Trying to figure out what to do with Danone shares right now? You are not alone. With the stock closing recently at €73.84, it has been quietly building momentum, posting a 1.7% return over the past week and up nearly 14% year-to-date. The longer-term numbers are compelling too, with gains of almost 70% over three years. This is a far cry from the meandering performance some consumer staples have seen lately.

Much of this steady rise can be linked to shifting sentiment around European food companies. Investors seem to be viewing Danone more favorably, possibly reflecting greater confidence in the company's focus on health trends or a reassessment of risk given wider market volatility. Despite these positive moves, a closer look at valuation tells a more nuanced story. Danone scores a 2 out of 6 on our value checklist, meaning it appears undervalued on only two out of six key checks. The numbers are intriguing but hardly conclusive for a classic bargain-hunter.

Still, numbers only tell part of the story. To really understand where Danone stands, we first need to pull apart what those traditional valuation methods reveal and, perhaps more importantly, what they leave out. Stay with me, because the most effective way to make sense of Danone's true worth is yet to come.

Danone scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Danone Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today. The idea is to determine what those future streams of cash are worth in today's euros.

For Danone, the current annual Free Cash Flow stands at €2.96 billion. Analysts project steady growth over the coming years, with Free Cash Flow reaching €3.21 billion by 2029. Beyond the analyst horizon, Simply Wall St extrapolates flows out to 2035, all in billions of euros. This reflects long-term compounding from strong core brands and improved margins.

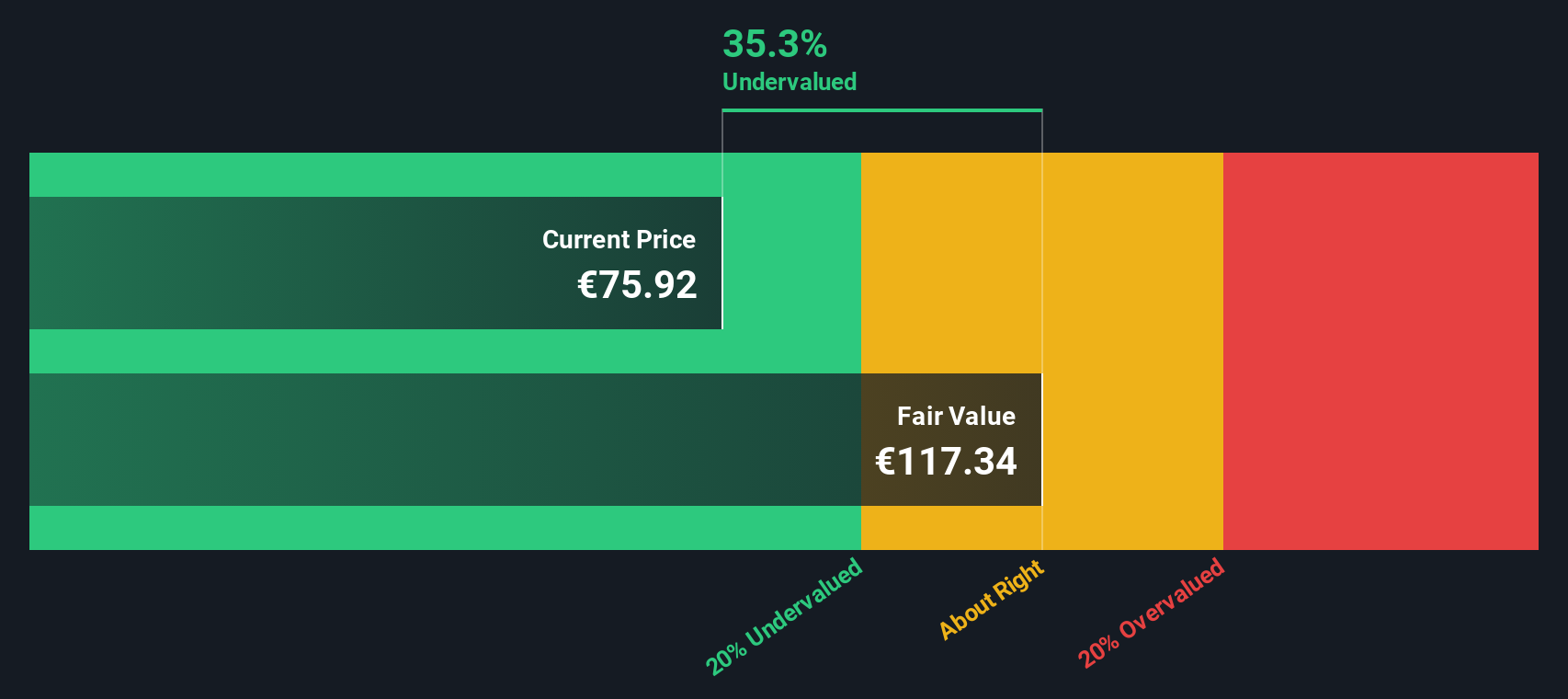

By taking these forecasts and discounting them appropriately, the DCF model computes an intrinsic value for Danone of €117.33 per share. This is significantly higher than the recent share price of €73.84, implying the stock is trading at a 37.1% discount to its estimated fair value.

In summary, the DCF model indicates that Danone appears significantly undervalued at current levels, presenting a substantial margin of safety for investors comfortable with long-term cash flow projections and some extrapolation risk.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Danone is undervalued by 37.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Danone Price vs Earnings

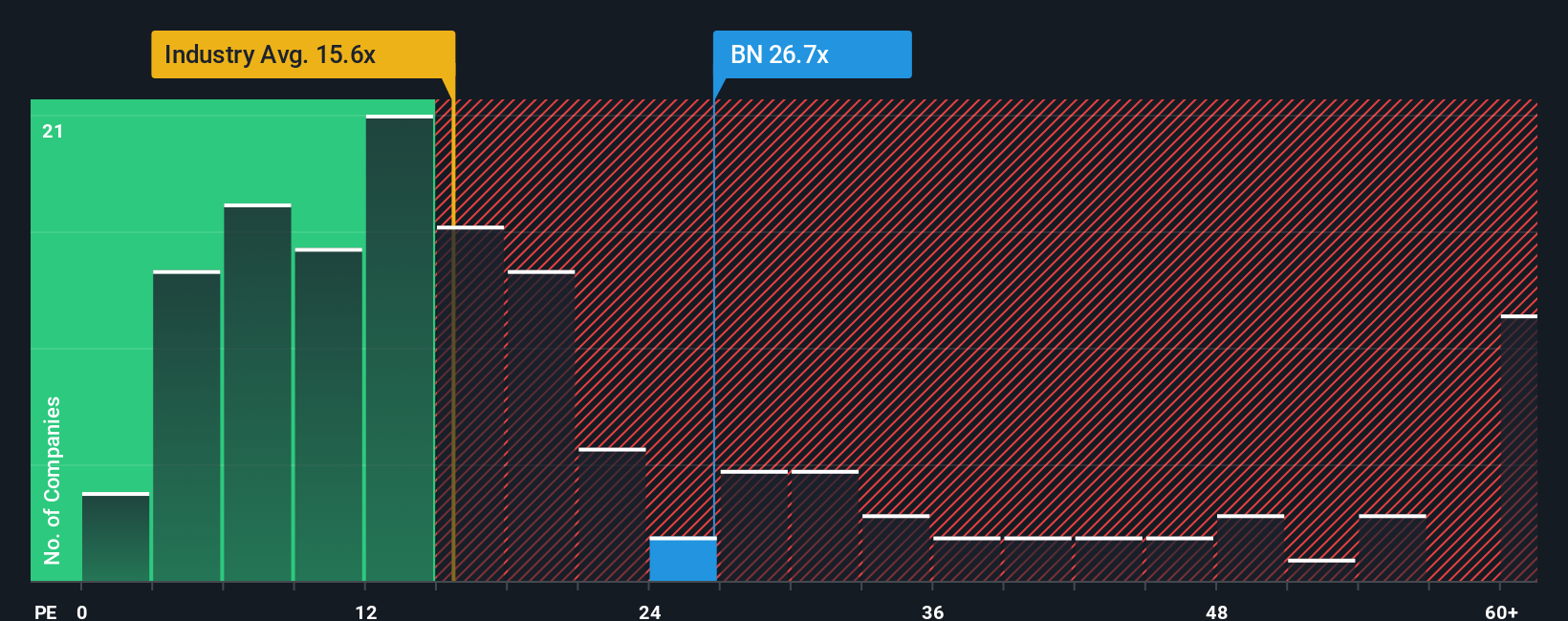

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it offers a clear snapshot of how much investors are willing to pay for each euro of earnings. For established firms like Danone, which generate consistent bottom-line profits, the PE ratio helps provide context for how the market values those earnings relative to comparable companies.

However, not all PE ratios are created equal. What counts as a "fair" PE is influenced by factors such as earnings growth, profit margins, and the risk profile of both the company and its wider industry. Higher expected growth or lower risk often justifies a higher PE multiple, while mature, slower-growing sectors tend to command lower ratios.

Danone currently trades at a 26x PE ratio. This is well above the European food industry average of 16.3x and its key peers, which average 13.1x. At first glance, Danone might seem expensive. However, Simply Wall St's proprietary "Fair Ratio," which blends in unique factors like the company’s growth rate, margins, sector, size, and risk, suggests a fair PE for Danone would be around 23.9x. This approach is more robust than a straight peer or sector comparison because it adjusts for what makes Danone distinct within its industry landscape.

With Danone’s current 26x slightly above its Fair Ratio, the shares look a bit expensive on this basis. While the premium is not sky-high, it implies investors are paying a premium, possibly for some of the company’s perceived strengths or growth potential.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Danone Narrative

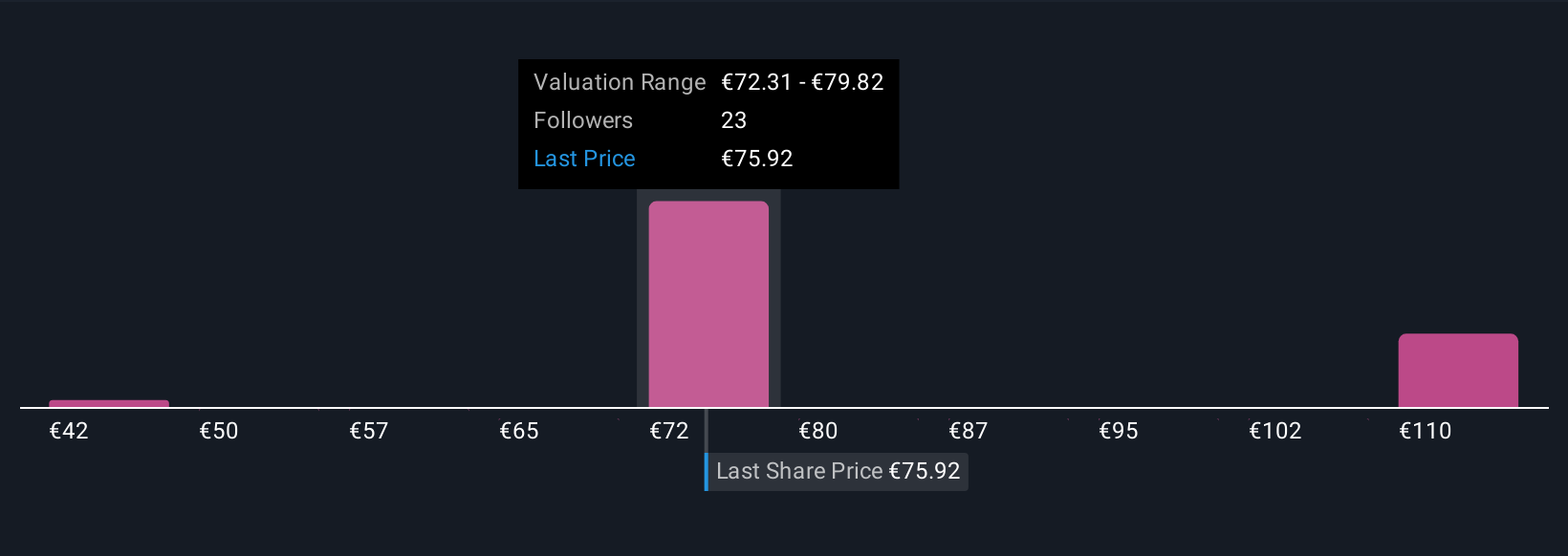

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear, personal story you build that connects your perspective on a company, such as how you think Danone will grow, what risks matter, and how its margins or revenues may evolve, to a financial forecast and ultimately a fair value for the stock.

Narratives make investing more accessible by letting you spell out your assumptions and see how changes ripple through to an up-to-date fair value, turning complex analysis into a simple to follow storyline that can be shared with others. On Simply Wall St’s Community page, millions of investors use Narratives to explore, debate, and update unique views on companies. This helps investors decide not just whether Danone is undervalued or overvalued, but why.

The beauty of Narratives is that they are dynamic. When new information or financial results come in, your Narrative (and fair value) updates automatically, helping you stay on top of what matters. For example, some investors might focus on Danone’s leadership in specialized nutrition and price in robust growth, resulting in a bullish fair value of €85 per share. Others, concerned about integration risks and margin pressures, may forecast a far lower outcome, such as €62 per share.

Do you think there's more to the story for Danone? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BN

Danone

Operates in the food and beverage industry in Europe, Ukraine, North America, China, North Asia, the Oceania, Latin America, rest of Asia, Africa, Turkey, the Middle East, and the Commonwealth of Independent States.

Established dividend payer with proven track record.

Market Insights

Community Narratives