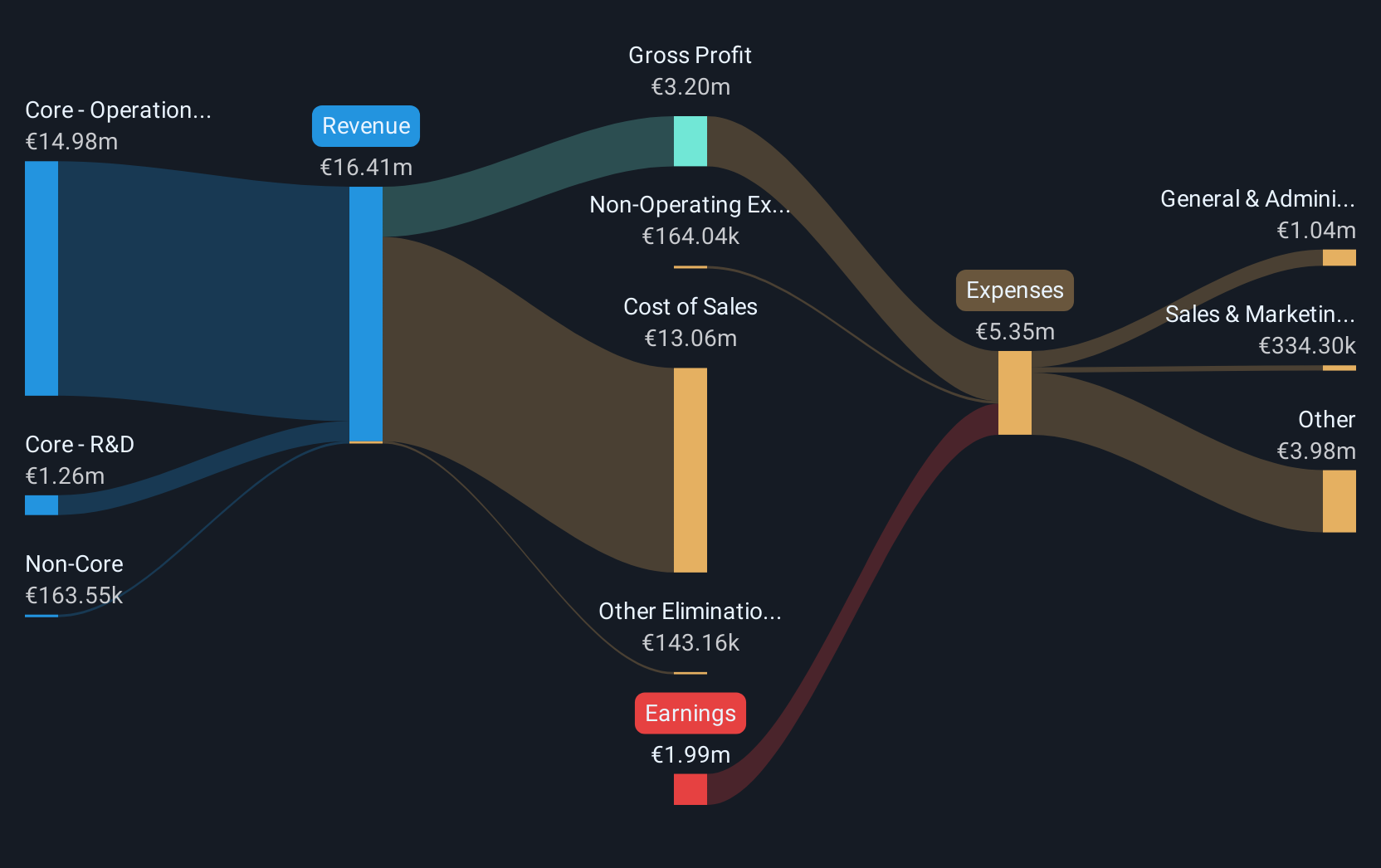

Operations: Tecma Solutions S.p.A. generates its revenue primarily from Core Operations (€14.98 million) and Core R&D (€1.26 million), with a smaller contribution from Non-Core activities (€0.16 million).

Market Cap: €19.97M

Tecma Solutions S.p.A., with a market cap of €19.97 million, generates revenue primarily from its core operations and R&D activities. Despite being unprofitable, the company has reduced its net loss significantly over the past year to €1.99 million from €7.7 million, while revenues increased to €16.41 million. The firm's net debt to equity ratio is high at 57.9%, but it maintains a positive cash flow with a runway exceeding three years if growth continues steadily at 1.6% annually. Its short-term assets cover both short and long-term liabilities, though share price volatility remains elevated compared to most Italian stocks.

- Get an in-depth perspective on Tecma Solutions' performance by reading our balance sheet health report here.

- Explore Tecma Solutions' analyst forecasts in our growth report.

Compa (BVB:CMP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Compa S.A. manufactures and sells parts and accessories for motor vehicles and engines in Romania, with a market cap of RON121.49 million.

Operations: The company generates revenue of RON553.30 million from its Auto Parts & Accessories segment.

Market Cap: RON121.49M

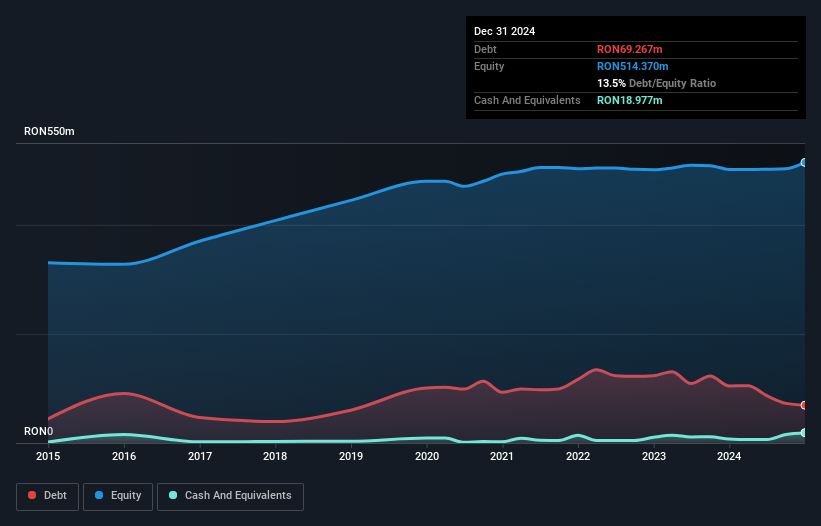

Compa S.A., with a market cap of RON121.49 million, has faced recent challenges as evidenced by its half-year earnings report showing a decline in sales and revenue to RON258.83 million and RON282.35 million respectively, alongside a net loss of RON5.54 million. Despite being unprofitable, the company maintains financial stability with short-term assets exceeding both short-term (RON104.9M) and long-term liabilities (RON79.2M). Its debt is well-managed with operating cash flow covering 86.6% of it, while the net debt to equity ratio stands satisfactorily at 10.1%. The experienced management team adds resilience amidst current volatility challenges.

- Unlock comprehensive insights into our analysis of Compa stock in this financial health report.

- Gain insights into Compa's past trends and performance with our report on the company's historical track record.

Reworld Media Société Anonyme (ENXTPA:ALREW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Reworld Media Société Anonyme operates in the thematic media sector in France and has a market capitalization of €96.12 million.

Operations: Reworld Media Société Anonyme generates revenue through two primary segments: B to B, accounting for €308.6 million, and B to C, contributing €226.1 million.

Market Cap: €96.12M

Reworld Media Société Anonyme, with a market cap of €96.12 million, operates within the thematic media sector and faces challenges typical for penny stocks. The company has stable revenue streams from its B to B (€308.6M) and B to C (€226.1M) segments but grapples with high debt levels as indicated by a net debt to equity ratio of 43.5%. Despite this, its interest payments are well-covered by EBIT (4.2x coverage), and it trades at good value compared to peers, being 79.2% below estimated fair value. However, earnings have declined recently, impacting overall profitability prospects in the near term.

- Click to explore a detailed breakdown of our findings in Reworld Media Société Anonyme's financial health report.

- Assess Reworld Media Société Anonyme's future earnings estimates with our detailed growth reports.

Next Steps

- Dive into all 331 of the European Penny Stocks we have identified here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tecma Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:TCM

Tecma Solutions

A tech company, develops technology and digital content for real estate businesses.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives