- France

- /

- Personal Products

- /

- ENXTPA:OR

L'Oréal (ENXTPA:OR): Examining Valuation as Shares Post 11% Gain Year-to-Date

Reviewed by Simply Wall St

See our latest analysis for L'Oréal.

L'Oréal’s 11% share price return so far this year reflects growing optimism about its steady fundamentals, despite a recent brief dip and a few headline-grabbing moments around the sector. Over both the short and long term, total shareholder returns have been robust. This points to momentum that appears firmly intact.

If you’re interested in spotting standouts beyond cosmetics, now is a smart time to broaden your investing search and discover fast growing stocks with high insider ownership

That leaves a core question for investors. Given this track record and current price levels, is the market underestimating L'Oréal’s future potential, or is all the upside already reflected in the valuation?

Most Popular Narrative: 3% Undervalued

With L'Oréal recently closing at €374.70, the most widely followed narrative places its fair value slightly higher, signaling moderate upside from here. The calculation weighs substantial future growth drivers against current price levels, highlighting the competition between steady financial performance and premium pricing.

Major capital allocation to strategic acquisitions (e.g., Medik8, Color Wow) and digital/AI-driven innovation (AI personalization, beauty tech partnerships) is expected to increase category leadership, fuel product differentiation, and raise future revenue and net margins.

Curious what bold forecasts are powering that valuation edge? The secret lies in ambitious profit margin expansion and an aggressive push into digital and emerging markets. Only by seeing the full narrative will you discover which of these moving pieces tip the scales and what it could mean for the price ahead.

Result: Fair Value of €387.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in key markets and shifting consumer preferences toward niche brands could quickly challenge L'Oréal’s growth expectations.

Find out about the key risks to this L'Oréal narrative.

Another View: Market Comparisons Raise Caution

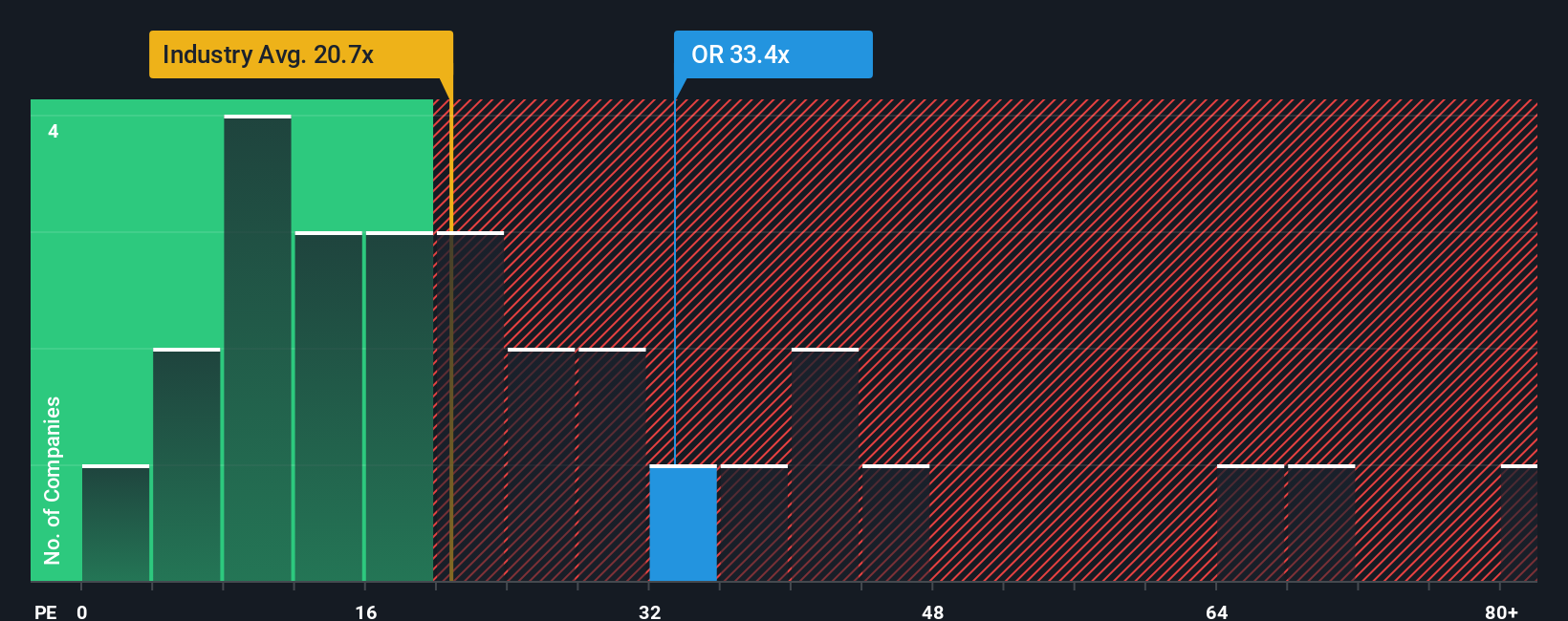

While analysts see room for upside, L'Oréal currently trades at a considerably higher earnings multiple than both its European industry average (32.6x vs. 20.8x) and key peers (average 30.1x). Its market ratio is also above its fair ratio of 30.5x. This means investors are paying a premium, which can increase the risk of downside if expectations slip. Does the market fully justify this premium, or is it pricing in more than the company can deliver?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own L'Oréal Narrative

If you prefer your own perspective or approach, now is the perfect opportunity to dive into the numbers yourself and share your narrative. All of this can be done in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding L'Oréal.

Looking for more investment ideas?

Why limit your opportunities? Take action and move ahead of the crowd with high-potential stocks and fresh sectors that others might overlook.

- Jump into generational growth opportunities by reviewing these 27 AI penny stocks, which are set to benefit from the rapid expansion of artificial intelligence applications.

- Capture market outperformance with these 877 undervalued stocks based on cash flows, featuring strong fundamentals and attractive pricing, before the broader market catches on.

- Unlock steady income with these 17 dividend stocks with yields > 3%, featuring robust dividend yields and consistent payout histories supported by healthy financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OR

L'Oréal

Through its subsidiaries, manufactures and sells cosmetic products for women and men worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives