- Austria

- /

- Telecom Services and Carriers

- /

- WBAG:TKA

Top European Dividend Stocks For June 2025

Reviewed by Simply Wall St

As European markets navigate renewed uncertainty due to U.S. trade policy and escalating geopolitical tensions in the Middle East, major stock indexes have experienced notable declines. Despite these challenges, dividend stocks remain a focal point for investors seeking stable income streams, especially in volatile market conditions where consistent payouts can offer a measure of financial reassurance.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.58% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.34% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.40% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 5.05% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 3.92% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.22% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.94% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.62% | ★★★★★★ |

Click here to see the full list of 244 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Piscines Desjoyaux (ENXTPA:ALPDX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piscines Desjoyaux SA designs, manufactures, and markets swimming pools and related products both in France and internationally, with a market cap of €129.70 million.

Operations: Piscines Desjoyaux SA generates its revenue primarily from the swimming pools segment, which accounts for €115.56 million, and also has a minor contribution from real estate at €0.10 million.

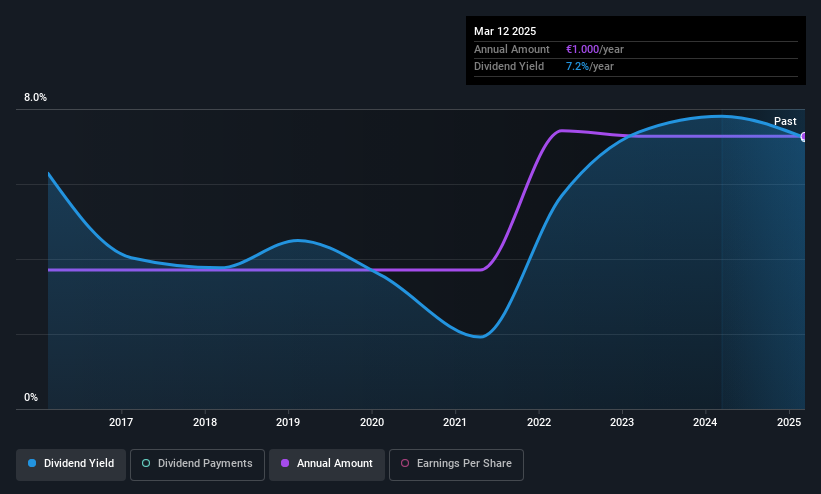

Dividend Yield: 6.9%

Piscines Desjoyaux offers a compelling dividend yield of 6.92%, placing it in the top 25% of French dividend payers. Its dividends have been stable and consistently increasing over the past decade, reflecting reliability. While its payout ratio is at 82%, indicating coverage by earnings, there is insufficient data to confirm coverage by cash flows. With a price-to-earnings ratio of 11.8x, it appears undervalued compared to the broader French market average of 15.6x.

- Take a closer look at Piscines Desjoyaux's potential here in our dividend report.

- Our expertly prepared valuation report Piscines Desjoyaux implies its share price may be too high.

Oeneo (ENXTPA:SBT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oeneo SA operates in the wine industry worldwide and has a market cap of €626.51 million.

Operations: Oeneo SA generates revenue from two primary segments: Closures, contributing €222.50 million, and Winemaking, accounting for €82.60 million.

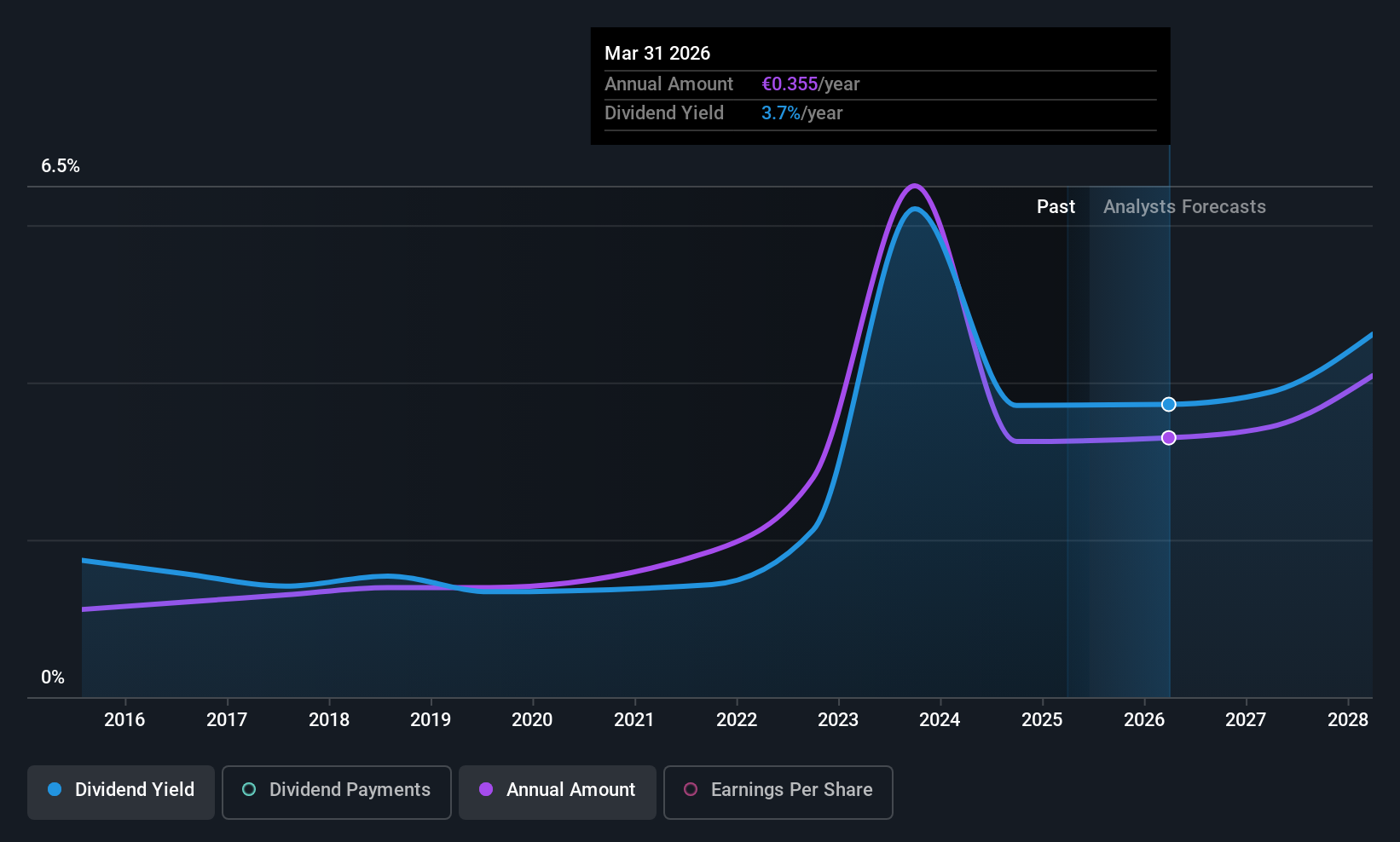

Dividend Yield: 3.6%

Oeneo's dividend yield of 3.58% is lower than the top 25% in France, but it maintains coverage by earnings with a payout ratio of 76.1% and cash flows at 59.1%. Despite a decade of growth, its dividends have been volatile, experiencing significant annual drops. Recent earnings showed slight growth to EUR 29.77 million for the year ended March 2025, with EPS rising modestly to EUR 0.46 from EUR 0.45 previously.

- Delve into the full analysis dividend report here for a deeper understanding of Oeneo.

- Our comprehensive valuation report raises the possibility that Oeneo is priced higher than what may be justified by its financials.

Telekom Austria (WBAG:TKA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Telekom Austria AG, with a market cap of €6.35 billion, offers fixed-line and mobile communications solutions across Austria and several Eastern European countries, including Belarus, Bulgaria, Croatia, North Macedonia, Serbia, and Slovenia.

Operations: Telekom Austria AG generates revenue primarily from its Wireless Communications Services segment, which accounts for €5.36 billion.

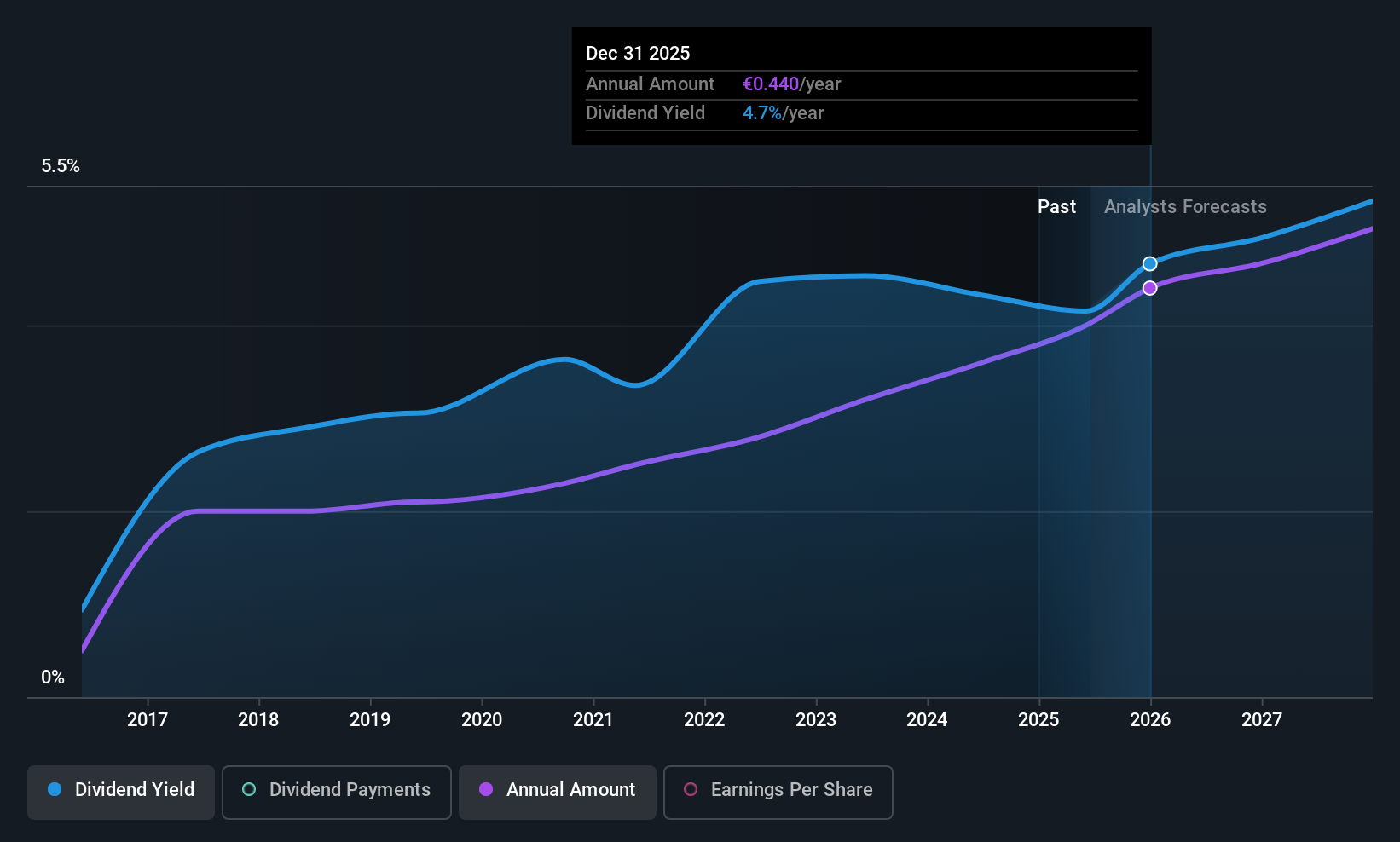

Dividend Yield: 4.2%

Telekom Austria's dividend stability is supported by a low cash payout ratio of 25.9% and earnings coverage at 42.4%, ensuring sustainability. Despite its 4.18% yield being below Austria's top quartile, dividends have consistently grown over the past decade with minimal volatility. Recent Q1 results showed revenue increasing to €1.32 billion and net income rising to €125 million, reflecting solid financial health that underpins its reliable dividend payments amidst reaffirmed growth guidance for 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Telekom Austria.

- The valuation report we've compiled suggests that Telekom Austria's current price could be quite moderate.

Next Steps

- Unlock our comprehensive list of 244 Top European Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telekom Austria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:TKA

Telekom Austria

Provides fixed-line and mobile communications solutions to individuals, commercial and non-commercial organizations, and other national and foreign carriers in Austria, Belarus, Bulgaria, Croatia, North Macedonia, Serbia, and Slovenia.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives