As global markets react to the recent Fed rate cut, France's CAC 40 Index has shown a modest gain, reflecting cautious optimism among investors. This backdrop provides an intriguing opportunity to explore some lesser-known French stocks that could benefit from the current economic climate. In this environment, identifying promising stocks often involves looking for companies with strong fundamentals and growth potential that may be overlooked by mainstream investors.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine Société coopérative | 4.90% | 7.75% | 11.53% | ★★★★★★ |

| VIEL & Cie société anonyme | 54.02% | 5.66% | 19.86% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market cap of €405.95 million.

Operations: EPC Groupe generates revenue primarily from the manufacture, storage, and distribution of explosives across multiple regions. The company has a market cap of €405.95 million.

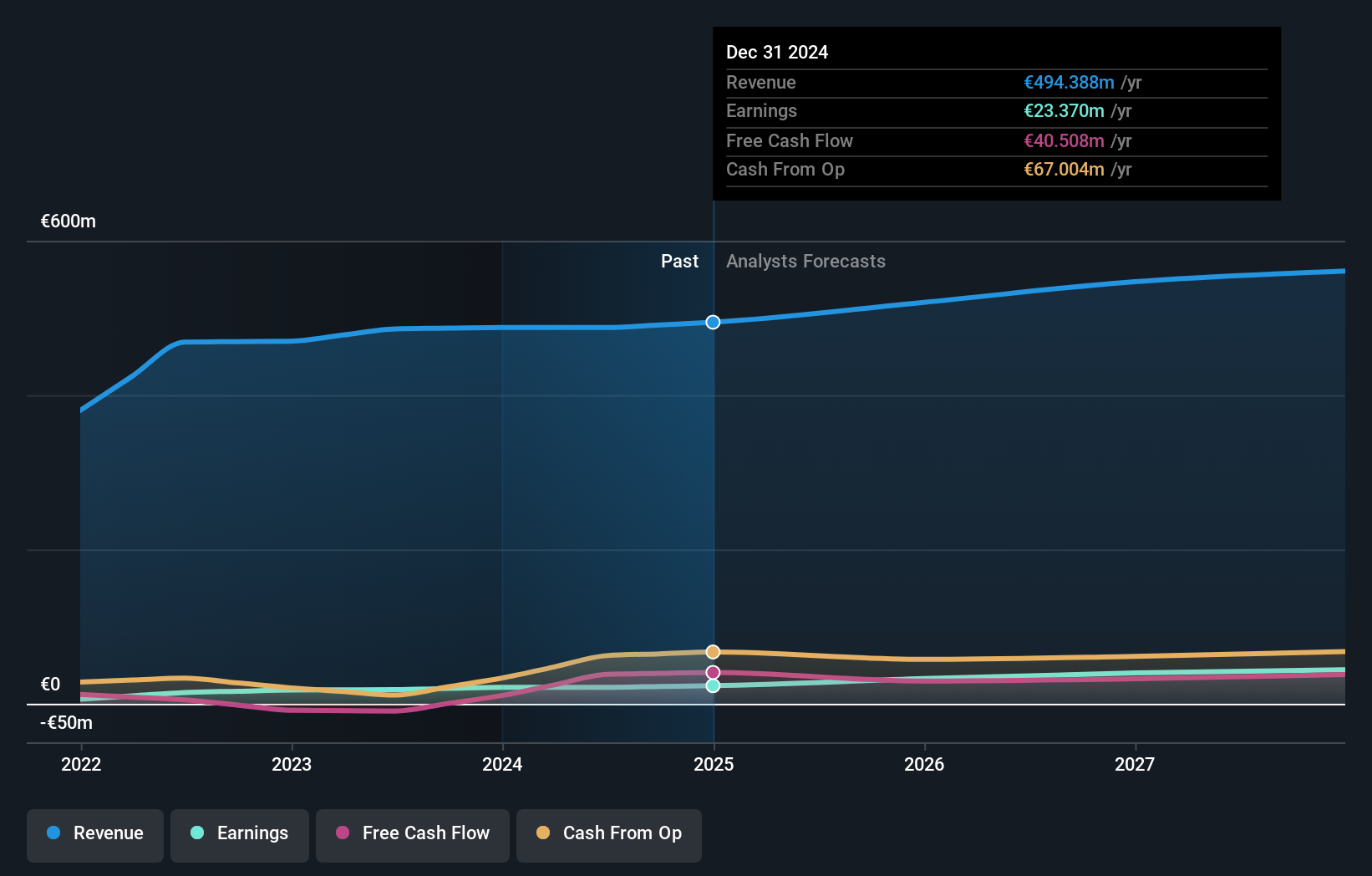

EPC Groupe, a small-cap player in the chemicals industry, reported half-year sales of €242.42 million and net income of €12.52 million, both slightly down from last year. Despite this, earnings grew by 17.4% over the past year and are forecasted to grow 25.15% annually. The company's debt to equity ratio has improved marginally from 60.7% to 60.1%. However, interest payments on its debt remain poorly covered by EBIT at just 2.6x coverage.

- Click to explore a detailed breakdown of our findings in EPC Groupe's health report.

Review our historical performance report to gain insights into EPC Groupe's's past performance.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services in France and internationally with a market cap of €1.05 billion.

Operations: Neurones generates revenue from three main segments: Infrastructure Services (€483.86 million), Application Services (€236.52 million), and Consulting (€54.53 million).

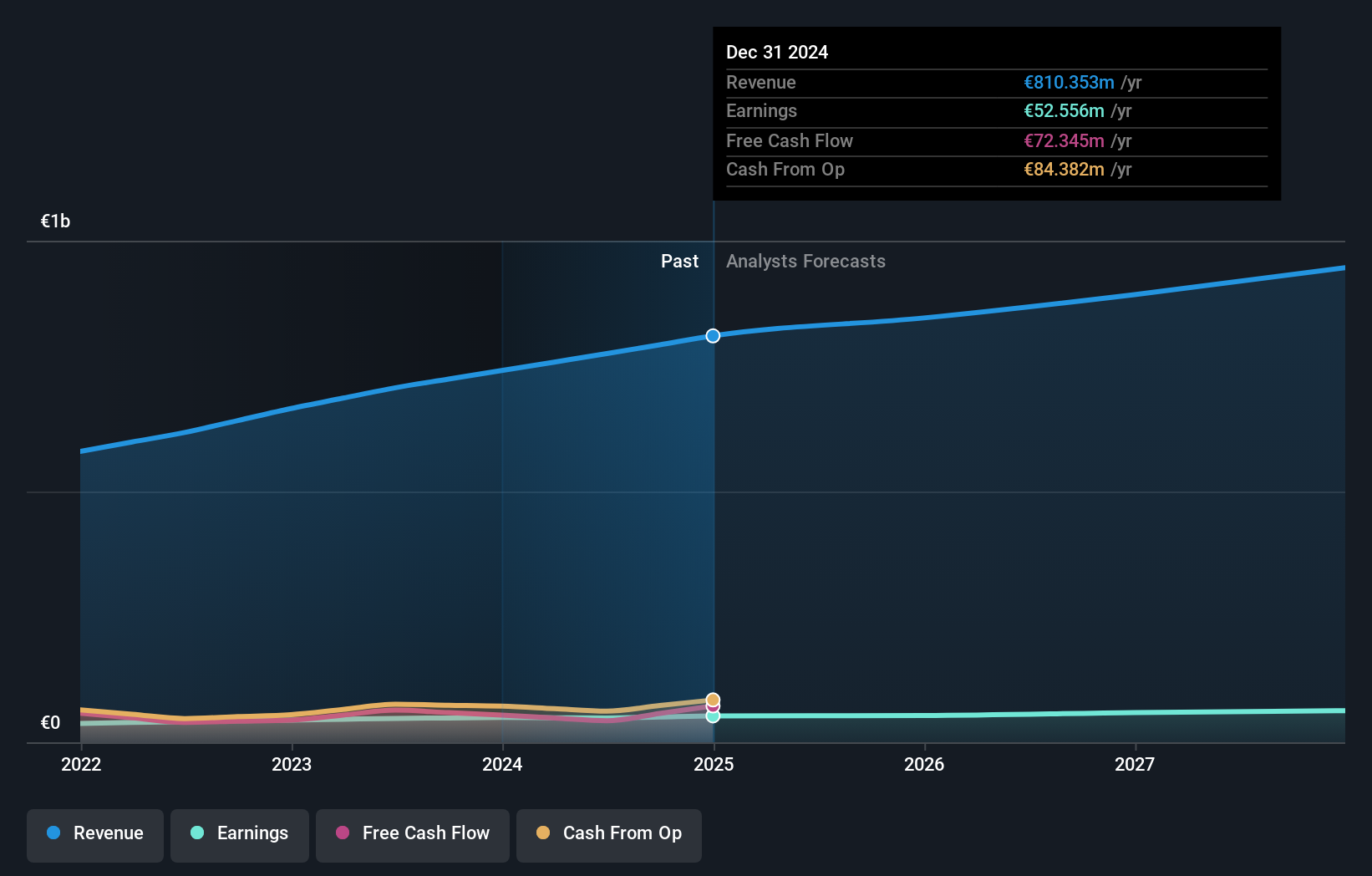

Neurones, a small French IT services firm, has shown steady performance with recent half-year revenue of €402.43 million, up from €368.69 million last year. Despite this growth, net income dipped slightly to €24.5 million from €25.42 million previously. Basic earnings per share stood at €1.01 compared to the prior year's €1.05. Over the past five years, its debt-to-equity ratio rose modestly from 0% to 2.8%, while maintaining high-quality earnings and positive free cash flow of approximately €59 million in the latest quarter.

- Click here to discover the nuances of Neurones with our detailed analytical health report.

Examine Neurones' past performance report to understand how it has performed in the past.

Savencia (ENXTPA:SAVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Savencia SA produces, distributes, and markets dairy and cheese products in France, the rest of Europe, and internationally with a market cap of €700.79 million.

Operations: Savencia generates revenue primarily from the production, distribution, and marketing of dairy and cheese products across France, Europe, and globally. The company has a market capitalization of €700.79 million.

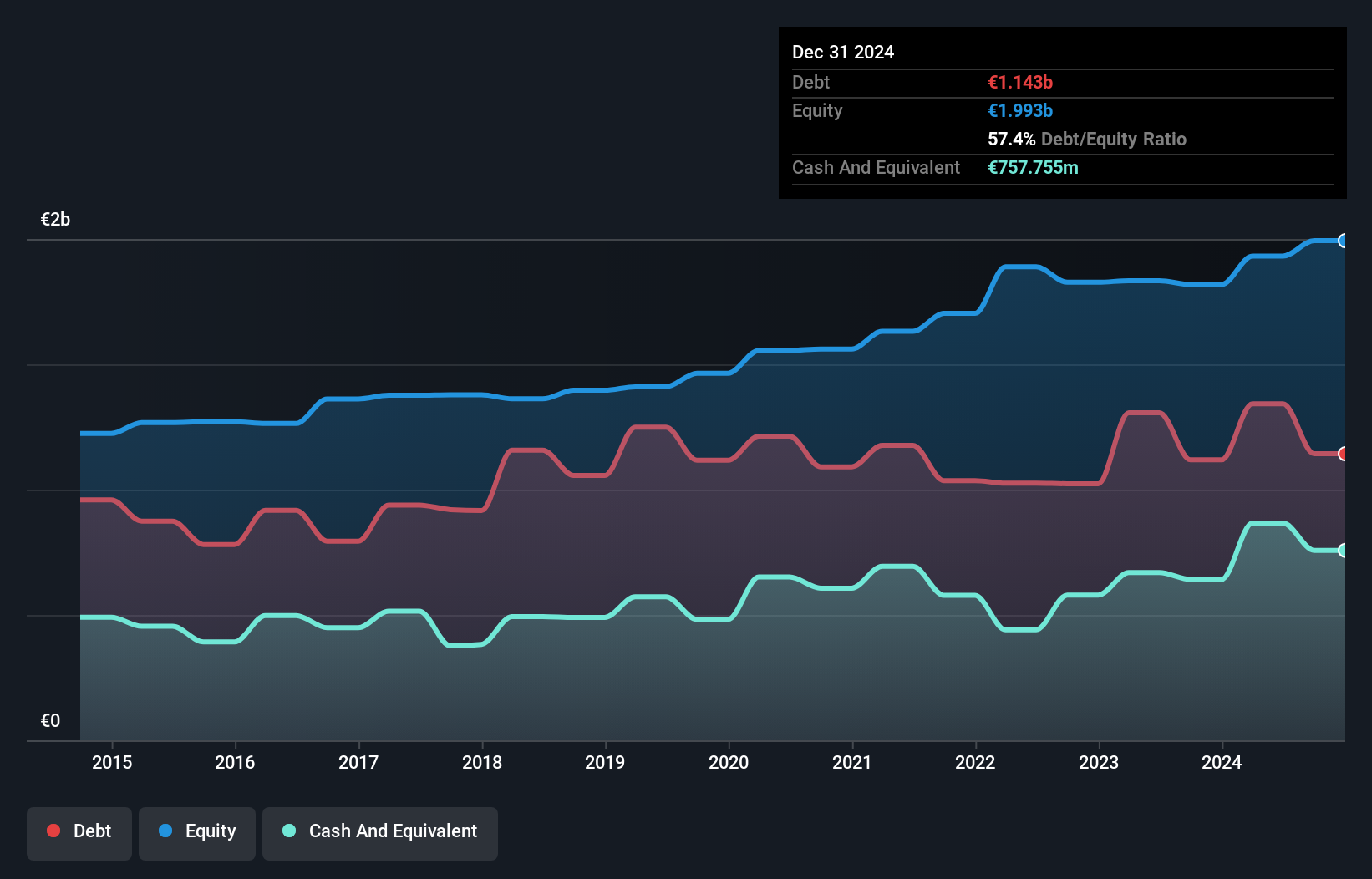

Savencia, a notable player in the French food industry, has shown impressive earnings growth of 114.7% over the past year, outpacing its industry peers. The company reported net income of €57.92M for H1 2024, up from €51.29M last year, with basic and diluted EPS rising to €4.33 from €3.8. Despite a one-off loss of €43.6M impacting recent financials, Savencia's debt-to-equity ratio improved to 69.5% from 88.6% over five years and EBIT covers interest payments by 32x.

- Dive into the specifics of Savencia here with our thorough health report.

Assess Savencia's past performance with our detailed historical performance reports.

Next Steps

- Get an in-depth perspective on all 35 Euronext Paris Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EPC Groupe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXPL

EPC Groupe

Engages in the manufacture, storage, and distribution of explosives in Europe, Africa, Asia Pacific, and the Americas.

Proven track record with adequate balance sheet.