- France

- /

- Medical Equipment

- /

- ENXTPA:AMPLI

Amplitude Surgical SA's (EPA:AMPLI) Popularity With Investors Is Clear

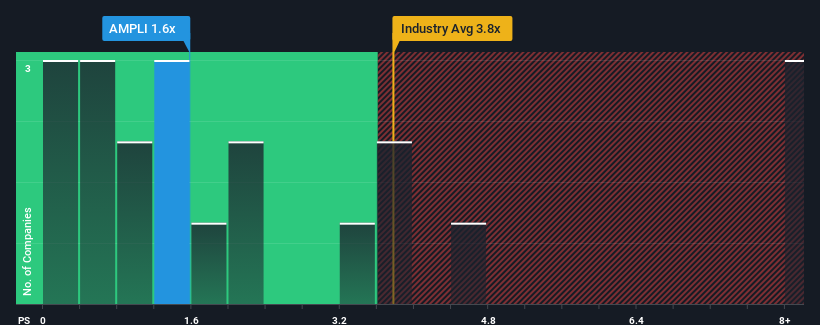

There wouldn't be many who think Amplitude Surgical SA's (EPA:AMPLI) price-to-sales (or "P/S") ratio of 1.6x is worth a mention when the median P/S for the Medical Equipment industry in France is very similar. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Amplitude Surgical

What Does Amplitude Surgical's P/S Mean For Shareholders?

The revenue growth achieved at Amplitude Surgical over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Amplitude Surgical will help you shine a light on its historical performance.How Is Amplitude Surgical's Revenue Growth Trending?

In order to justify its P/S ratio, Amplitude Surgical would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 23% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 6.1% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, it's clear to see why Amplitude Surgical's P/S matches up closely to its industry peers. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Bottom Line On Amplitude Surgical's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we've seen, Amplitude Surgical's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Amplitude Surgical with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Amplitude Surgical's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:AMPLI

Amplitude Surgical

Designs, develops, and markets products for orthopedic surgery in France and internationally.

Slightly overvalued with questionable track record.

Similar Companies

Market Insights

Community Narratives