- France

- /

- Energy Services

- /

- ENXTPA:VK

Vallourec (ENXTPA:VK): Assessing the Valuation Case as Market Sentiment Shifts

Reviewed by Kshitija Bhandaru

See our latest analysis for Vallourec.

This year, Vallourec’s modest share price returns suggest the market is taking a wait-and-see approach. The company has delivered steady progress on profitability and revenue growth. Looking at total shareholder return, the long-term picture is much brighter. This indicates that recent momentum could be the start of something bigger if trends continue.

If you’re intrigued by Vallourec’s outlook and want to spot other promising energy sector names, check out the full range with our curated list: See the full list for free.

With shares still trading nearly 43 percent below some intrinsic value estimates and up strongly over the past year, the key question is whether Vallourec remains undervalued or if the market is already pricing in its future growth.

Most Popular Narrative: 19.5% Undervalued

The current consensus narrative places Vallourec’s fair value at €21.04, which reflects a significant premium compared to the most recent closing price of €16.95. This notable gap highlights the assumptions driving analyst optimism, particularly regarding emerging catalysts and financial discipline that could influence profits.

Recent cost reduction and operational excellence initiatives, especially in Brazil, are significantly ahead of schedule and exceeding targets. These efforts are positioning Vallourec for structurally higher group margins and improved EBITDA from 2026 onward.

What is fueling this higher target? The narrative points to bold improvements in profitability and future margins. Want to discover the specific growth drivers and one key metric analysts believe could make all the difference? Find out which numbers they think will move the needle on Vallourec’s share price.

Result: Fair Value of €21.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including Vallourec’s ongoing exposure to oil and gas cycles as well as cost pressures, which could challenge margins if market conditions shift.

Find out about the key risks to this Vallourec narrative.

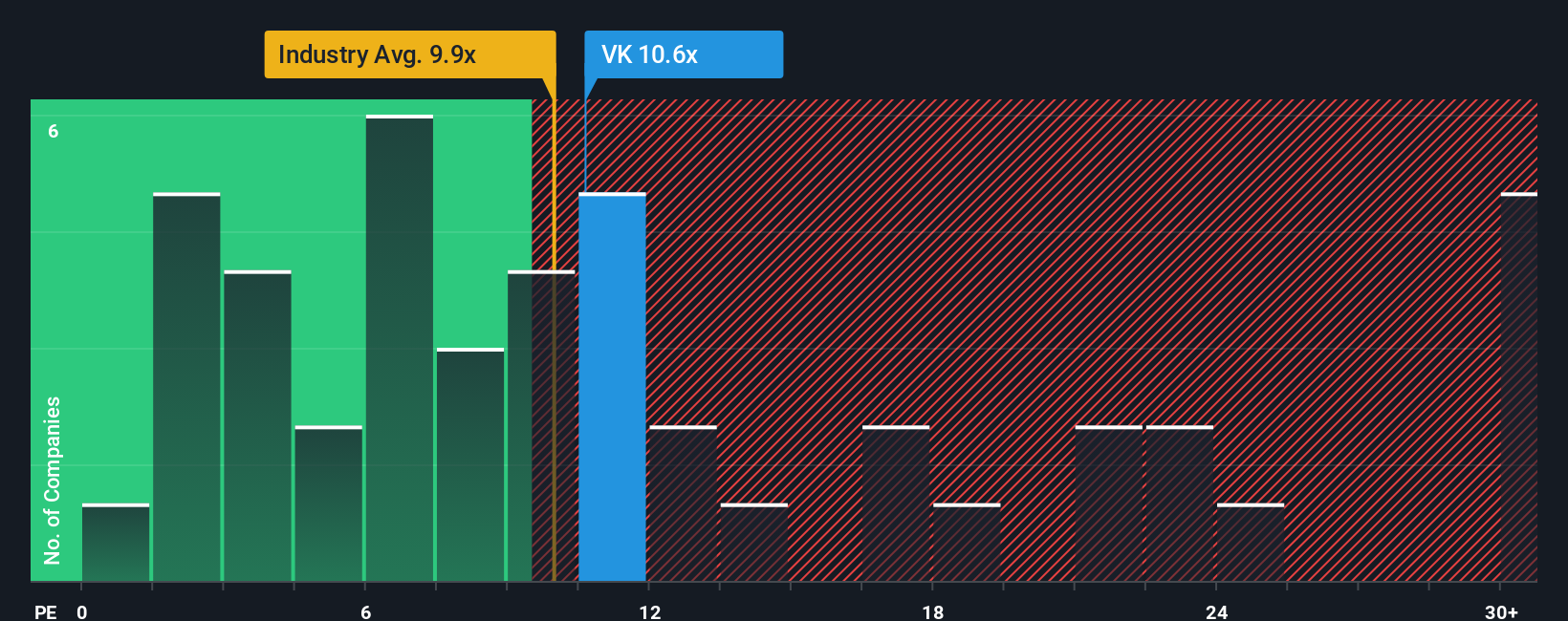

Another View: What Do Earnings Ratios Suggest?

While many see value based on future earnings growth, a look at the price-to-earnings ratio offers a different perspective. Vallourec trades at 11.2 times earnings, above the European Energy Services industry average of 10.2 and its own fair ratio of 13.9, but below the peer average of 13.6. This suggests the market may be factoring in some optimism, though there is still some risk for investors if those higher earnings do not materialize as expected. Is the current price justified, or are expectations getting ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vallourec Narrative

If you think the consensus view doesn’t tell the full story, explore the data and pull together your own perspective in just minutes with Do it your way.

A great starting point for your Vallourec research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your opportunities. Uncover smart stock picks and fresh trends with powerful tools that make your research easier. Explore these handpicked screens and stay ahead:

- Unlock growth by targeting attractive valuations and strong fundamentals through these 885 undervalued stocks based on cash flows before these stocks catch the crowd's attention.

- Tap into the AI revolution and position yourself at the forefront of innovation via these 24 AI penny stocks shaping tomorrow’s technologies.

- Benefit from robust yield potential by checking out these 19 dividend stocks with yields > 3%. Find companies rewarding shareholders while maintaining financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VK

Vallourec

Through its subsidiaries, provides tubular solutions for the oil and gas, industry, and new energies markets in Europe, North America, South America, Asia, the Middle East, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives