Plastiques du Val de Loire (EPA:PVL investor three-year losses grow to 71% as the stock sheds €9.9m this past week

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of Plastiques du Val de Loire (EPA:PVL), who have seen the share price tank a massive 71% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And more recent buyers are having a tough time too, with a drop of 33% in the last year. Shareholders have had an even rougher run lately, with the share price down 22% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Since Plastiques du Val de Loire has shed €9.9m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Plastiques du Val de Loire

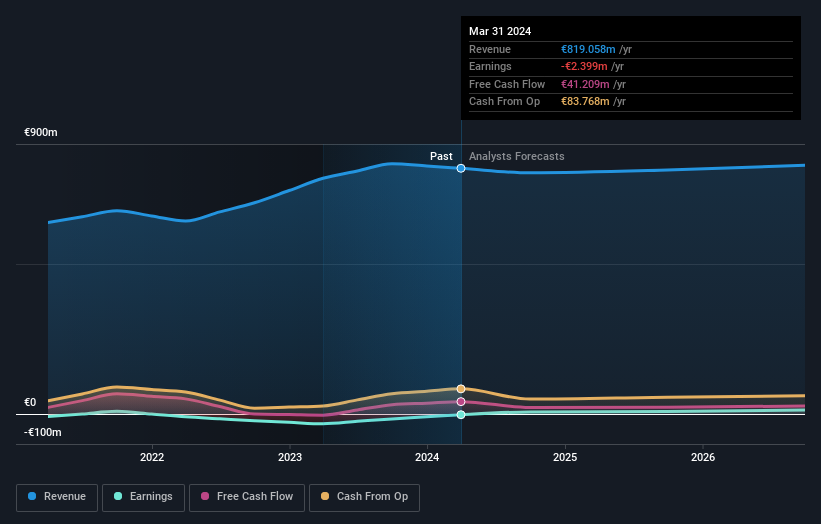

Because Plastiques du Val de Loire made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Plastiques du Val de Loire grew revenue at 10% per year. That's a pretty good rate of top-line growth. So it seems unlikely the 20% share price drop (each year) is entirely about the revenue. More likely, the market was spooked by the cost of that revenue. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Plastiques du Val de Loire's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Plastiques du Val de Loire had a tough year, with a total loss of 33%, against a market gain of about 4.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Plastiques du Val de Loire (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:PVL

Plastiques du Val de Loire

Manufactures and sells plastic parts in Europe and North America.

Undervalued with moderate growth potential.