Does Pernod Ricard (ENXTPA:RI) Still Have Pricing Power Amid Weak Q1 Sales in China and US?

Reviewed by Sasha Jovanovic

- Pernod Ricard recently reported a 7.6% year-over-year decline in organic net sales for Q1 FY2026, citing soft consumer demand and inventory reductions in China and the US, alongside currency headwinds; fiscal Q1 sales were €2,384 million.

- Despite a slow start and sharper-than-expected sales decline, the company reaffirmed its full-year 2026 guidance and announced medium-term targets for organic net sales growth of 3% to 6% per year through 2029, signaling a focus on margin expansion and cost efficiency.

- We'll examine how weak demand in China and the US during the first quarter could influence Pernod Ricard's outlook and future growth assumptions.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Pernod Ricard Investment Narrative Recap

To own Pernod Ricard, I believe an investor must have confidence in management’s ability to restore growth in its two key mature markets, the US and China, while executing a plan for margin expansion through cost efficiency and premiumization. The recent Q1 sales decline amplifies concerns over demand softness in these markets, keeping attention on the company’s near-term ability to reignite organic sales momentum; this news has made the sales recovery in the second half the most important short-term catalyst, while further weakness in China or the US presents the biggest risk.

Of the recent announcements, Pernod Ricard’s reaffirmation of its full-year 2026 organic net sales guidance, despite a soft start, stands out as most pertinent. This commitment, together with newly stated mid-term annual organic sales growth targets (3 percent to 6 percent through 2029), frames management’s determination to deliver against current headwinds and positions the group’s second-half sales trajectory as a key area to watch.

Yet, against the company’s optimistic guidance, there remains one risk that investors should be aware of: if weak consumer demand in China continues to drag into the second half of this year ...

Read the full narrative on Pernod Ricard (it's free!)

Pernod Ricard's outlook forecasts €10.8 billion in revenue and €1.8 billion in earnings by 2028. This is based on an expected annual revenue decline of 0.4% and an earnings increase of €0.2 billion from the current €1.6 billion.

Uncover how Pernod Ricard's forecasts yield a €104.33 fair value, a 17% upside to its current price.

Exploring Other Perspectives

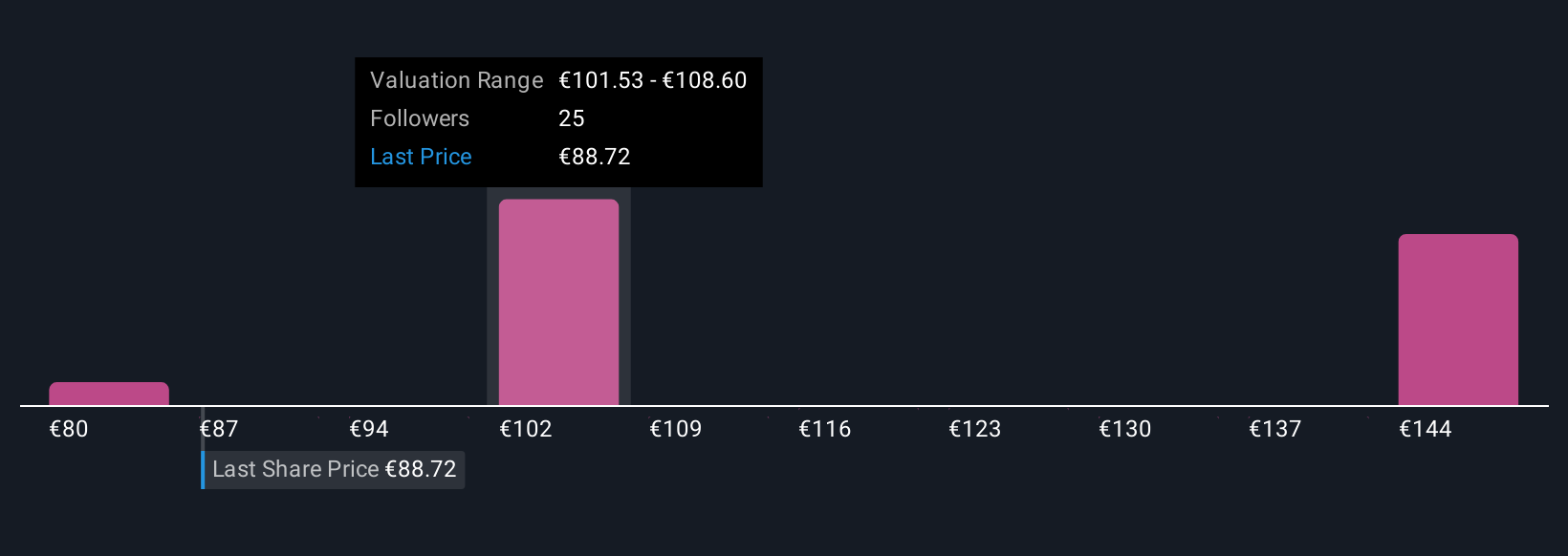

Simply Wall St Community members provided nine fair value estimates for Pernod Ricard that span €80.30 to €151.06. While you weigh these varied viewpoints, keep in mind the risk that persistent demand softness in China could affect the company’s progress toward its sales targets.

Explore 9 other fair value estimates on Pernod Ricard - why the stock might be worth as much as 69% more than the current price!

Build Your Own Pernod Ricard Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pernod Ricard research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pernod Ricard research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pernod Ricard's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RI

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives