Danone (ENXTPA:BN) Valuation in Focus as Steady Growth Draws Investor Attention

Reviewed by Kshitija Bhandaru

Danone (ENXTPA:BN) has delivered solid annual financials, with revenue rising 3% and net income up 10% over the past year. This steady growth is drawing attention from investors who are curious about its future valuation path.

See our latest analysis for Danone.

Danone’s steady operating performance has translated into gentle but positive stock momentum, with its 1-year total shareholder return nudging up 0.18%. After a stretch of relatively stable price action, investors appear to be reassessing growth prospects and risk. This is giving the shares a firmer footing for the year ahead.

If you're interested in exploring what else is showing promise right now, this could be a great time to discover fast growing stocks with high insider ownership

With steady financial performance and some upside to analyst targets, the question now turns to valuation. Is Danone’s share price still reflecting opportunity for long-term investors, or has the market already factored in the company’s next stage of growth?

Most Popular Narrative: 3.7% Undervalued

The narrative’s fair value for Danone sits at €76.01, a modest premium compared to the latest close at €73.16. With such a small gap, the price target signals a market close to consensus and invites a deeper look behind the numbers for what really drives this stance.

Expanding in emerging markets and shifting towards digital and healthcare channels enhances growth opportunities, operational efficiency, and long-term margin stability. Strategic investments and recent acquisitions (Kate Farms, The Akkermansia Company) strengthen Danone's leadership in plant-based, gut health, and medical nutrition, reinforcing differentiation and supporting both premiumization (higher revenue per unit sold) and improved long-term margin potential.

Want to know which growth trends and financial levers led analysts to this valuation edge? The full narrative reveals the key ingredient that could propel future profits, and hints at a bold call on margins few expect. Curious about the logic that underpins this price target? Read on if you crave the specifics behind Danone’s valuation story.

Result: Fair Value of €76.01 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on legacy segments and operational hiccups in key markets could still challenge Danone’s path to sustained and high-quality growth.

Find out about the key risks to this Danone narrative.

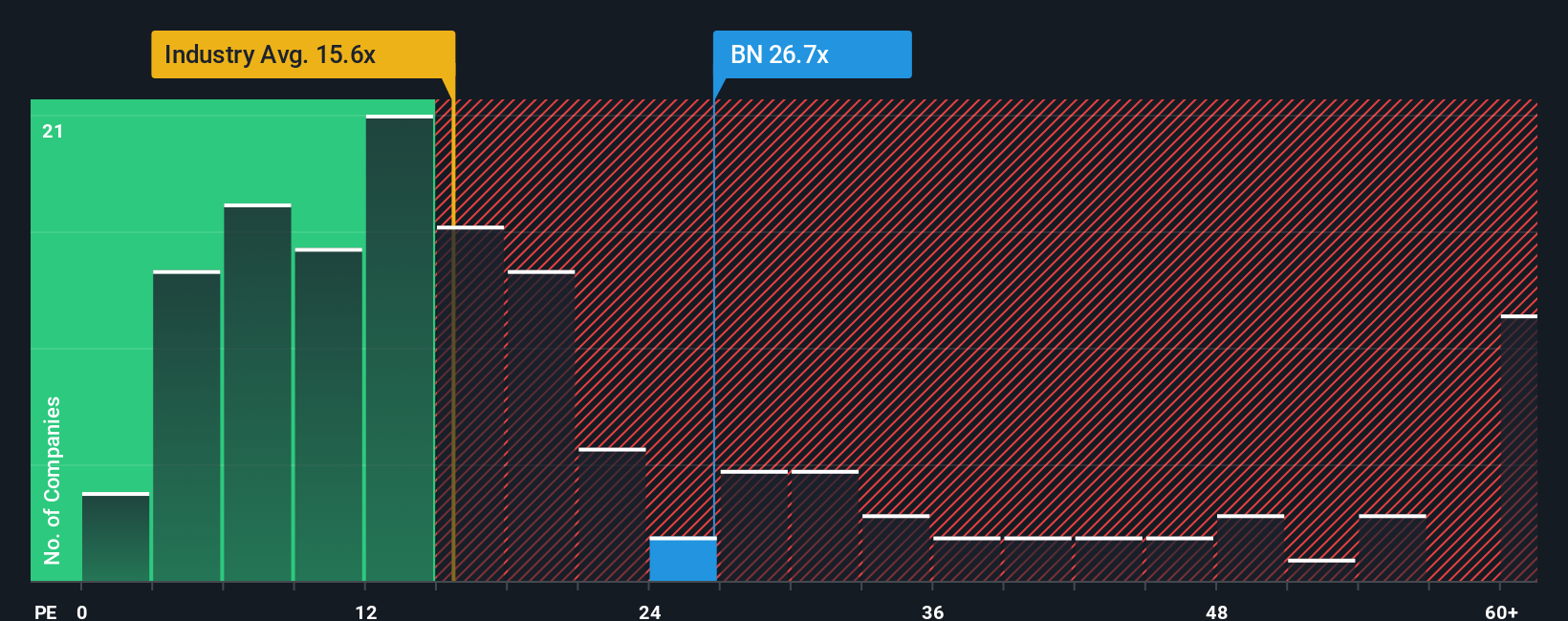

Another View: Valuation Ratios Raise Concerns

Looking through the lens of earnings multiples, Danone appears expensive. Its price-to-earnings ratio sits at 25.7x, which is much higher than both the European food industry average of 15.5x and its peers at 12.2x. Even the estimated fair ratio is lower, at 23.9x. This suggests a valuation premium that could limit upside if the market begins to focus on profitability or compares Danone more closely to its sector. Will investors accept this premium, or is it a warning sign for future returns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danone Narrative

If you’re keen to dig into the data yourself or if you have a different perspective on Danone, building your own view is quick and easy. Do it your way

A great starting point for your Danone research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity slip away. Use the power of the Simply Wall Street Screener to find your next winning investment and stay ahead of the market curve.

- Unlock long-term value by targeting companies that are trading below their intrinsic worth through these 893 undervalued stocks based on cash flows, where fundamental strength meets attractive pricing.

- Capitalize on the AI shift by following these 24 AI penny stocks, which features businesses riding artificial intelligence trends and shaping tomorrow’s breakthroughs.

- Strengthen your income portfolio by tapping into these 19 dividend stocks with yields > 3%, which offers generous yields above 3% and proven track records of reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BN

Danone

Operates in the food and beverage industry in Europe, Ukraine, North America, China, North Asia, the Oceania, Latin America, rest of Asia, Africa, Turkey, the Middle East, and the Commonwealth of Independent States.

Established dividend payer with proven track record.

Market Insights

Community Narratives