Shareholders in Fermentalg (EPA:FALG) have lost 43%, as stock drops 24% this past week

It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Investors in Fermentalg SA (EPA:FALG) have tasted that bitter downside in the last year, as the share price dropped 43%. That contrasts poorly with the market decline of 11%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 12% in three years. Even worse, it's down 32% in about a month, which isn't fun at all.

With the stock having lost 24% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Before we look at the performance, you might like to know that our analysis indicates that FALG is potentially overvalued!

Because Fermentalg made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Fermentalg increased its revenue by 156%. That's a strong result which is better than most other loss making companies. Given the revenue growth, the share price drop of 43% seems quite harsh. Our sympathies to shareholders who are now underwater. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

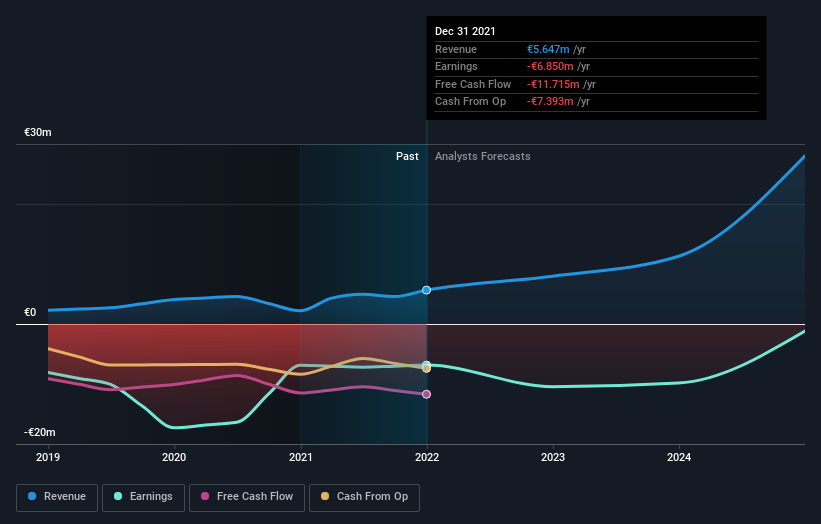

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Fermentalg's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 11% in the twelve months, Fermentalg shareholders did even worse, losing 43%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Fermentalg better, we need to consider many other factors. For instance, we've identified 4 warning signs for Fermentalg that you should be aware of.

Of course Fermentalg may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALGAE

Fermentalg

Develops, produces, and sells active ingredients extracted from microalgae for the food, health, nutrition, and environment sectors in France and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives