- Italy

- /

- Semiconductors

- /

- BIT:ELES

ELES Semiconductor Equipment Leads These 3 European Penny Stocks To Watch

Reviewed by Simply Wall St

As European markets navigate a landscape of mixed economic signals, including hopes for easing trade tensions and fluctuating interest rates, investors are increasingly looking at diverse opportunities. Penny stocks may be a somewhat outdated term, but they continue to represent intriguing prospects for those interested in smaller or newer companies with potential growth at lower price points. When these stocks are supported by strong balance sheets and solid fundamentals, they can offer compelling opportunities that defy traditional market expectations.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.295 | SEK2.2B | ✅ 4 ⚠️ 1 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.95 | SEK285.45M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.71 | SEK278.19M | ✅ 5 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.46 | SEK210.5M | ✅ 2 ⚠️ 2 View Analysis > |

| Tesgas (WSE:TSG) | PLN2.46 | PLN27.92M | ✅ 2 ⚠️ 3 View Analysis > |

| IMS (WSE:IMS) | PLN3.70 | PLN125.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.64 | €55.68M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.99 | €33.15M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.60 | €17.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.22 | €306.5M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 442 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

ELES Semiconductor Equipment (BIT:ELES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ELES Semiconductor Equipment S.p.A. designs, manufactures, and sells test equipment and solutions for the semiconductor industry both in Italy and internationally, with a market cap of €29.70 million.

Operations: The company's revenue of €35.73 million is generated from its Semiconductor Equipment and Services segment.

Market Cap: €29.7M

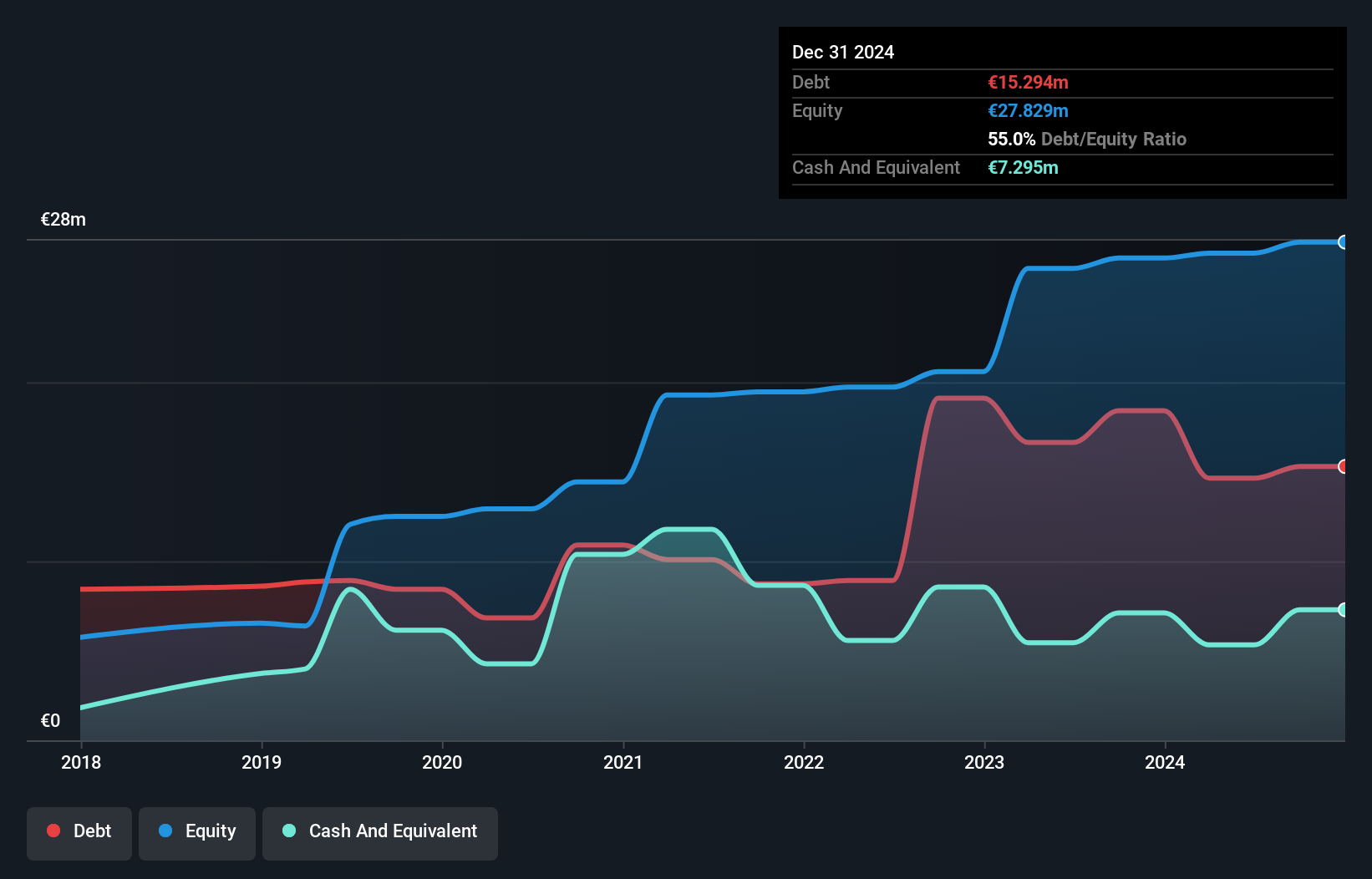

ELES Semiconductor Equipment S.p.A. has demonstrated solid financial performance with revenues of €36.55 million for the year ending December 31, 2024, up from €33.66 million the previous year, and net income rising to €1.24 million from €0.799 million. The company benefits from a satisfactory net debt to equity ratio of 28.7% and strong short-term asset coverage over liabilities (€37.7M vs €16.2M). Despite low return on equity at 4.5%, earnings growth of 55.6% this past year outpaced industry trends significantly, though large one-off items have impacted results recently.

- Get an in-depth perspective on ELES Semiconductor Equipment's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into ELES Semiconductor Equipment's future.

Reworld Media Société Anonyme (ENXTPA:ALREW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Reworld Media Société Anonyme operates in the thematic media sector in France with a market capitalization of €90.10 million.

Operations: The company generates revenue through its B to B segment, amounting to €308.6 million, and its B to C segment, which brings in €226.1 million.

Market Cap: €90.1M

Reworld Media Société Anonyme, with a market cap of €90.10 million, operates in the thematic media sector and reported 2024 sales of €534.7 million, slightly down from the previous year. Despite high net debt to equity at 43.5%, its interest payments are well covered by EBIT and operating cash flow covers debt adequately. The company trades at a significant discount to estimated fair value and has not diluted shareholders recently, though its earnings have declined by 15.5% over the past year compared to industry growth rates. Short-term liabilities exceed assets, indicating potential liquidity challenges despite stable weekly volatility.

- Jump into the full analysis health report here for a deeper understanding of Reworld Media Société Anonyme.

- Explore Reworld Media Société Anonyme's analyst forecasts in our growth report.

Arctic Bioscience (OB:ABS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Arctic Bioscience AS is a clinical-stage biotechnology company focused on developing and commercializing pharmaceutical and nutraceutical ingredients derived from bioactive marine compounds, with a market cap of NOK99.38 million.

Operations: The company's revenue is derived from two main segments: B2B, which generates NOK38.53 million, and B2C, contributing NOK4.95 million.

Market Cap: NOK99.38M

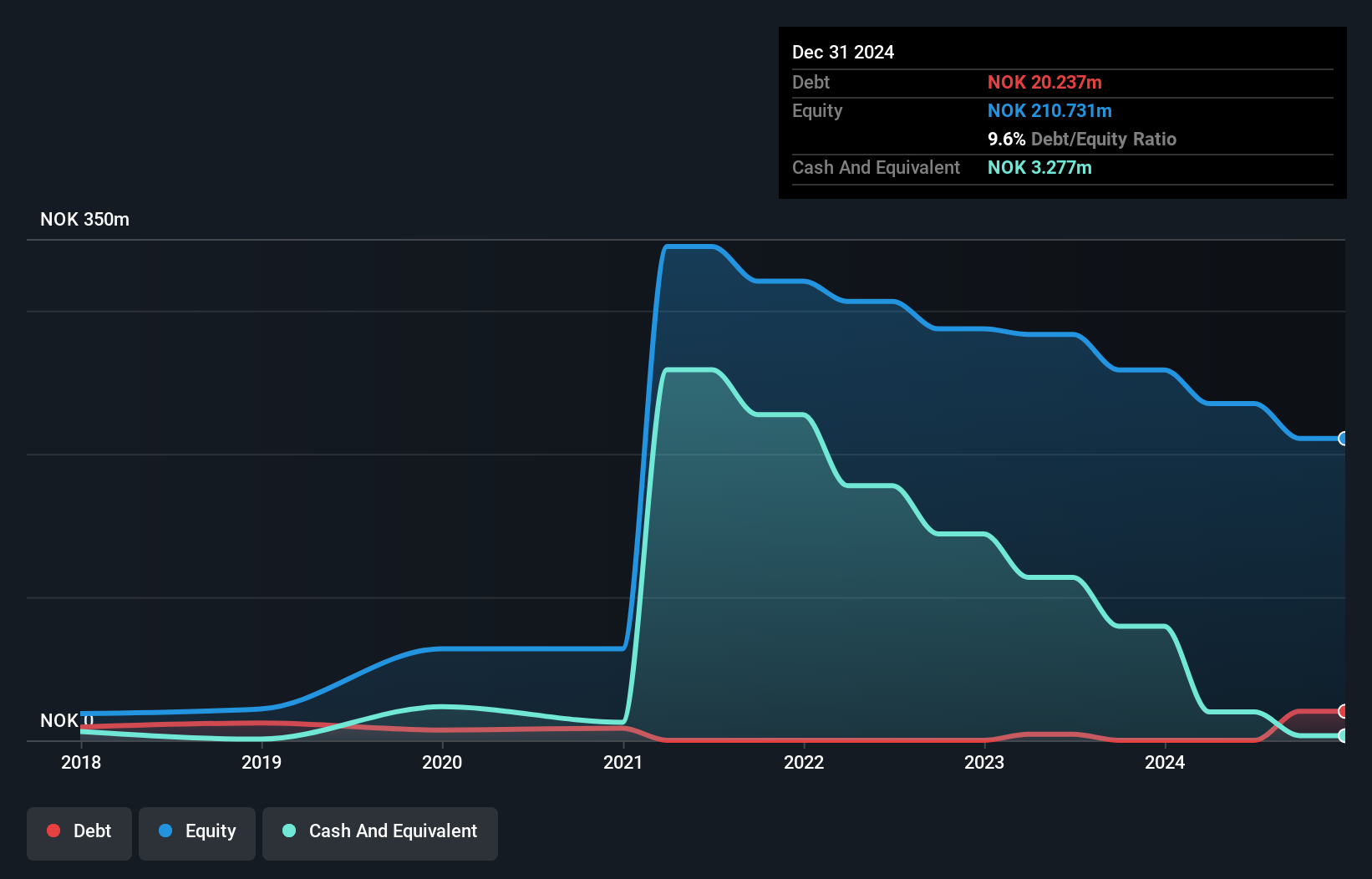

Arctic Bioscience AS, with a market cap of NOK99.38 million, reported 2024 revenue of NOK44.4 million but remains pre-revenue due to its clinical-stage focus. Recent earnings results showed a net loss of NOK47.93 million, and auditors expressed doubts about its ability to continue as a going concern. The company’s HeROPA phase 2b study in psoriasis indicated promising secondary endpoint results but requires further funding for development beyond the current phase. Despite having seasoned management and board members, Arctic Bioscience faces challenges with short-term liabilities exceeding assets and high share price volatility over the past year.

- Navigate through the intricacies of Arctic Bioscience with our comprehensive balance sheet health report here.

- Gain insights into Arctic Bioscience's past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Click here to access our complete index of 442 European Penny Stocks.

- Searching for a Fresh Perspective? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ELES Semiconductor Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ELES

ELES Semiconductor Equipment

Designs, manufactures, and sells test equipment, fixtures, solutions, and services for the semiconductor industry in Italy and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives