SCOR (ENXTPA:SCR) Earnings Growth Surges 173%, Challenging Cautious Market Narratives

Reviewed by Simply Wall St

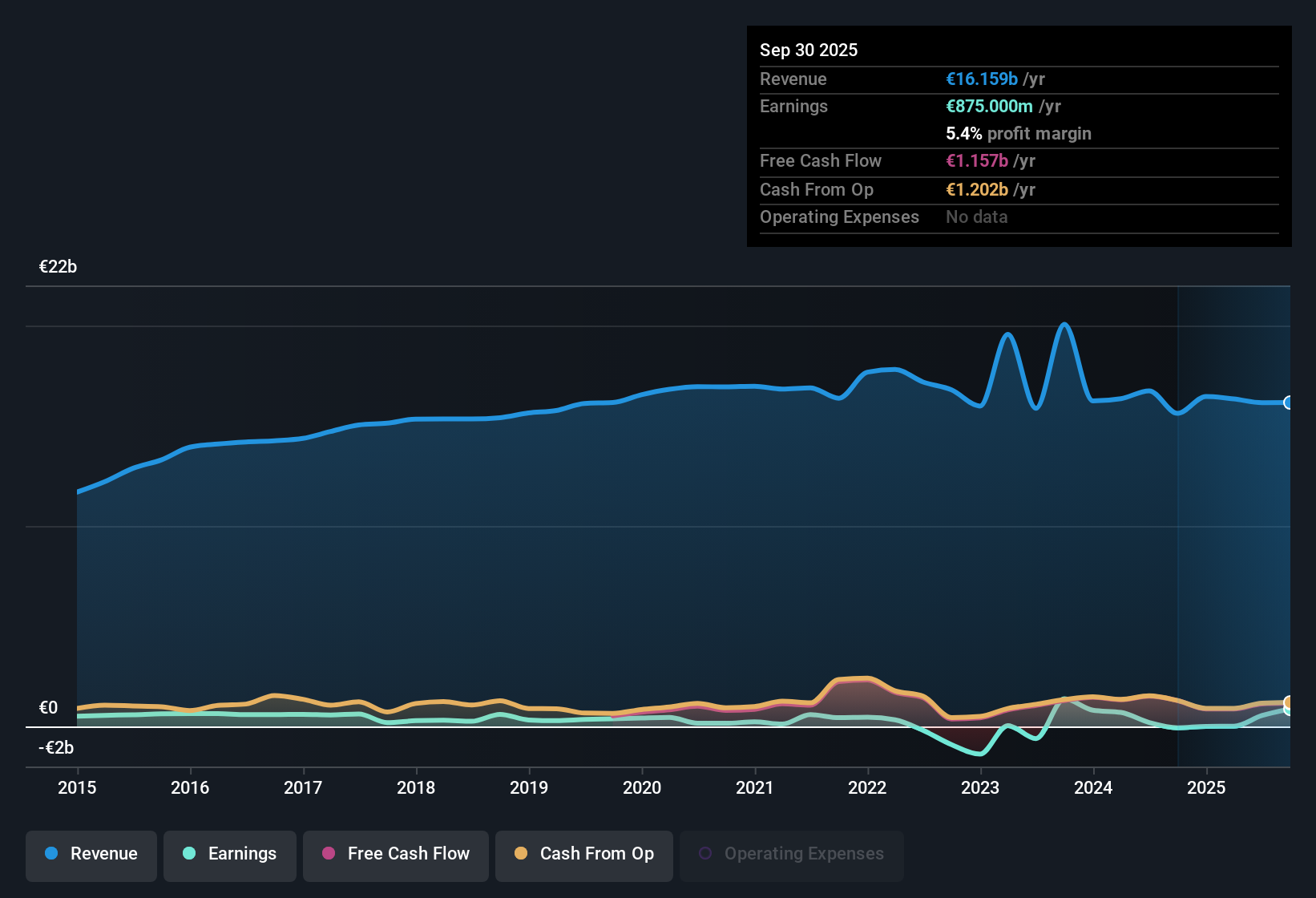

SCOR (ENXTPA:SCR) delivered a remarkable 173.2% earnings growth year-over-year, far outpacing its five-year average of 3.5% per year. Net profit margins rose to 3.3% from 1.2% last year, and with shares trading at a Price-to-Earnings Ratio of 8.7x, which is below the European Insurance industry average, investors may see opportunity in this combination of improving profitability and relative value. While the company trades below estimated fair value and shows steady revenue growth forecasts, the sustainability of its dividend will remain in focus for income-oriented shareholders.

See our full analysis for SCOR.Next up, we’re weighing these results against some of the market’s prevailing narratives to see what gets confirmed and where the story might be shifting.

See what the community is saying about SCOR

Margin Expansion Expected by 2028

- Analysts expect profit margins to rise from 3.3% today to 4.4% within three years, even though near-term revenue growth guidance has softened for 2025.

- According to the analysts' consensus view:

- SCOR’s data-driven underwriting and business diversification are credited with supporting margin expansion and resilience, enabling the company to weather a pullback to "flattish" 2025 insurance revenues after one-off contract impacts and agriculture premium revisions.

- Analysts note that the strong attritional loss ratio and technology adoption should translate to further improvements in underwriting profitability, while the company’s robust solvency ratio of 210% adds flexibility to support margins and potential future returns.

Consensus narrative points to how the new margin targets and ongoing diversification are shaping opinions on SCOR’s medium-term profitability. 📊 Read the full SCOR Consensus Narrative.

Catastrophe Exposure Raises Risk Profile

- SCOR’s net exposure to North American hurricanes rose by 40 to 50 percent year-on-year, leaving the company potentially more vulnerable to climate-driven claims volatility than last year.

- Bears argue that:

- The secular trend of more frequent, severe catastrophes combined with SCOR retaining more property-catastrophe risk could drive higher losses that may erode profit margins and drag on future net income if large storms occur.

- The ongoing legal disputes with Covéa and exposure to adverse currency swings have already offset a large part of value creation for early 2025, so persistent shocks or negative arbitration outcomes could materially impact capital positions.

Valuation Gap Versus DCF Fair Value

- SCOR shares trade at €26.28, significantly below the estimated DCF fair value of €96.97 and beneath the sole allowed analyst price target of €31.96.

- According to the analysts' consensus view:

- The current Price-to-Earnings ratio of 8.7 times compares favorably to the European Insurance industry’s 12.7 times average and supports the thesis that the stock screens as undervalued by both discounted cash flow and peer valuation metrics.

- Consensus highlights that the forecasted annual earnings growth of 9.19 percent is less robust than the broader French market, suggesting value investors should weigh the limited top-line growth outlook against the substantial gap to DCF fair value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SCOR on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Shape your unique perspective on SCOR’s story in just a few minutes and Do it your way.

A great starting point for your SCOR research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

SCOR faces limited revenue growth forecasts and ongoing exposure to catastrophic risk, which casts doubt on its ability to achieve truly stable long-term earnings.

If you want more predictable results, use our stable growth stocks screener (2097 results) to zero in on companies that consistently deliver steady growth, whatever the market throws at them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SCR

SCOR

Provides life and non-life reinsurance products in Europe, the Middle East, Africa, the Americas, Latin America, and the Asia Pacific.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion