- France

- /

- Electrical

- /

- ENXTPA:PERR

Exploring France's Undiscovered Stock Gems This October 2024

Reviewed by Simply Wall St

As the European Central Bank continues to lower interest rates, the French market has shown resilience, with the CAC 40 Index experiencing modest gains amid broader European optimism. In this environment of monetary easing and economic recalibration, identifying undiscovered stock gems in France requires a keen eye for companies that demonstrate strong fundamentals and potential for growth despite market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative | 10.84% | 3.22% | 6.38% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| ADLPartner | 82.84% | 9.86% | 16.18% | ★★★★★☆ |

| VIEL & Cie société anonyme | 54.02% | 5.66% | 19.86% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Vaziva Société anonyme | 8.03% | 68.56% | 431.41% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative (ENXTPA:CCN)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative provides a range of banking products and services to diverse clients in France, with a market capitalization of €453.72 million.

Operations: The company generates revenue primarily from its retail banking segment, amounting to €350.44 million.

Nestled in the financial landscape of France, Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine stands out with its solid foundation. Boasting total assets of €25.5 billion and equity of €3 billion, this cooperative bank relies heavily on customer deposits, which make up 92% of its liabilities—a notably low-risk funding strategy. The bank's earnings grew by 4% over the past year, surpassing industry growth rates. With a robust allowance for bad loans at 111% and non-performing loans at just 1.1%, it trades significantly below estimated fair value, offering potential appeal to discerning investors seeking undervalued opportunities.

Laurent-Perrier (ENXTPA:LPE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Laurent-Perrier S.A. is a company that focuses on the production and sale of champagne, with a market capitalization of €591.80 million.

Operations: Laurent-Perrier generates revenue primarily through the production and distribution of champagne wines, amounting to €312.54 million.

Renowned for its sparkling wines, Laurent-Perrier showcases a robust financial profile with earnings growth of 8.7% over the past year, outpacing the Beverage industry's -31.5%. The company has effectively managed its debt, bringing the debt-to-equity ratio down from 84.3% to 39% in five years, while maintaining a satisfactory net debt-to-equity ratio of 30.5%. Despite trading at 15% below estimated fair value and possessing high-quality earnings with an EBIT covering interest payments by 11.8 times, future earnings are expected to decrease slightly by an average of 0.4% annually over three years.

- Navigate through the intricacies of Laurent-Perrier with our comprehensive health report here.

Gain insights into Laurent-Perrier's past trends and performance with our Past report.

Gérard Perrier Industrie (ENXTPA:PERR)

Simply Wall St Value Rating: ★★★★★★

Overview: Gérard Perrier Industrie S.A. specializes in the design, manufacture, installation, and maintenance of electrical, electronic, automation, and instrumentation equipment both in France and internationally with a market cap of €318.99 million.

Operations: The company's revenue is primarily derived from its Branch Manufacturing and Specializations (€96.75 million), Branch Installation Maintenance (€95.89 million), and Energy Branch (€90.37 million). The Aeronautical Branch contributes €40.25 million to the total revenue, while Holding accounts for €10.11 million.

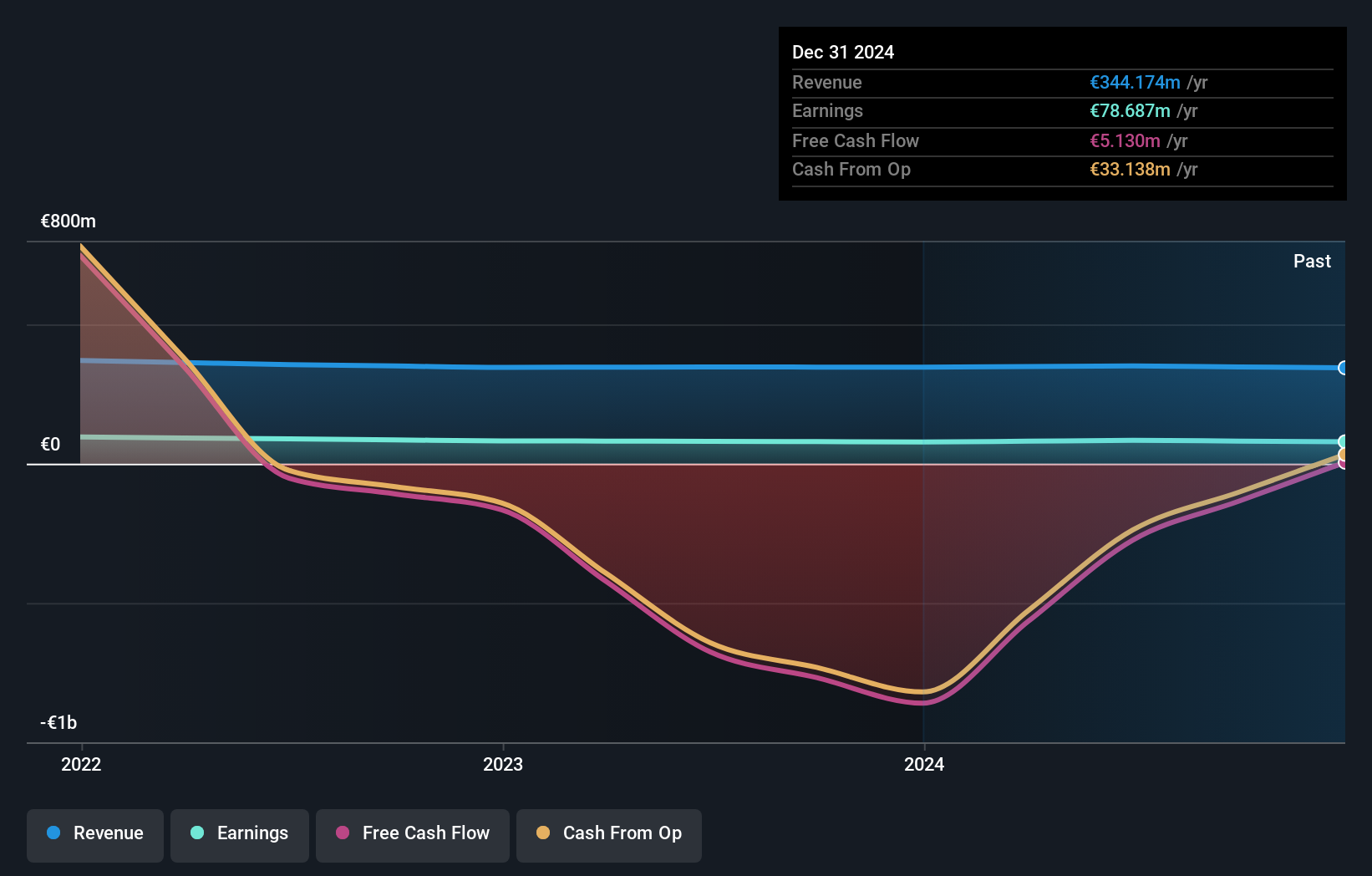

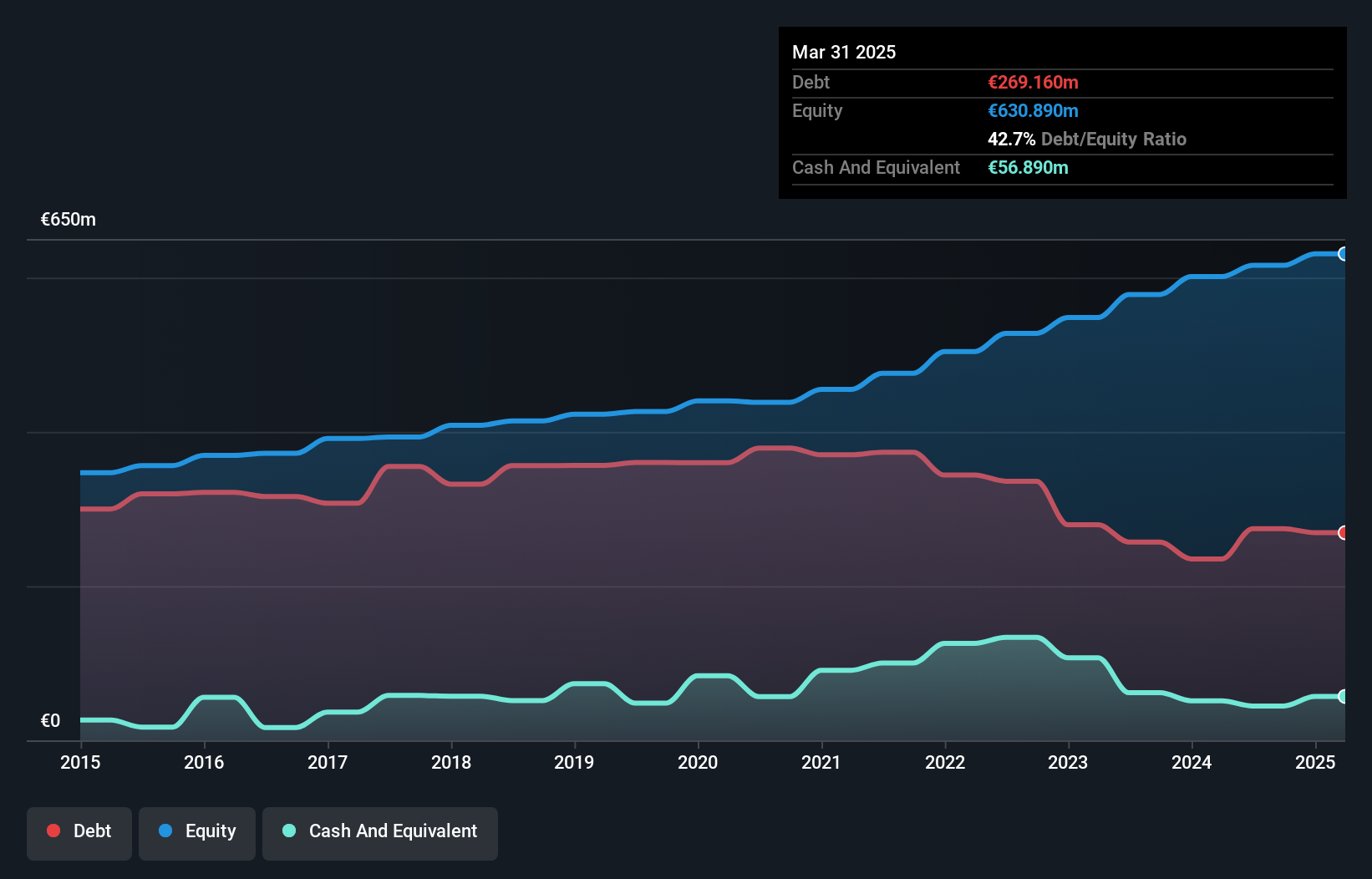

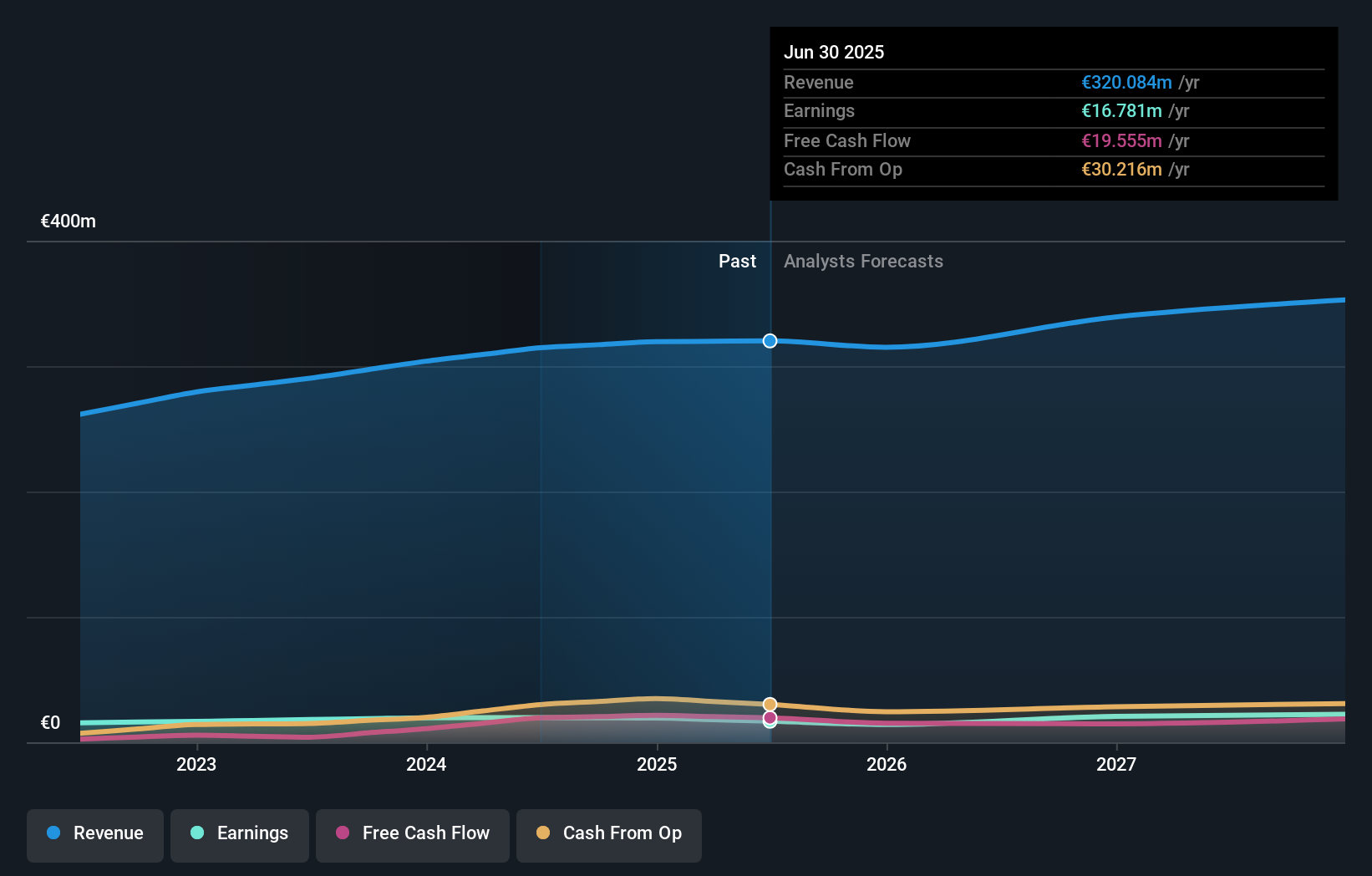

Gérard Perrier Industrie, a notable player in the electrical industry, showcases solid financial health with earnings growth of 8.6% over the past year, outpacing the industry's -1.2%. The company's debt-to-equity ratio has slightly improved from 25.1% to 25% over five years, indicating prudent financial management. With sales reaching €157.26 million for the half-year ending June 2024 and net income at €9.29 million, it demonstrates consistent performance compared to last year’s figures of €146.55 million and €9.17 million respectively. Its price-to-earnings ratio stands attractively at 16x against an industry average of 19x, suggesting potential value for investors seeking opportunities in this sector.

- Click to explore a detailed breakdown of our findings in Gérard Perrier Industrie's health report.

Assess Gérard Perrier Industrie's past performance with our detailed historical performance reports.

Key Takeaways

- Delve into our full catalog of 38 Euronext Paris Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:PERR

Gérard Perrier Industrie

Engages in design, manufacture, installation, and maintenance of electrical, electronic, automation, and instrumentation equipment in France and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives