If You Had Bought AgroGeneration (EPA:ALAGR) Stock A Year Ago, You Could Pocket A 211% Gain Today

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the AgroGeneration SA (EPA:ALAGR) share price had more than doubled in just one year - up 211%. On top of that, the share price is up 130% in about a quarter. Unfortunately the longer term returns are not so good, with the stock falling 51% in the last three years.

See our latest analysis for AgroGeneration

AgroGeneration wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

AgroGeneration actually shrunk its revenue over the last year, with a reduction of 15%. We're a little surprised to see the share price pop 211% in the last year. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

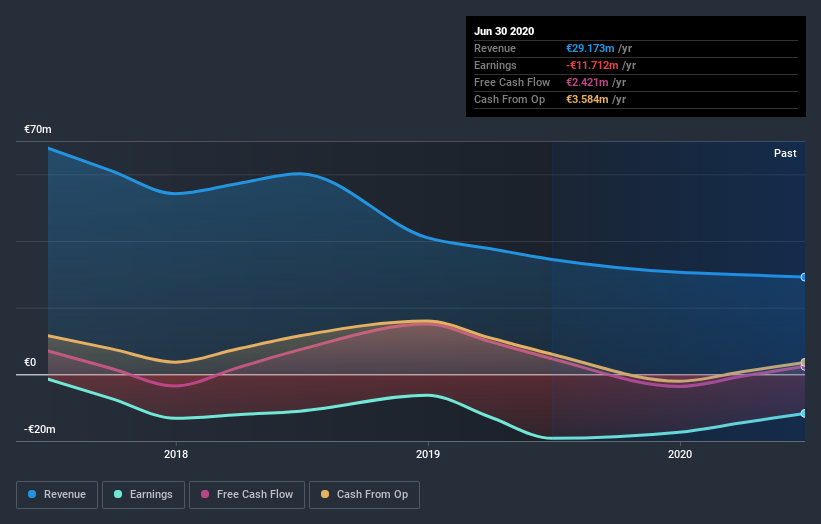

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that AgroGeneration has rewarded shareholders with a total shareholder return of 211% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 7% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand AgroGeneration better, we need to consider many other factors. Even so, be aware that AgroGeneration is showing 3 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

When trading AgroGeneration or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALAGR

AgroGeneration

An agricultural company, engages in the grain and oil commodity crop farming business in Ukraine and France.

Mediocre balance sheet low.

Market Insights

Community Narratives