- France

- /

- Basic Materials

- /

- ENXTPA:VCT

Vicat SA Just Recorded A 6.3% EPS Beat: Here's What Analysts Are Forecasting Next

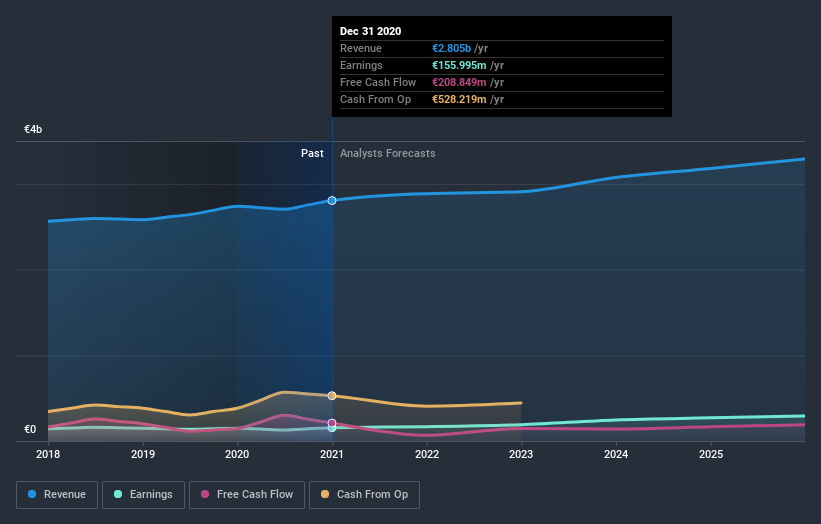

Vicat SA (EPA:VCT) defied analyst predictions to release its yearly results, which were ahead of market expectations. Results were good overall, with revenues beating analyst predictions by 3.9% to hit €2.8b. Statutory earnings per share (EPS) came in at €3.47, some 6.3% above whatthe analysts had expected. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for Vicat

After the latest results, the six analysts covering Vicat are now predicting revenues of €2.89b in 2021. If met, this would reflect a reasonable 2.9% improvement in sales compared to the last 12 months. Statutory earnings per share are predicted to accumulate 5.5% to €3.66. Yet prior to the latest earnings, the analysts had been anticipated revenues of €2.76b and earnings per share (EPS) of €3.45 in 2021. It looks like there's been a modest increase in sentiment following the latest results, withthe analysts becoming a bit more optimistic in their predictions for both revenues and earnings.

Althoughthe analysts have upgraded their earnings estimates, there was no change to the consensus price target of €44.21, suggesting that the forecast performance does not have a long term impact on the company's valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Vicat analyst has a price target of €52.10 per share, while the most pessimistic values it at €36.00. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. Next year brings more of the same, according to the analysts, with revenue forecast to grow 2.9%, in line with its 2.8% annual growth over the past five years. Compare this with the wider industry (in aggregate), which analyst estimates suggest will see revenues grow 4.4% next year. So although Vicat is expected to maintain its revenue growth rate, it's forecast to grow slower than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Vicat following these results. Fortunately, they also upgraded their revenue estimates, although our data indicates sales are expected to perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At Simply Wall St, we have a full range of analyst estimates for Vicat going out to 2025, and you can see them free on our platform here..

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Vicat , and understanding this should be part of your investment process.

If you’re looking to trade Vicat, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:VCT

Vicat

Engages in the production and sale of cement, ready-mixed concrete, and aggregates for construction industry.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives