Assessing Air Liquide (ENXTPA:AI) Valuation Following Breakthrough Launch of Industrial-Scale Ammonia Cracking in Belgium

Reviewed by Simply Wall St

L'Air Liquide (ENXTPA:AI) drew investor attention after announcing the successful launch of an industrial-scale ammonia cracking unit in Belgium. This breakthrough addresses key challenges in hydrogen transport and supports broader energy transition goals.

See our latest analysis for L'Air Liquide.

L'Air Liquide's push into next-generation hydrogen solutions has caught the market's eye, though the stock has seen mixed momentum lately. While its most recent 1-day and 90-day share price returns have slipped, the company’s 1-year total shareholder return of 8.3% points to steady long-term value creation. Its impressive 45% gain over three years highlights its sustained growth potential.

With innovation driving the sector forward, now could be a smart moment to see what other fast-growing, high-conviction companies are emerging. Discover fast growing stocks with high insider ownership

But with the stock trading at a discount to analyst price targets following strong multi-year gains, the question remains: is this an overlooked buying opportunity, or are markets already pricing in the company’s next chapter of growth?

Most Popular Narrative: 13% Undervalued

L'Air Liquide's widely followed narrative sees room for upside, with future earnings and margins supporting a higher value than the current share price. The market is watching closely for structural drivers and bold growth levers.

Large, long-term investments in green and blue hydrogen infrastructure, now de-risked by recent regulatory clarity and significant government subsidies, are creating robust new revenue streams and enabling Air Liquide to capitalize on the accelerating decarbonization trend. This will enhance both top-line growth and net margin expansion as adoption increases.

Want to know what’s fueling this optimism? Underpinning the fair value is a set of ambitious assumptions about future revenue and profit margins. Only the boldest growth and margin projections justify these lofty expectations. Curious which forward-looking forecasts drive this narrative premium? Unlock the details and see for yourself—these predictions might surprise you.

Result: Fair Value of €196.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker industrial demand or delays in major hydrogen projects could quickly temper current optimism and challenge the bullish narrative for L'Air Liquide.

Find out about the key risks to this L'Air Liquide narrative.

Another View: Market Multiples Suggest the Stock Isn’t Cheap

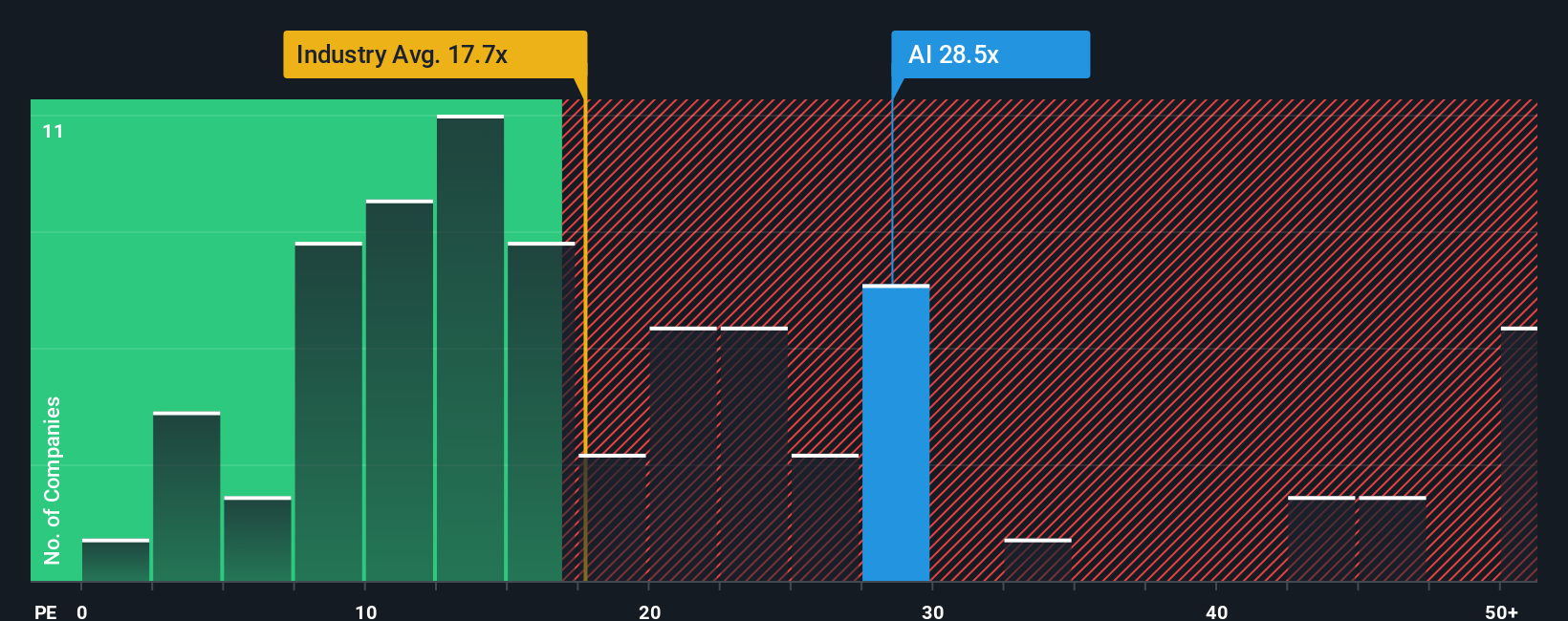

Looking at price-to-earnings ratios, L'Air Liquide stands out as expensive compared to both its peers and the broader European Chemicals industry. Its ratio of 28.8x is notably higher than the peer average of 21.9x and the industry's 17.9x, while the fair ratio is considered to be 25x. This gap suggests the market sees real earnings strength, but it also sets a high bar for future growth. Could this premium be at risk if the outlook shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own L'Air Liquide Narrative

If you see things differently or want to shape your own perspective, you can dive into the data and craft your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding L'Air Liquide.

Looking for More Investment Ideas?

Smart investors stay ahead by regularly hunting for tomorrow’s winners. Don’t let unique market opportunities slip by. Use these tailored stock ideas to sharpen your strategy now:

- Unlock cash flow bargains and hunt for undervalued gems across sectors with these 886 undervalued stocks based on cash flows.

- Get ahead of the next wave in healthcare innovation by tracking breakthroughs with these 32 healthcare AI stocks.

- Boost your income strategy by targeting secure, high-yield payers through these 16 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AI

L'Air Liquide

Provides gases, technologies, and services for the industrial and health sectors in Europe, the Americas, the Asia Pacific, the Middle East, and Africa.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives