Subdued Growth No Barrier To Metadvertise Société anonyme (EPA:ALMTA) With Shares Advancing 261%

Metadvertise Société anonyme (EPA:ALMTA) shareholders have had their patience rewarded with a 261% share price jump in the last month. The last 30 days were the cherry on top of the stock's 396% gain in the last year, which is nothing short of spectacular.

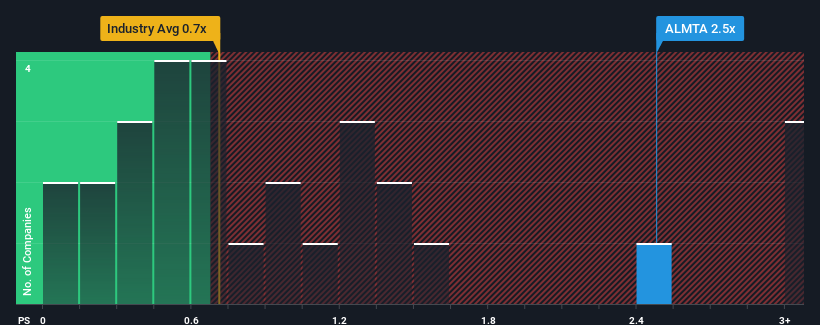

Following the firm bounce in price, you could be forgiven for thinking Metadvertise Société anonyme is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.5x, considering almost half the companies in France's Media industry have P/S ratios below 0.7x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Metadvertise Société anonyme

How Has Metadvertise Société anonyme Performed Recently?

The revenue growth achieved at Metadvertise Société anonyme over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Metadvertise Société anonyme will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Metadvertise Société anonyme would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.0% last year. Still, lamentably revenue has fallen 8.0% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to decline by 0.7% over the next year, which is just as bad as the company's recent medium-term revenue decline.

With this information, it's perhaps curious that Metadvertise Société anonyme is trading at a higher P/S in comparison. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On Metadvertise Société anonyme's P/S

Metadvertise Société anonyme's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Metadvertise Société anonyme trades at a higher than average P/S since its recent three-year revenue is only matching the forecasts for a struggling industry. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. We're also cautious about the company's ability to stay its recent medium-term course and resist further pain to its business from the broader industry turmoil. Should recent revenue trends persist, it would pose a significant risk to existing shareholders' investments and potentially subject prospective investors to paying above fair value for the stock.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Metadvertise Société anonyme (at least 2 which are significant), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALSRS

Sirius Media

Engages in audio visual production activities, including feature films, films animation, TV series, commercials, etc.

Slight risk with weak fundamentals.

Market Insights

Community Narratives