- France

- /

- Personal Products

- /

- ENXTPA:ITP

Did Business Growth Power Interparfums's (EPA:ITP) Share Price Gain of 163%?

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Interparfums SA (EPA:ITP) share price has soared 163% in the last three years. That sort of return is as solid as granite. Also pleasing for shareholders was the 40% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

View our latest analysis for Interparfums

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

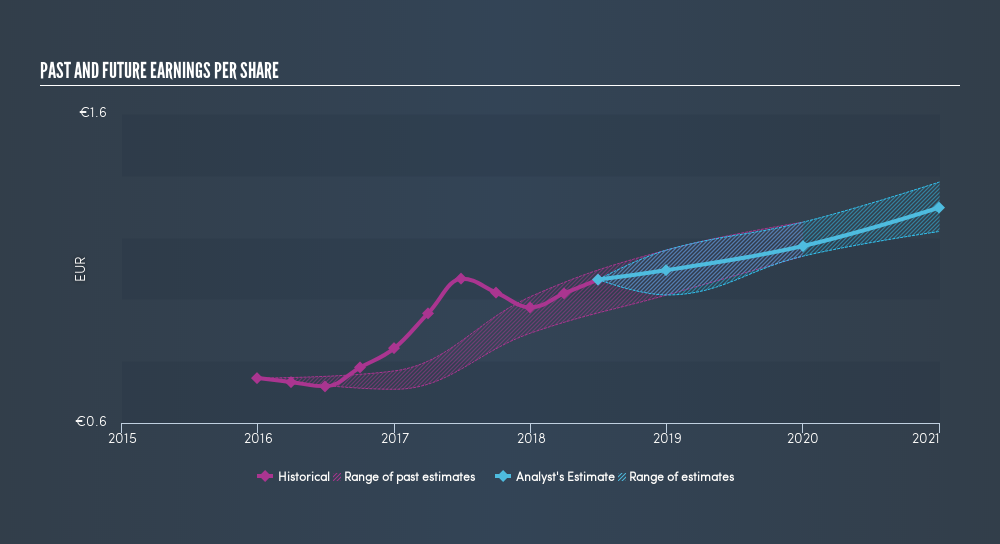

During three years of share price growth, Interparfums achieved compound earnings per share growth of 13% per year. This EPS growth is lower than the 38% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did three years ago. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our freereport on Interparfums's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Interparfums the TSR over the last 3 years was 178%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Interparfums shareholders have received a total shareholder return of 40% over one year. Of course, that includes the dividend. That's better than the annualised return of 21% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Is Interparfums cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:ITP

Interparfums

Designs, manufactures, and distributes perfumes and cosmetics through license agreements with ready-to-wear, jewelry, or accessories houses in France, Africa, North America, South America, Eastern Europe, Western Europe, Asia, and the Middle East.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives