Omer-Decugis & Cie SA's (EPA:ALODC) 27% Price Boost Is Out Of Tune With Revenues

Omer-Decugis & Cie SA (EPA:ALODC) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 53% in the last year.

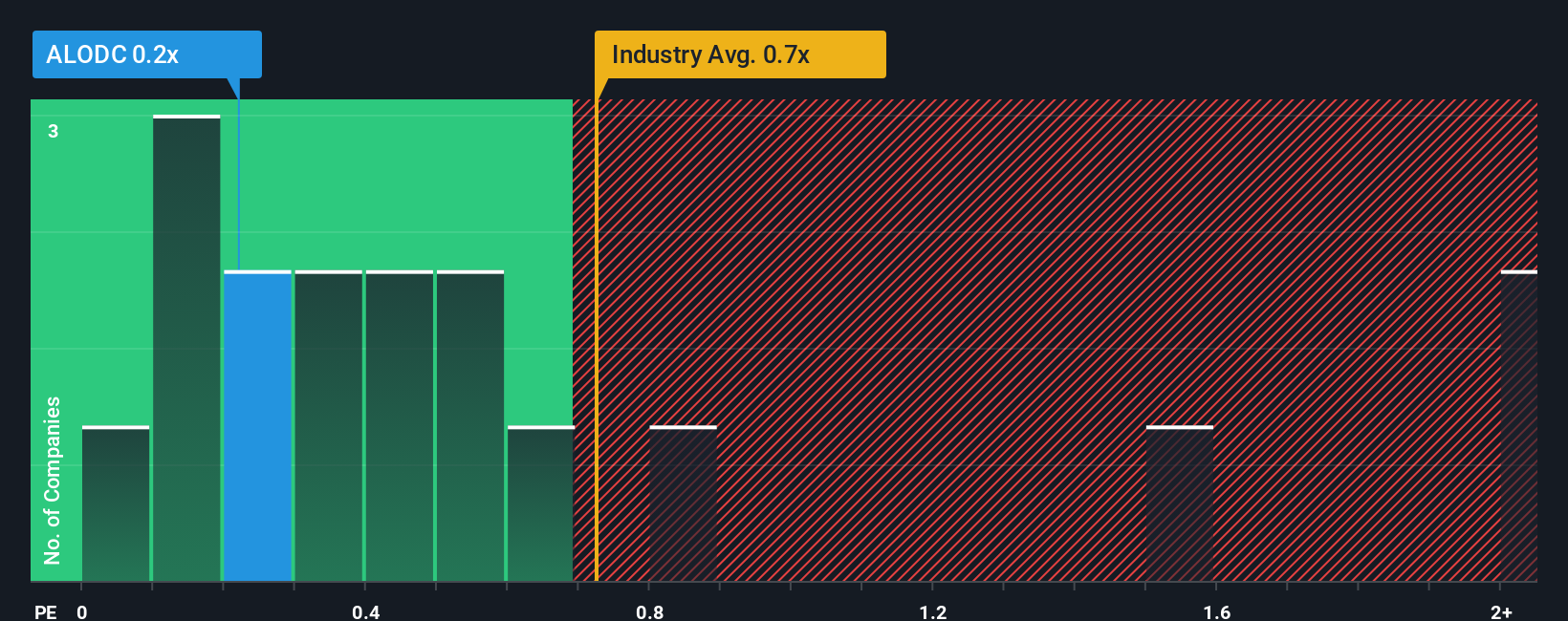

In spite of the firm bounce in price, it's still not a stretch to say that Omer-Decugis & Cie's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Food industry in France, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Omer-Decugis & Cie

How Omer-Decugis & Cie Has Been Performing

Recent times have been pleasing for Omer-Decugis & Cie as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. Those who are bullish on Omer-Decugis & Cie will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Omer-Decugis & Cie's future stacks up against the industry? In that case, our free report is a great place to start.How Is Omer-Decugis & Cie's Revenue Growth Trending?

Omer-Decugis & Cie's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 86% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 0.8% as estimated by the dual analysts watching the company. With the industry predicted to deliver 1.1% growth, that's a disappointing outcome.

In light of this, it's somewhat alarming that Omer-Decugis & Cie's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

Its shares have lifted substantially and now Omer-Decugis & Cie's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

While Omer-Decugis & Cie's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Having said that, be aware Omer-Decugis & Cie is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALODC

Omer-Decugis & Cie

Produces and sells fresh fruits and vegetables in France and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives