- France

- /

- Healthcare Services

- /

- ENXTPA:EMEIS

The Bull Case For emeis Société anonyme (ENXTPA:EMEIS) Could Change Following Major Debt Reduction Initiatives and Improved Results

Reviewed by Sasha Jovanovic

- emeis Société anonyme recently announced half-year results for 2025, reporting higher sales of €2.91 billion and reduced net loss of €137 million compared to the previous year.

- The company also confirmed positive free cash flow, achieved major disposals, and launched a healthcare real estate initiative set to cut net debt by nearly €700 million.

- We'll explore how emeis Société anonyme’s focus on debt reduction through asset disposals shapes its evolving investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is emeis Société anonyme's Investment Narrative?

For emeis Société anonyme, being a shareholder today means believing in a recovery story that is being driven by two key themes: turning around persistent losses and aggressively reducing debt. The latest half-year results show tangible progress, with narrowing net losses and sales edging higher, but what truly stands out is the company's commitment to positive free cash flow and asset disposals designed to cut net debt by nearly €700 million. This move could directly address what has historically been one of the largest risks: high leverage and weak profitability. In the short term, the positive reaction in the share price suggests the market sees this as a material catalyst for a re-rating of the stock, although there are still questions about the pace of operational improvement and the relatively new board’s ability to execute the new strategies. For now, the risk profile for emeis is shifting, perhaps meaningfully, yet operational and governance challenges remain.

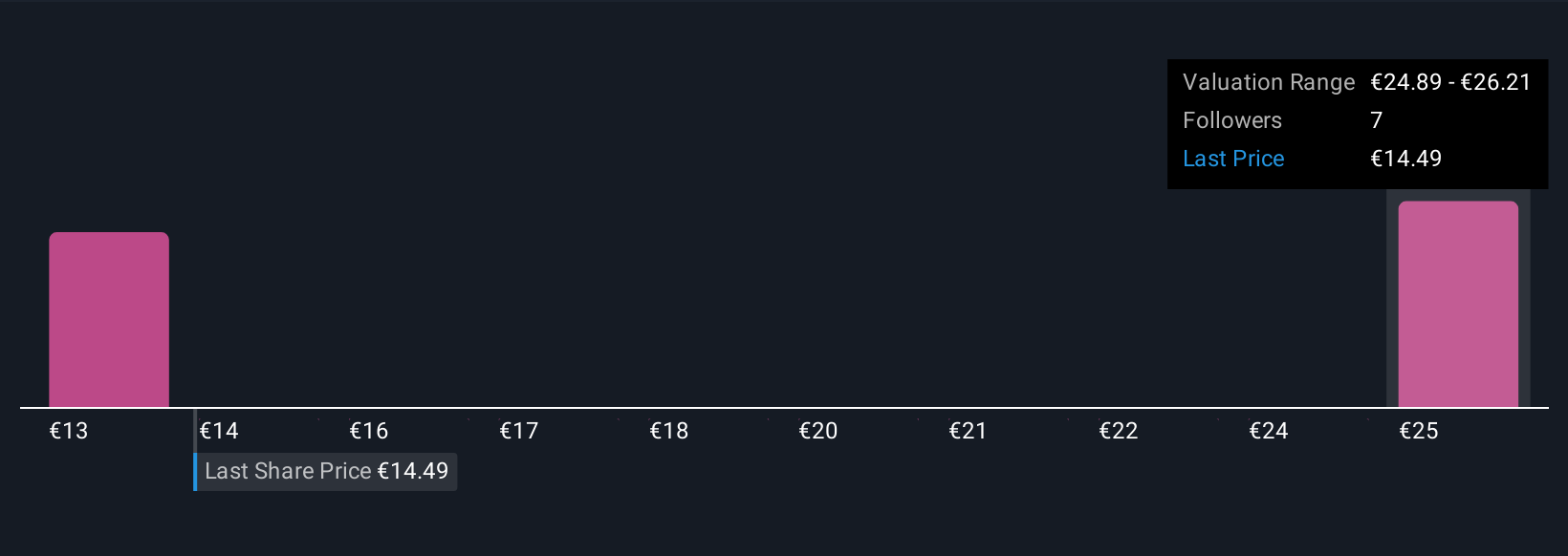

But with all this progress, new board turnover could raise fresh questions for shareholders. emeis Société anonyme's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on emeis Société anonyme - why the stock might be worth 17% less than the current price!

Build Your Own emeis Société anonyme Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your emeis Société anonyme research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free emeis Société anonyme research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate emeis Société anonyme's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EMEIS

emeis Société anonyme

Operates nursing homes, assisted-living facilities, post-acute and rehabilitation hospitals, and psychiatric hospitals.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives