As global markets react to China's robust stimulus measures, European indices have shown notable resilience, with France's CAC 40 Index climbing nearly 4% recently. Against this backdrop of economic optimism and potential interest rate cuts in Europe, dividend stocks on the Euronext Paris can offer a compelling opportunity for income-focused investors. In this article, we will explore three top dividend stocks listed on Euronext Paris that are yielding up to 7.2%. These stocks not only provide attractive yields but also exhibit strong fundamentals that align well with the current market conditions.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.67% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.08% | ★★★★★★ |

| Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 7.93% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.09% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.83% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.74% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.75% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.41% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.78% | ★★★★★☆ |

| Infotel (ENXTPA:INF) | 4.66% | ★★★★☆☆ |

Click here to see the full list of 34 stocks from our Top Euronext Paris Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

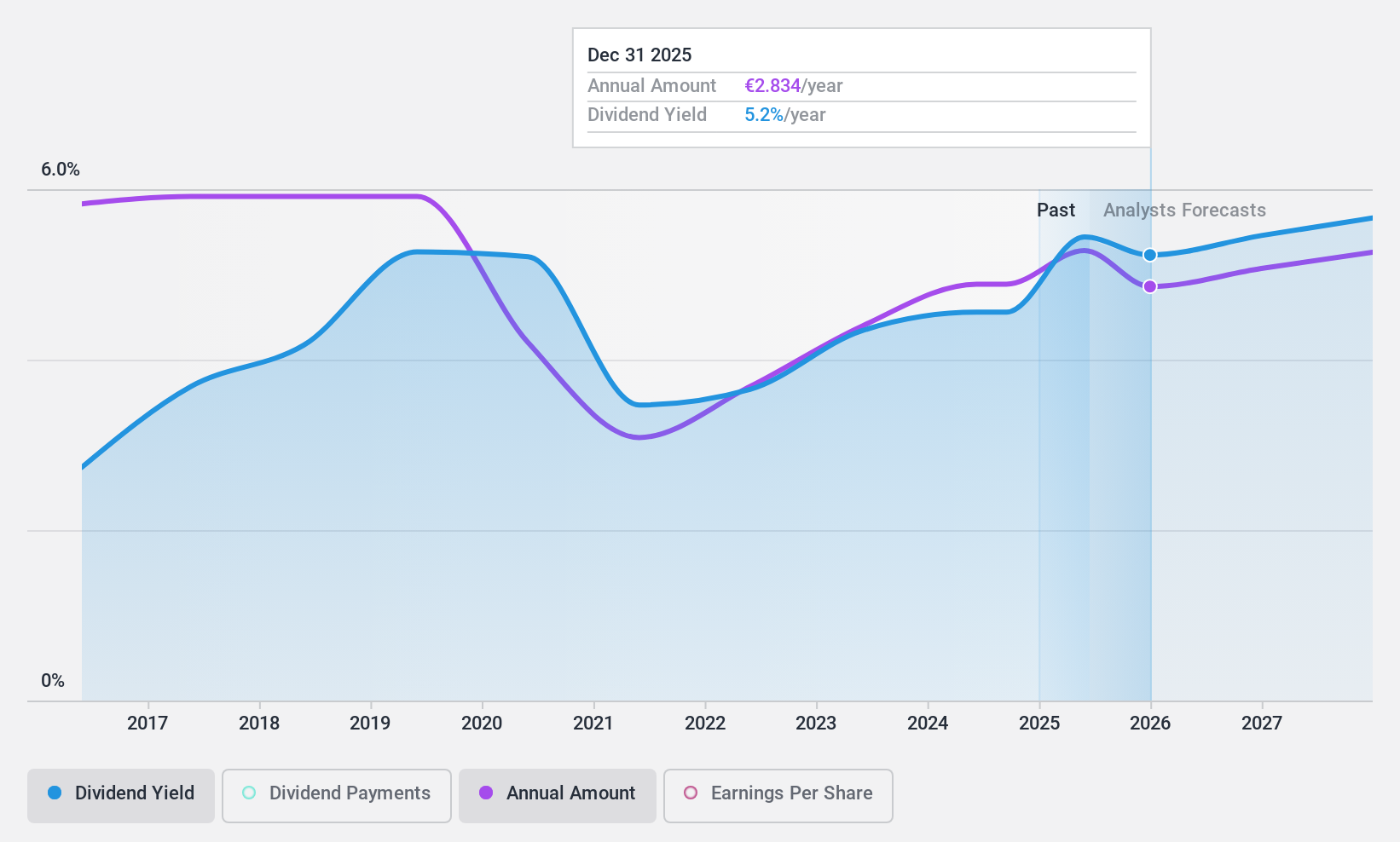

Société BIC (ENXTPA:BB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Société BIC SA manufactures and sells stationery, lighters, shavers, and other products worldwide with a market cap of €2.51 billion.

Operations: Société BIC SA's revenue segments include Flame for Life (€820 million), Blade Excellence (€540 million), and Human Expression (€838 million).

Dividend Yield: 4.7%

Société BIC is trading at 31.4% below its estimated fair value and has a forecasted earnings growth of 6.43% per year. The company's dividends, covered by both earnings (55.4%) and cash flows (41.9%), have been volatile over the past decade but have increased overall in that period. Recent events include a share buyback program, executive changes, and stable net income despite slight declines in sales for Q2 2024 compared to the previous year.

- Click here to discover the nuances of Société BIC with our detailed analytical dividend report.

- Our expertly prepared valuation report Société BIC implies its share price may be lower than expected.

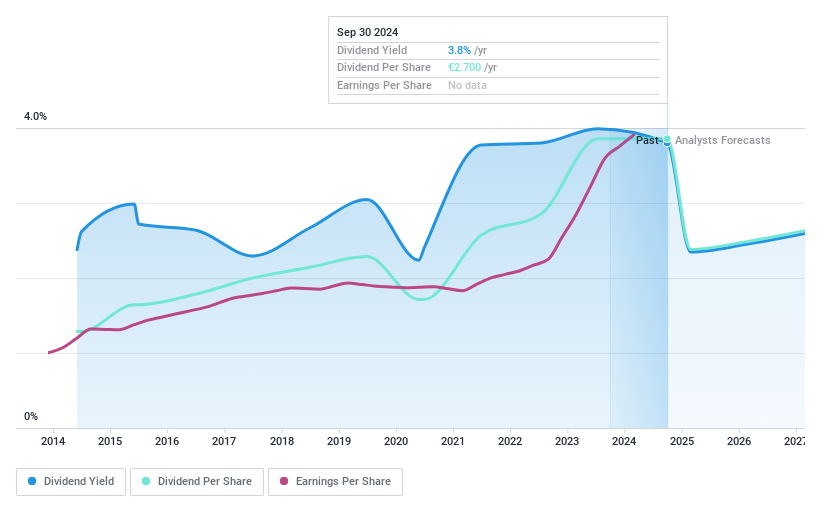

L.D.C (ENXTPA:LOUP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: L.D.C. S.A. produces and sells poultry and processed products in France and internationally, with a market cap of €2.46 billion.

Operations: L.D.C. S.A.'s revenue segments include €847.43 million from abroad, €4.52 billion from poultry, and €916.89 million from processed products.

Dividend Yield: 3.8%

L.D.C. S.A. is trading at 62.4% below its estimated fair value with a recent 2:1 stock split on September 30, 2024. Its dividend yield of 3.8% is lower than the top quartile in France, but payments have grown over the past decade despite being volatile and sometimes unstable. The dividends are well covered by both earnings (20.5%) and cash flows (47.4%). Earnings have grown by 16.5% annually over the last five years, indicating strong financial health.

- Unlock comprehensive insights into our analysis of L.D.C stock in this dividend report.

- Our valuation report here indicates L.D.C may be undervalued.

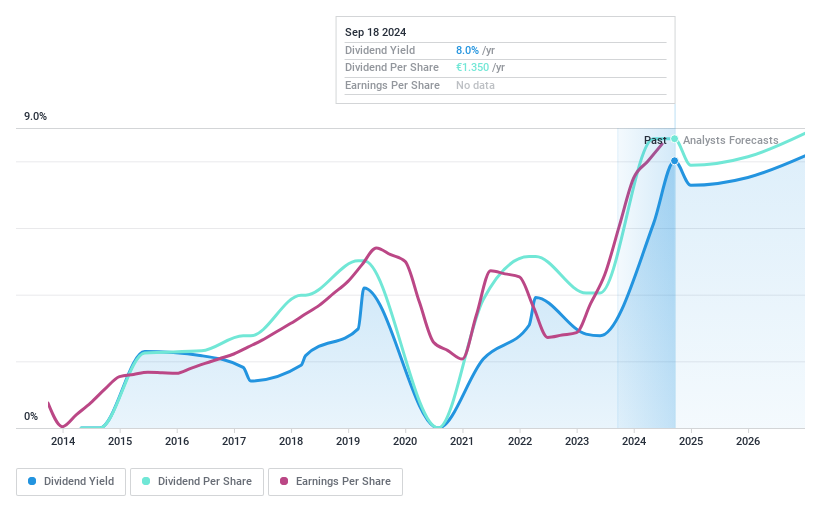

Manitou BF (ENXTPA:MTU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Manitou BF SA, with a market cap of €712.51 million, develops, manufactures, and provides equipment and services globally through its subsidiaries.

Operations: Manitou BF SA generates revenue primarily through its Products Division (€2.47 billion) and Services & Solutions (S&S) Division (€395.12 million).

Dividend Yield: 7.3%

Manitou BF has a dividend yield of 7.25%, placing it in the top 25% of French dividend payers, with dividends well-covered by earnings (payout ratio: 31.7%) and cash flows (cash payout ratio: 65.5%). However, its dividend track record is unstable and volatile over the past nine years. Recent earnings for H1 2024 showed sales at €1.41 billion and net income at €81.75 million, up from €62.53 million a year ago, indicating solid financial performance despite high debt levels.

- Click here and access our complete dividend analysis report to understand the dynamics of Manitou BF.

- In light of our recent valuation report, it seems possible that Manitou BF is trading behind its estimated value.

Summing It All Up

- Reveal the 34 hidden gems among our Top Euronext Paris Dividend Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LOUP

L.D.C

Produces and sells poultry and processed products in France and internationally.

Very undervalued with flawless balance sheet and pays a dividend.