Global Bioenergies (EPA:ALGBE) Shareholders Have Enjoyed An Impressive 187% Share Price Gain

Global Bioenergies SA (EPA:ALGBE) shareholders might be concerned after seeing the share price drop 11% in the last month. But that doesn't detract from the splendid returns of the last year. During that period, the share price soared a full 187%. So it may be that the share price is simply cooling off after a strong rise. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

Check out our latest analysis for Global Bioenergies

Given that Global Bioenergies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, Global Bioenergies' revenue grew by 2,696%. That's a head and shoulders above most loss-making companies. And the share price has responded, gaining 187% as we previously mentioned. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

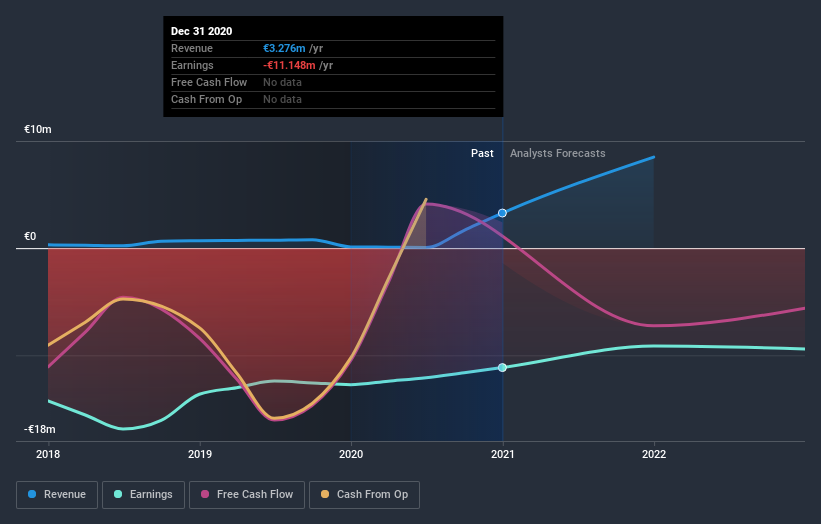

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Global Bioenergies' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Global Bioenergies has rewarded shareholders with a total shareholder return of 187% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 11% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Global Bioenergies better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Global Bioenergies , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

When trading Global Bioenergies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALGBE

Global Bioenergies

Engages in the development of a process for converting plant-based feedstocks into isobutene used in the cosmetic and aviation fuel industry.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026