With European markets showing promising signs of stability as inflation nears the ECB's target, investors are increasingly looking for reliable income streams. In this context, dividend stocks on Euronext Paris offer an attractive proposition for those seeking steady returns amidst a cautiously optimistic economic environment. A good dividend stock typically combines a solid financial foundation with consistent payout history, making it resilient to market fluctuations and appealing in times of economic uncertainty.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 6.36% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.80% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.78% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 6.08% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.94% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.72% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.16% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.69% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.97% | ★★★★★☆ |

| Eiffage (ENXTPA:FGR) | 4.32% | ★★★★☆☆ |

Click here to see the full list of 35 stocks from our Top Euronext Paris Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Exacompta Clairefontaine (ENXTPA:ALEXA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exacompta Clairefontaine S.A. produces, finishes, and formats papers in France, Europe, and internationally with a market cap of €161.80 million.

Operations: Exacompta Clairefontaine S.A. generates revenue from two main segments: Paper (€368.58 million) and Processing (€613.23 million).

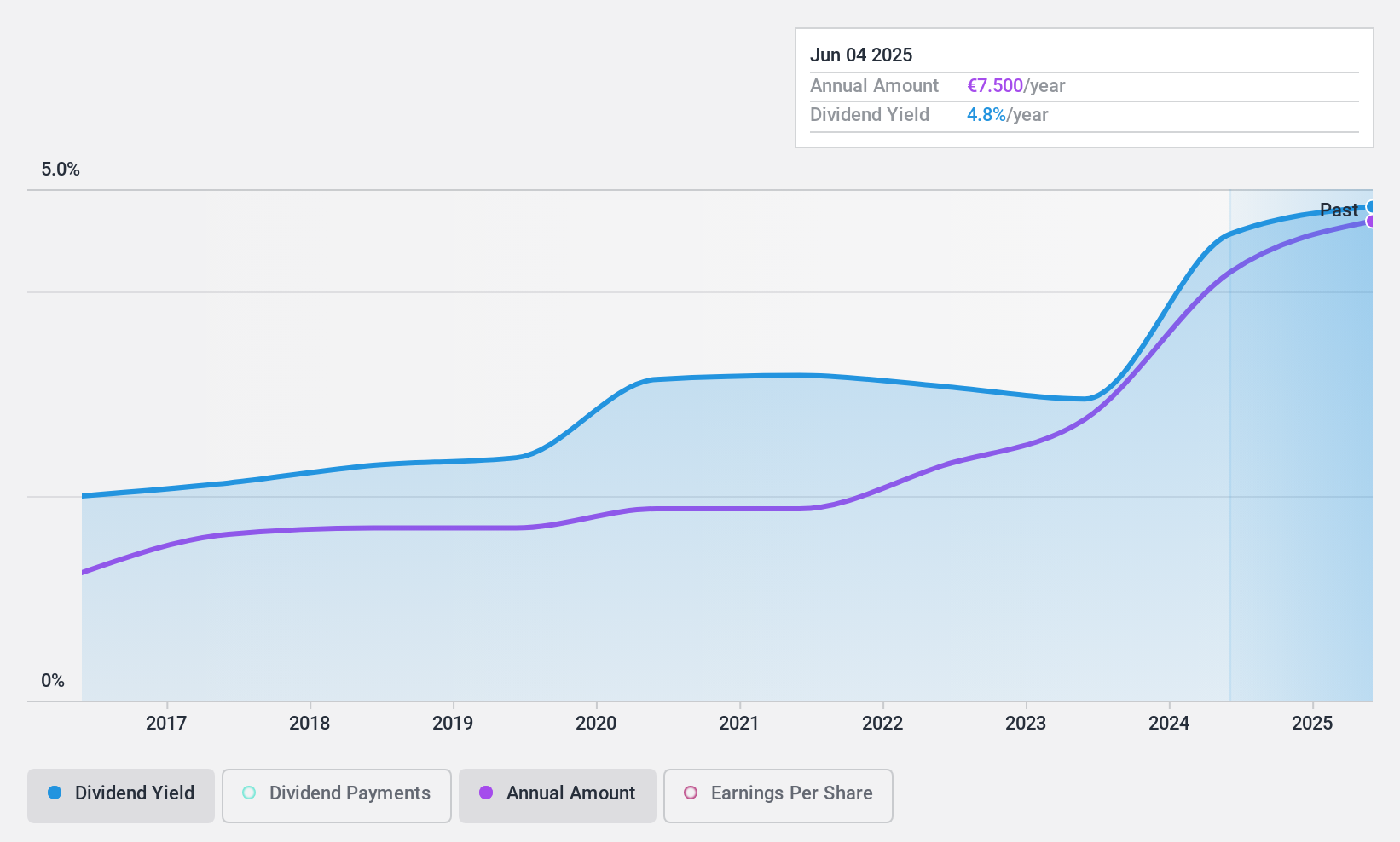

Dividend Yield: 4.7%

Exacompta Clairefontaine offers a reliable dividend, consistently growing over the past 10 years. With a low payout ratio of 17.6% and a cash payout ratio of 10.3%, its dividends are well-covered by both earnings and cash flows. Despite the attractive Price-To-Earnings ratio of 3.8x compared to the French market's average, its dividend yield (4.69%) is lower than the top quartile payers in France (5.45%). However, recent share price volatility may concern some investors.

- Click here to discover the nuances of Exacompta Clairefontaine with our detailed analytical dividend report.

- Our expertly prepared valuation report Exacompta Clairefontaine implies its share price may be too high.

Trigano (ENXTPA:TRI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Trigano S.A., with a market cap of €2.05 billion, designs, manufactures, markets, and sells leisure vehicles for individuals and professionals in Europe.

Operations: Trigano S.A. generates revenue primarily from its Leisure Vehicles segment, which accounts for €3.59 billion, and its Leisure Equipment segment, contributing €188.90 million.

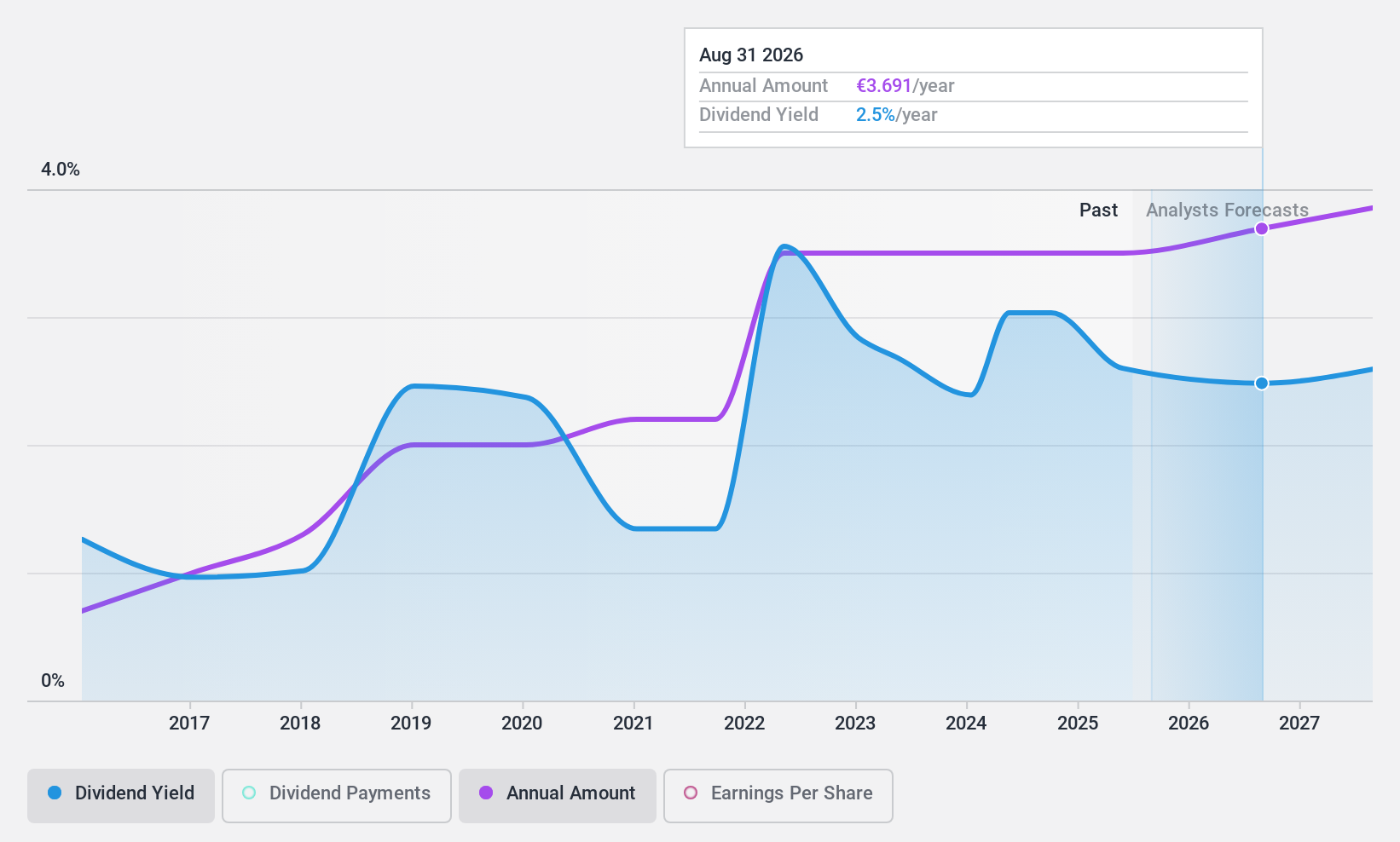

Dividend Yield: 3.3%

Trigano's dividend payments have been stable and growing over the past 10 years, supported by a low payout ratio of 18.4%. However, with a high cash payout ratio of 8451.5%, dividends are not well covered by free cash flows. Trading at 10% below its estimated fair value, Trigano's current dividend yield (3.29%) is lower than the top quartile in France (5.45%). Earnings grew by 41.8% last year but are forecast to decline annually by 5.7% over the next three years.

- Navigate through the intricacies of Trigano with our comprehensive dividend report here.

- According our valuation report, there's an indication that Trigano's share price might be on the cheaper side.

Vicat (ENXTPA:VCT)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Vicat S.A., with a market cap of €1.40 billion, operates in the construction industry through the production and sale of cement, ready-mixed concrete, and aggregates.

Operations: Vicat S.A. generates revenue primarily from three segments: €2.52 billion from cement, €1.55 billion from concrete and aggregates, and €459.99 million from other products and services.

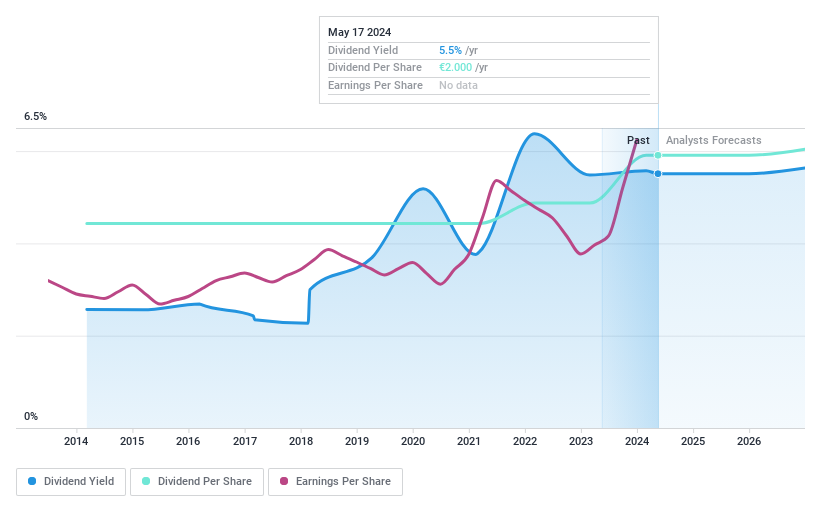

Dividend Yield: 6.4%

Vicat's dividend payments have been stable and growing over the past 10 years, supported by a low payout ratio of 33.4% and a cash payout ratio of 45.7%, indicating sustainability. The current yield is 6.36%, placing it in the top quartile of French dividend payers. Recent earnings show growth, with H1 sales at €1.94 billion and net income at €103.54 million, up from €94.05 million last year, reflecting strong financial health despite high debt levels.

- Take a closer look at Vicat's potential here in our dividend report.

- The analysis detailed in our Vicat valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Click here to access our complete index of 35 Top Euronext Paris Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Trigano, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Trigano might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TRI

Trigano

Designs, manufactures, markets, and sells leisure vehicles for individuals and professionals in Europe.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives