- France

- /

- Entertainment

- /

- ENXTPA:ALECP

Market Participants Recognise EuropaCorp's (EPA:ALECP) Revenues Pushing Shares 46% Higher

The EuropaCorp (EPA:ALECP) share price has done very well over the last month, posting an excellent gain of 46%. The last 30 days bring the annual gain to a very sharp 42%.

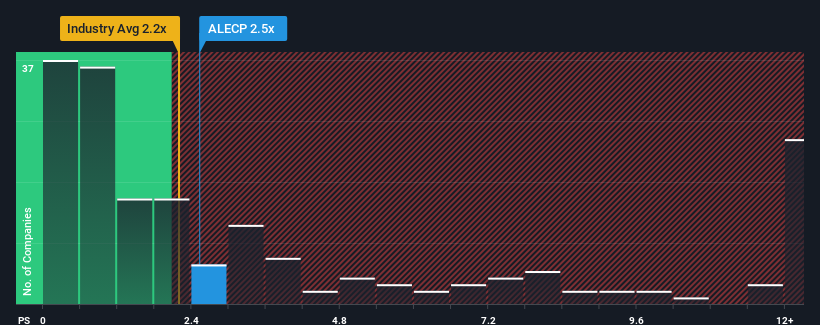

After such a large jump in price, given close to half the companies operating in France's Entertainment industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider EuropaCorp as a stock to potentially avoid with its 2.5x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for EuropaCorp

How EuropaCorp Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, EuropaCorp has been doing quite well of late. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on EuropaCorp.How Is EuropaCorp's Revenue Growth Trending?

EuropaCorp's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a decent 6.2% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 46% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 335% during the coming year according to the one analyst following the company. Meanwhile, the broader industry is forecast to contract by 11%, which would indicate the company is doing very well.

With this in consideration, we understand why EuropaCorp's P/S is a cut above its industry peers. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Final Word

EuropaCorp shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of EuropaCorp's analyst forecasts revealed that its superior revenue outlook against a shaky industry is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

Having said that, be aware EuropaCorp is showing 4 warning signs in our investment analysis, and 1 of those is a bit concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if EuropaCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALECP

EuropaCorp

Engages in the production and distribution of films and television series and dramas in France and internationally.

High growth potential and fair value.

Market Insights

Community Narratives