Investors Don't See Light At End Of SergeFerrari Group SA's (EPA:SEFER) Tunnel And Push Stock Down 25%

SergeFerrari Group SA (EPA:SEFER) shares have had a horrible month, losing 25% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 58% loss during that time.

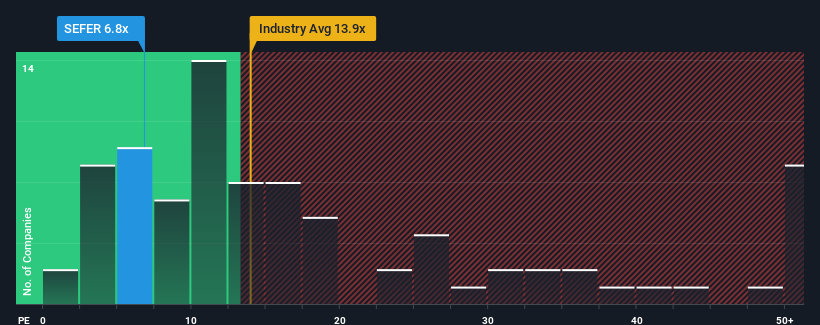

Following the heavy fall in price, SergeFerrari Group's price-to-earnings (or "P/E") ratio of 6.8x might make it look like a strong buy right now compared to the market in France, where around half of the companies have P/E ratios above 15x and even P/E's above 26x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, SergeFerrari Group's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for SergeFerrari Group

Is There Any Growth For SergeFerrari Group?

The only time you'd be truly comfortable seeing a P/E as depressed as SergeFerrari Group's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 9.9% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 189% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings growth is heading into negative territory, declining 8.2% each year over the next three years. With the market predicted to deliver 13% growth each year, that's a disappointing outcome.

With this information, we are not surprised that SergeFerrari Group is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From SergeFerrari Group's P/E?

Having almost fallen off a cliff, SergeFerrari Group's share price has pulled its P/E way down as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that SergeFerrari Group maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with SergeFerrari Group (at least 2 which don't sit too well with us), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than SergeFerrari Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:SEFER

SergeFerrari Group

Designs, develops, manufactures, and markets composite materials for lightweight architectural and outdoor applications in France and internationally.

Moderate growth potential and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026