- France

- /

- Oil and Gas

- /

- ENXTPA:WAGA

Waga Energy SA (EPA:WAGA) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

Waga Energy SA (EPA:WAGA) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 16% in the last twelve months.

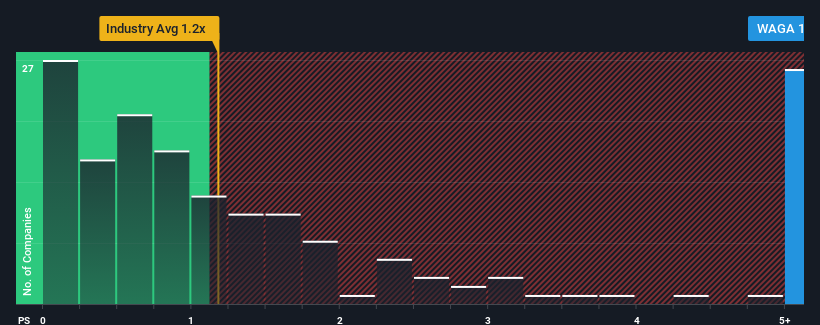

After such a large jump in price, you could be forgiven for thinking Waga Energy is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 10.1x, considering almost half the companies in France's Oil and Gas industry have P/S ratios below 2.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Waga Energy

What Does Waga Energy's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Waga Energy has been doing quite well of late. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Waga Energy.Is There Enough Revenue Growth Forecasted For Waga Energy?

Waga Energy's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 75%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 82% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 2.4% per year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Waga Energy's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Waga Energy's P/S Mean For Investors?

Shares in Waga Energy have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Waga Energy shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 4 warning signs for Waga Energy (2 are significant!) that you need to take into consideration.

If you're unsure about the strength of Waga Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Waga Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:WAGA

Waga Energy

Develops and produces biomethane for the renewable natural gas industry worldwide.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives