Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that ERAMET S.A. (EPA:ERA) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for ERAMET

What Is ERAMET's Net Debt?

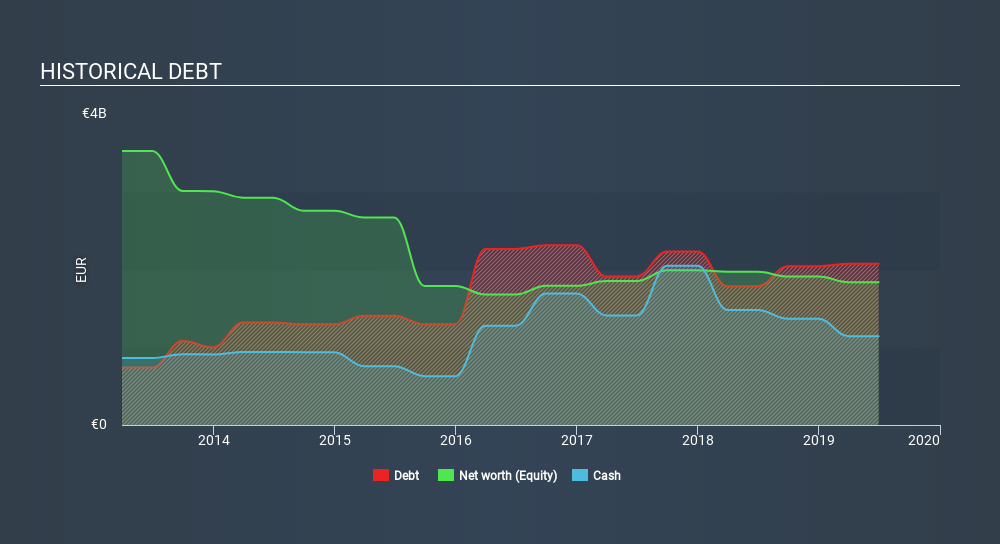

As you can see below, at the end of June 2019, ERAMET had €2.07b of debt, up from €1.78b a year ago. Click the image for more detail. However, it also had €1.14b in cash, and so its net debt is €930.0m.

A Look At ERAMET's Liabilities

Zooming in on the latest balance sheet data, we can see that ERAMET had liabilities of €1.37b due within 12 months and liabilities of €2.89b due beyond that. Offsetting this, it had €1.14b in cash and €413.0m in receivables that were due within 12 months. So it has liabilities totalling €2.71b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the €1.08b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, ERAMET would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Looking at its net debt to EBITDA of 1.5 and interest cover of 3.6 times, it seems to us that ERAMET is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Shareholders should be aware that ERAMET's EBIT was down 41% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if ERAMET can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, ERAMET's free cash flow amounted to 41% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

To be frank both ERAMET's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at managing its debt, based on its EBITDA,; that's encouraging. After considering the datapoints discussed, we think ERAMET has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for ERAMET you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:ERA

ERAMET

Produces and sells manganese and nickel metals in Asia, Europe, North America, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion