As European markets experience a positive shift, with the pan-European STOXX Europe 600 Index rising by 3.44% amid easing tariff concerns and economic growth in the eurozone doubling its previous rate, investors are increasingly turning their attention to small-cap stocks that may have been overlooked. In this climate of renewed optimism and cautious economic expansion, identifying promising companies requires a keen eye for those with strong fundamentals and potential for growth within their respective sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Jensen-Group (ENXTBR:JEN)

Simply Wall St Value Rating: ★★★★★★

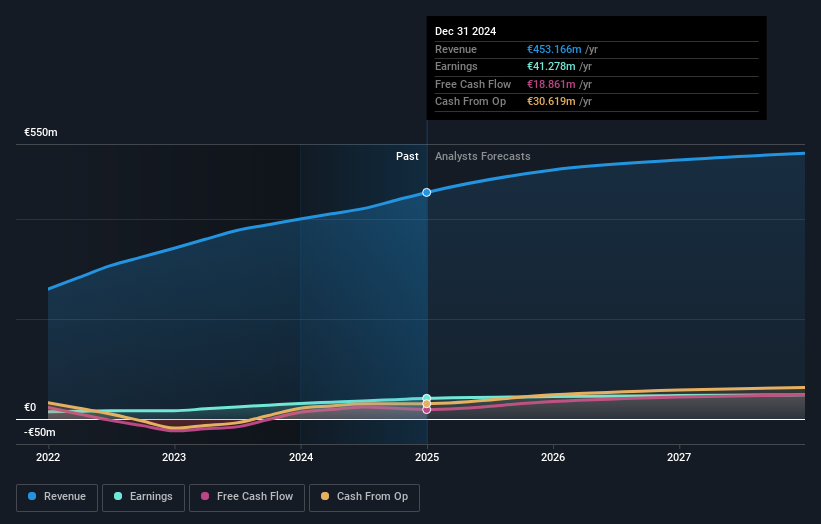

Overview: Jensen-Group NV, with a market cap of €426.81 million, designs, produces, and supplies single machines, systems, turnkey solutions, and laundry process automation for the heavy-duty laundry industry.

Operations: Jensen-Group generates its revenue primarily from the heavy-duty laundry segment, amounting to €453.17 million. The company's net profit margin is a key financial metric, reflecting its profitability after all expenses.

Jensen-Group, a notable player in the machinery sector, has demonstrated robust performance with earnings growth of 32.5% over the past year, outpacing the industry's 3.1%. The company's debt to equity ratio improved from 27.3% to 21.6% over five years, reflecting prudent financial management. Trading at a significant discount of 42.3% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities. The net debt to equity stands at a satisfactory 2.4%, indicating sound leverage levels without compromising financial stability and interest coverage is not an issue due to high-quality earnings supporting future growth prospects confidently projected at around 5%.

- Take a closer look at Jensen-Group's potential here in our health report.

Review our historical performance report to gain insights into Jensen-Group's's past performance.

Robertet (ENXTPA:RBT)

Simply Wall St Value Rating: ★★★★★☆

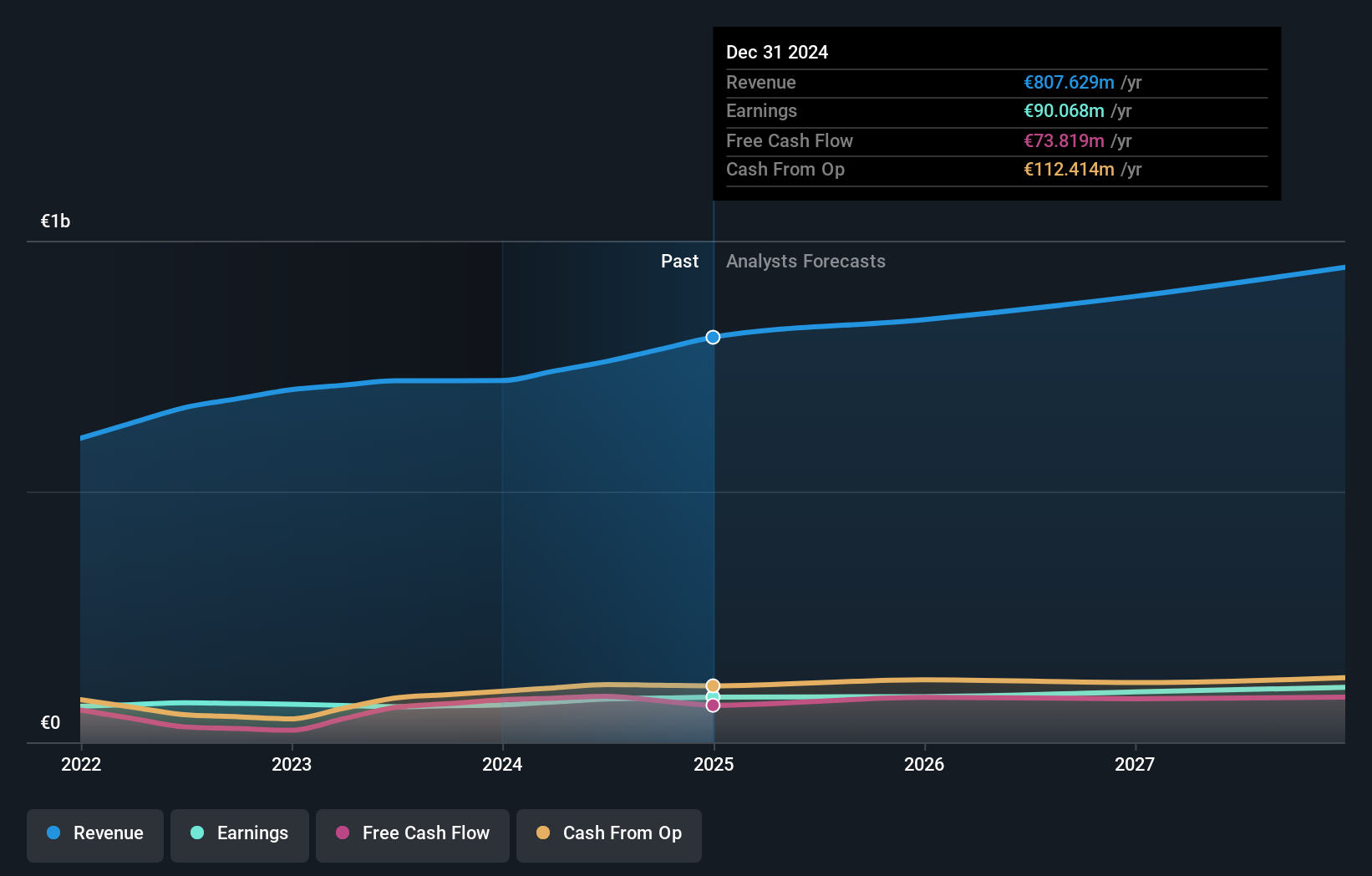

Overview: Robertet SA is a company that specializes in the production and sale of perfumes, aromas, and natural products with a market capitalization of €1.59 billion.

Operations: The company's revenue is primarily derived from three segments: Aroma (€268.72 million), Perfumery (€290.80 million), and Raw Materials and Health & Beauty (€199.75 million).

In the niche world of fragrance and flavor, Robertet stands out with its robust financial health. The company has seen earnings grow by 21.8% over the past year, outpacing the broader Chemicals industry growth of 9.5%. This growth is underpinned by high-quality earnings and a satisfactory net debt to equity ratio of 23.4%. Despite an increase in its debt to equity ratio from 26.5% to 61.8% over five years, interest payments remain well covered at an impressive EBIT coverage of 18.1x. Recently, Robertet announced a dividend increase to EUR 10 per share, reflecting confidence in its ongoing profitability and shareholder value creation strategy.

- Click here and access our complete health analysis report to understand the dynamics of Robertet.

Gain insights into Robertet's past trends and performance with our Past report.

RHÖN-KLINIKUM (XTRA:RHK)

Simply Wall St Value Rating: ★★★★★★

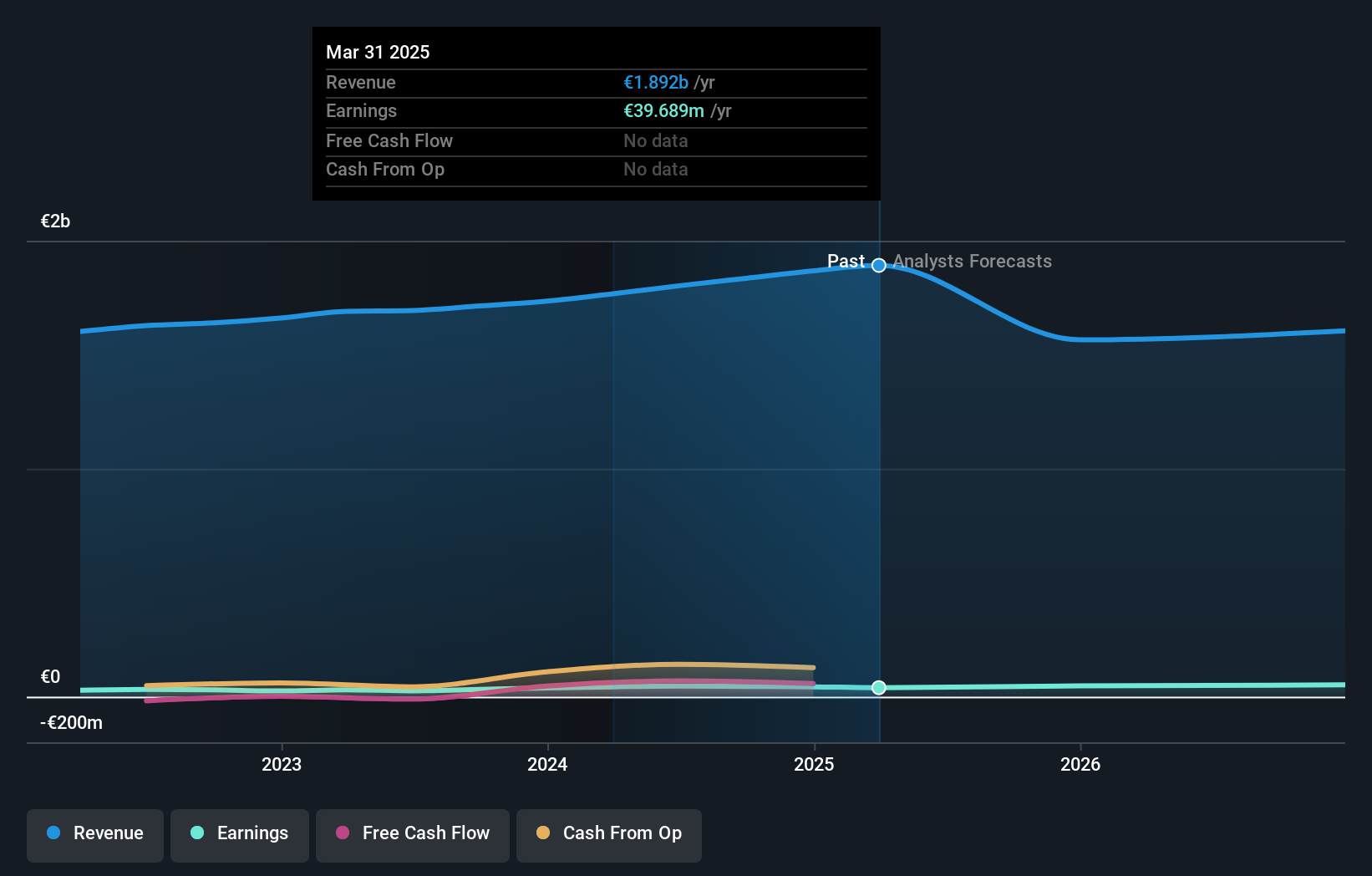

Overview: RHÖN-KLINIKUM Aktiengesellschaft, along with its subsidiaries, provides in-patient, semi-patient, and outpatient healthcare services across Germany with a market capitalization of approximately €1.04 billion.

Operations: RHÖN-KLINIKUM generates revenue primarily from Acute Clinics (€1.53 billion), followed by Rehabilitation Clinics (€36.40 million) and Medical Care Centres (€24.40 million).

RHÖN-KLINIKUM, a notable player in the healthcare sector, has demonstrated robust financial health with earnings growing by 12% over the past year, outpacing the industry average of 7.8%. The company reported revenue of €1.87 billion for 2024, up from €1.74 billion the previous year, and net income rose to €43.35 million from €38.71 million. With a debt-to-equity ratio reduced to 10.8% over five years and trading at 62% below estimated fair value, it appears undervalued relative to its potential. Recent management changes may streamline operations further as they navigate future growth prospects effectively.

- Click to explore a detailed breakdown of our findings in RHÖN-KLINIKUM's health report.

Examine RHÖN-KLINIKUM's past performance report to understand how it has performed in the past.

Taking Advantage

- Click through to start exploring the rest of the 334 European Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:JEN

Jensen-Group

Designs, produces, and supplies single machines, systems, turnkey solutions, and laundry process automation for the heavy-duty laundry industry.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives