- France

- /

- Personal Products

- /

- ENXTPA:ITP

Interparfums (EPA:ITP) Has Gifted Shareholders With A Fantastic 250% Total Return On Their Investment

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of Interparfums SA (EPA:ITP) stock is up an impressive 226% over the last five years. It's also good to see the share price up 14% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 10% in 90 days).

Check out our latest analysis for Interparfums

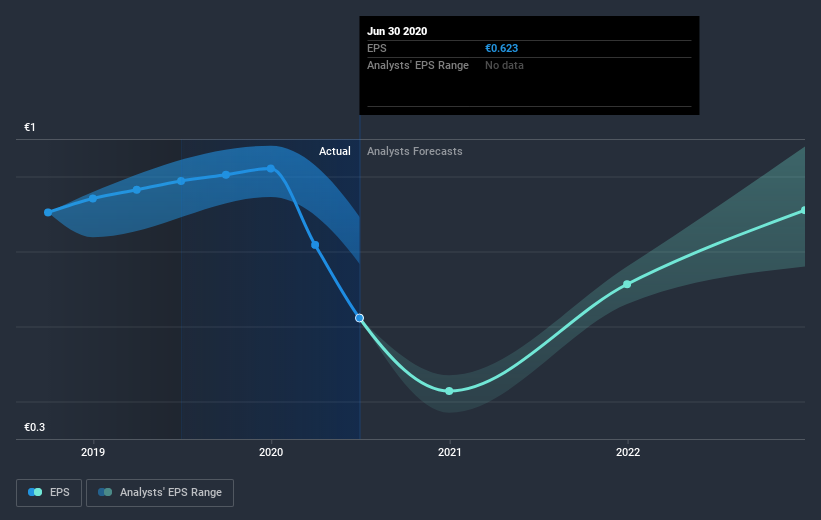

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Interparfums managed to grow its earnings per share at 5.5% a year. This EPS growth is slower than the share price growth of 27% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 69.94.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Interparfums' earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Interparfums' total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Interparfums shareholders, and that cash payout contributed to why its TSR of 250%, over the last 5 years, is better than the share price return.

A Different Perspective

We're pleased to report that Interparfums shareholders have received a total shareholder return of 35% over one year. That gain is better than the annual TSR over five years, which is 29%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before forming an opinion on Interparfums you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you decide to trade Interparfums, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ITP

Interparfums

Designs, manufactures, and distributes perfumes and cosmetics through license agreements with ready-to-wear, jewelry, or accessories houses in France, Africa, North America, South America, Eastern Europe, Western Europe, Asia, and the Middle East.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives