- France

- /

- Medical Equipment

- /

- ENXTPA:ALMKT

Mauna Kea Technologies (EPA:MKEA) Share Prices Have Dropped 70% In The Last Three Years

Mauna Kea Technologies SA (EPA:MKEA) shareholders should be happy to see the share price up 27% in the last month. But that doesn't change the fact that the returns over the last three years have been stomach churning. The share price has sunk like a leaky ship, down 70% in that time. So it's about time shareholders saw some gains. The thing to think about is whether the business has really turned around.

View our latest analysis for Mauna Kea Technologies

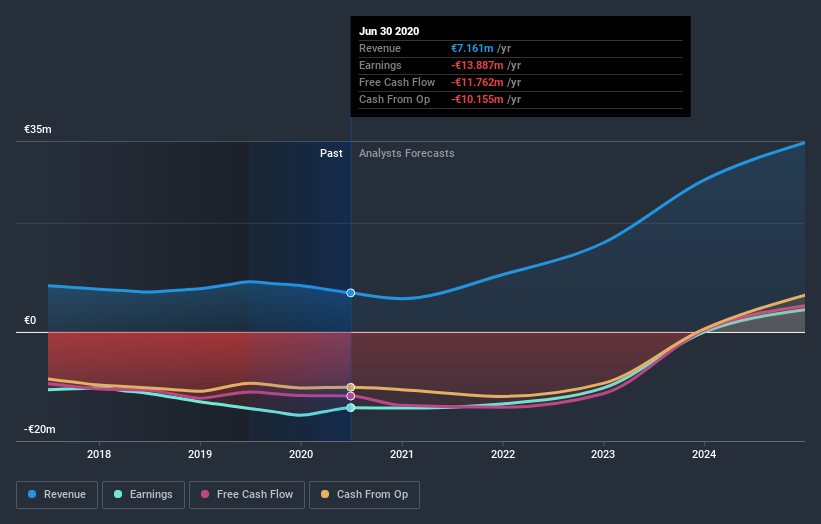

Given that Mauna Kea Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Mauna Kea Technologies saw its revenue grow by 0.5% per year, compound. That's not a very high growth rate considering it doesn't make profits. But the share price crash at 19% per year does seem a bit harsh! While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Mauna Kea Technologies has rewarded shareholders with a total shareholder return of 52% in the last twelve months. Notably the five-year annualised TSR loss of 9% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Mauna Kea Technologies better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Mauna Kea Technologies (of which 1 shouldn't be ignored!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you decide to trade Mauna Kea Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Mauna Kea Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ALMKT

Mauna Kea Technologies

A medical device company, manufactures and sells medical devices in Europe and internationally.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives