- France

- /

- Metals and Mining

- /

- ENXTPA:ALCOI

Coil S.A./N.V. (EPA:ALCOI) Stock Rockets 31% As Investors Are Less Pessimistic Than Expected

Coil S.A./N.V. (EPA:ALCOI) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

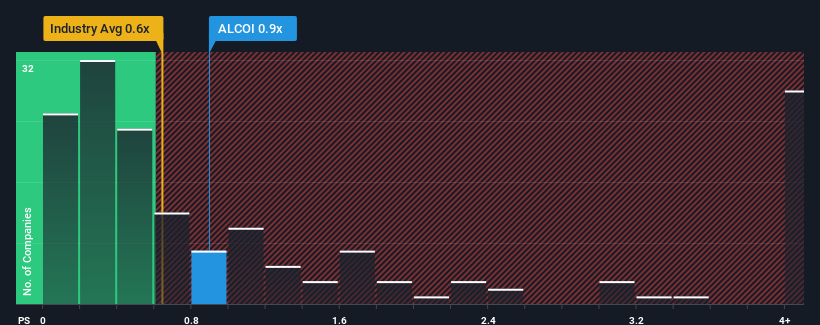

Although its price has surged higher, it's still not a stretch to say that Coil/N.V's price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" compared to the Metals and Mining industry in France, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Coil/N.V

What Does Coil/N.V's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Coil/N.V over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Coil/N.V's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Coil/N.V's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 8.4% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 17% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to decline by 1.0% over the next year, or less than the company's recent medium-term annualised revenue decline.

In light of this, it's somewhat peculiar that Coil/N.V's P/S sits in line with the majority of other companies. In general, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Key Takeaway

Its shares have lifted substantially and now Coil/N.V's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Coil/N.V currently trades on a higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. When we see below average revenue, we suspect the share price is at risk of declining, sending the moderate P/S lower. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. This would place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider and we've discovered 8 warning signs for Coil/N.V (4 make us uncomfortable!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALCOI

Coil/N.V

Provides anodizing services on aluminum flat rolled products in coil form, sheets, and panels in Europe.

Good value with adequate balance sheet.

Market Insights

Community Narratives