- France

- /

- Personal Products

- /

- ENXTPA:OR

Is It Time to Reassess L'Oréal After Skincare Expansion and 5.8% Weekly Surge?

Reviewed by Bailey Pemberton

- Wondering if L'Oréal is trading at a bargain or a premium? Let’s cut through the noise and take a closer look at what the numbers and the market are signaling.

- L'Oréal’s stock has delivered a healthy 15.3% return over the past year, with a sharp 5.8% jump in just the last week. This may suggest renewed optimism or perhaps a shift in sentiment among investors.

- Recent news has centered around L'Oréal’s expansion in the skincare segment, including a major acquisition and the launch of new sustainable product lines. These moves have attracted the attention of both market watchers and competitors, raising questions about future growth and innovation.

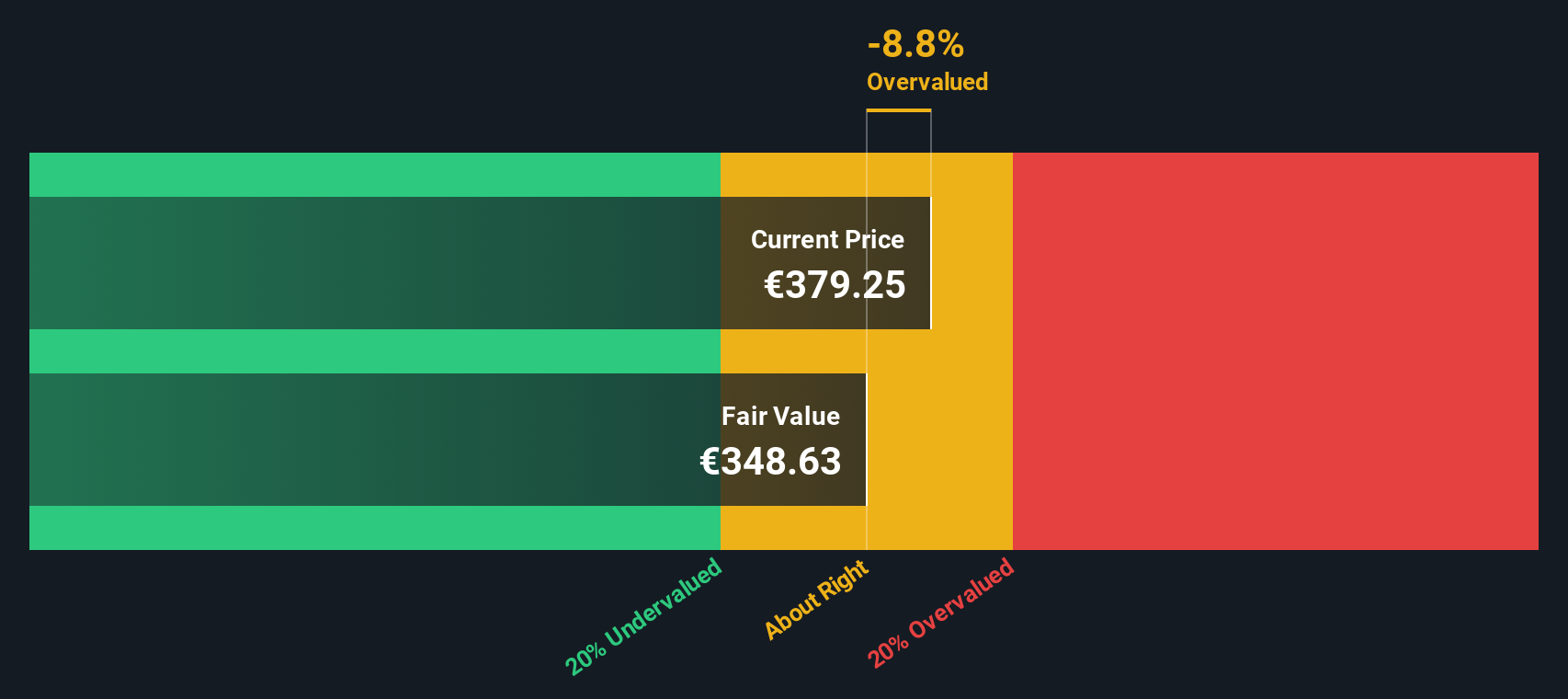

- According to our valuation framework, L'Oréal scores just 1 out of 6 on our undervaluation checks. A deeper dive into different valuation approaches is coming up, so keep reading for a potentially smarter perspective.

L'Oréal scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: L'Oréal Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today's value. This approach focuses on the actual cash L'Oréal generates, providing a more fundamental sense of value than just looking at the stock price or earnings multiples.

Currently, L'Oréal's Free Cash Flow (FCF) stands at around €7.4 billion. Analysts forecast a steady increase, with FCF projected to reach €9.7 billion by 2029. Beyond this, projections are extrapolated out to 2035, suggesting further gradual growth in FCF according to Simply Wall St's modeling. All these figures are based in euros, which matches both the company’s financial reporting and its share listing currency.

The DCF model pegs L'Oréal’s intrinsic value at €381.54 per share, using the 2 Stage Free Cash Flow to Equity method. When compared to its current share price, the stock appears about 2.3% undervalued according to this analysis. In other words, it is trading very close to its estimated fair value. This suggests there is not a significant discount or premium at the moment.

Result: ABOUT RIGHT

L'Oréal is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

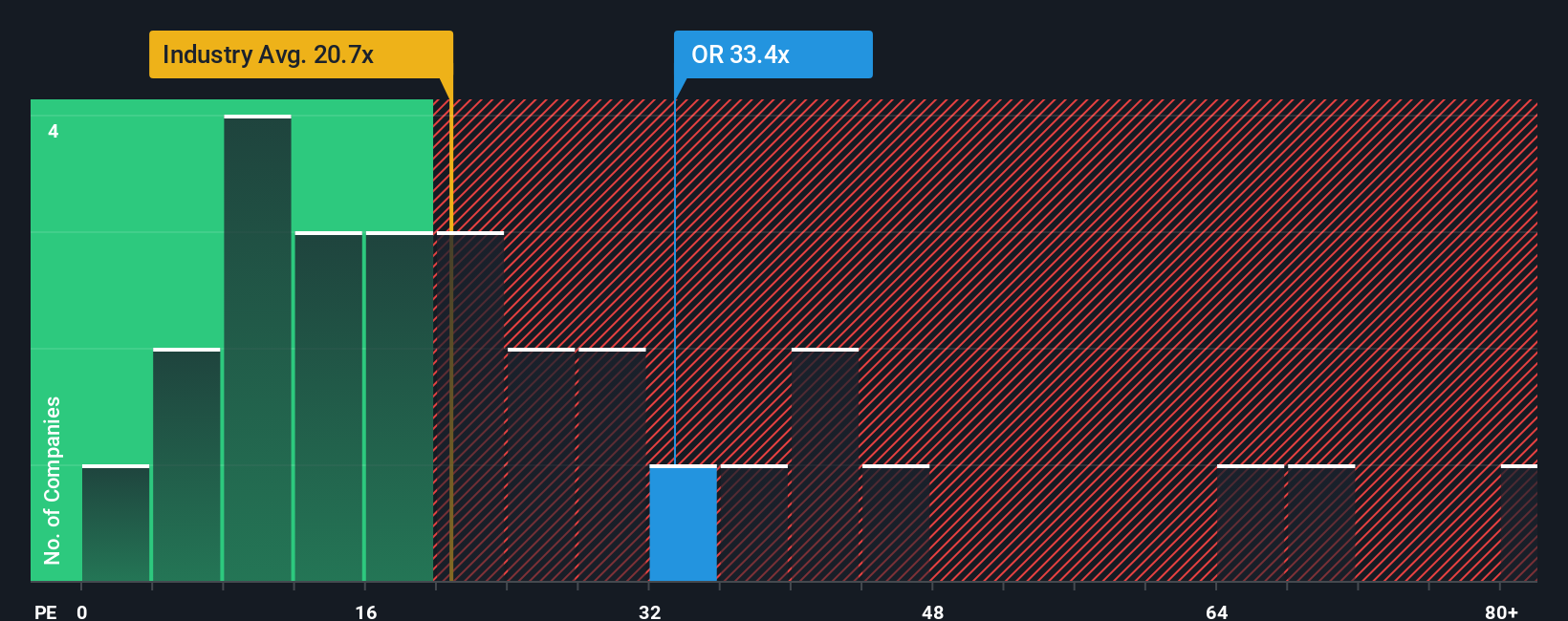

Approach 2: L'Oréal Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like L'Oréal. It gives a snapshot of how much investors are willing to pay for each euro of earnings and is a simple way to compare companies of different sizes and across industries.

Growth expectations and risk play a large role in determining what a “normal” or “fair” PE ratio should be. Companies with higher anticipated growth and lower perceived risk tend to command higher PE ratios. Conversely, slower-growing or riskier companies generally trade at lower multiples.

L'Oréal is currently trading at a PE ratio of 32.46x. That is notably higher than the industry average of 21.92x for Personal Products and above the peer average of 28.54x. This premium reflects the market’s confidence in L'Oréal's growth prospects and resilient earnings profile. However, using a simple comparison to industry or peer multiples can be misleading if the company’s unique growth, risk profile, profitability, and scale are not considered.

This is where the Simply Wall St Fair Ratio comes in. The Fair Ratio is a proprietary metric that estimates what L'Oréal’s PE should reasonably be by taking into account not just growth, but also profit margins, risks, industry dynamics, and market cap. It provides a more tailored, context-aware benchmark than a straight comparison to averages.

L'Oréal’s Fair Ratio is calculated to be 29.97x. With the current PE at 32.46x, this signals the stock is marginally more expensive than fundamentally justified, but the difference is small and within a range that suggests it is fairly valued.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

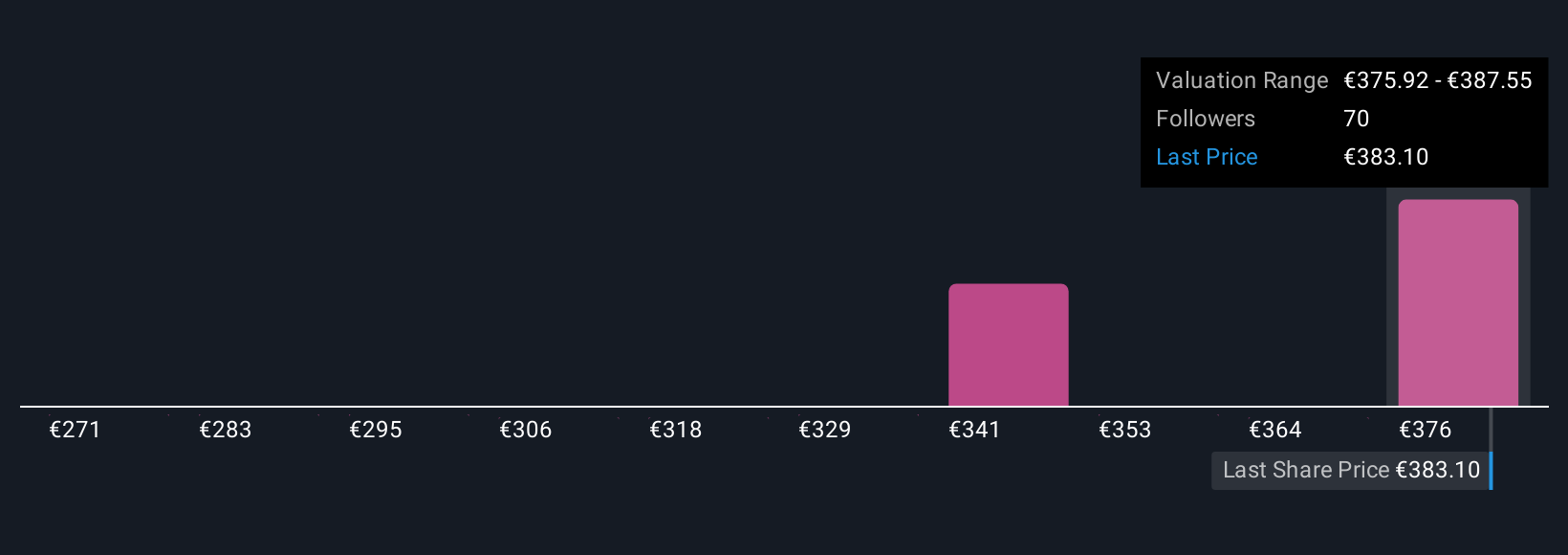

Upgrade Your Decision Making: Choose your L'Oréal Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a more powerful investment tool that let you connect the story you believe about a company, like L'Oréal’s growth in emerging markets or the risks from rising competition, directly to your expectations for its future revenue, earnings, and margins.

By building a Narrative, you turn your perspective into a simple forecast. This approach links what’s actually happening in the business with a calculation of fair value. Narratives are easy to use and freely accessible to millions of investors on Simply Wall St’s Community page, making advanced investing more approachable for everyone.

The real beauty of Narratives is how they keep you grounded as the story evolves. You can see at a glance if L'Oréal’s current share price is above or below your fair value based on your assumptions, helping you decide if it’s time to buy, hold, or sell.

Plus, as new earnings reports and news come in, Narratives are updated instantly, so your investment thesis stays fresh and relevant. For example, some investors see L'Oréal's fair value as high as €430 for bold growth, while others are more cautious with a €325 target.

Do you think there's more to the story for L'Oréal? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OR

L'Oréal

Through its subsidiaries, manufactures and sells cosmetic products for women and men worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success