Is Weakness In L.D.C. S.A. (EPA:LOUP) Stock A Sign That The Market Could be Wrong Given Its Strong Financial Prospects?

It is hard to get excited after looking at L.D.C's (EPA:LOUP) recent performance, when its stock has declined 5.4% over the past three months. But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Specifically, we decided to study L.D.C's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for L.D.C

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for L.D.C is:

10% = €146m ÷ €1.4b (Based on the trailing twelve months to February 2020).

The 'return' is the yearly profit. That means that for every €1 worth of shareholders' equity, the company generated €0.10 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

L.D.C's Earnings Growth And 10% ROE

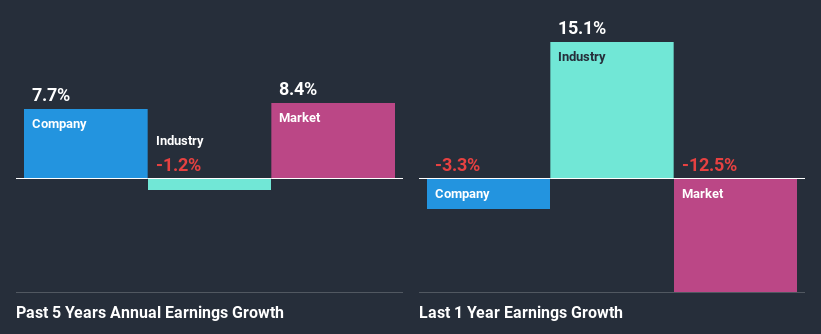

To start with, L.D.C's ROE looks acceptable. Further, the company's ROE compares quite favorably to the industry average of 7.9%. This probably laid the ground for L.D.C's moderate 7.7% net income growth seen over the past five years.

Given that the industry shrunk its earnings at a rate of 1.2% in the same period, the net income growth of the company is quite impressive.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is LOUP fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is L.D.C Using Its Retained Earnings Effectively?

In L.D.C's case, its respectable earnings growth can probably be explained by its low three-year median payout ratio of 18% (or a retention ratio of 82%), which suggests that the company is investing most of its profits to grow its business.

Besides, L.D.C has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 16% of its profits over the next three years. Accordingly, forecasts suggest that L.D.C's future ROE will be 10% which is again, similar to the current ROE.

Conclusion

Overall, we are quite pleased with L.D.C's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. We also studied the latest analyst forecasts and found that the company's earnings growth is expected be similar to its current growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you’re looking to trade L.D.C, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:LOUP

L.D.C

Produces and sells poultry and processed products in France and internationally.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026