- France

- /

- Oil and Gas

- /

- ENXTPA:TTE

TotalEnergies (ENXTPA:TTE) Is Up 5.4% After Raising Production Guidance and Reporting Stronger Refining Margins – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In the past week, TotalEnergies provided updated third-quarter 2025 guidance, projecting oil and gas production of 2.5 million barrels of oil equivalent per day, up 4% year-on-year, alongside improved refining margins in Europe despite a decrease in oil prices and planned maintenance work.

- This outlook highlights the company’s resilience as its rising production and better downstream margins are driving expected increases in earnings and cash flow, even as oil prices remain lower than a year ago.

- We’ll examine what TotalEnergies’ higher production targets and stronger refining margins could mean for its evolving investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

TotalEnergies Investment Narrative Recap

To be a shareholder in TotalEnergies, you need conviction in the company’s ability to balance cyclical oil and gas markets with its expanding portfolio across renewables, electricity, and digitalized operations. The updated production and margin guidance reinforces confidence in near-term cash flow, with rising output and stronger refining set to partially offset the primary risk of prolonged low oil prices. This recent news does not materially alter the most important catalyst, TotalEnergies’ integrated strategy providing insulation during energy market volatility, nor does it diminish the ongoing risk around commodity price cycles.

Of the recent announcements, the new partnership with Veolia stands out in context. While the current production boost grabs short-term attention, the Veolia collaboration highlights TotalEnergies’ commitment to energy transition and operational efficiency, helping underpin longer-term stability amid commodity swings. This supports the catalyst of building more resilient, sustainable cash flows outside of traditional hydrocarbons.

However, investors should also be aware that, in contrast, even robust production growth can be eclipsed by...

Read the full narrative on TotalEnergies (it's free!)

TotalEnergies' narrative projects $194.9 billion revenue and $15.8 billion earnings by 2028. This requires 1.4% yearly revenue growth and a $3.0 billion earnings increase from $12.8 billion today.

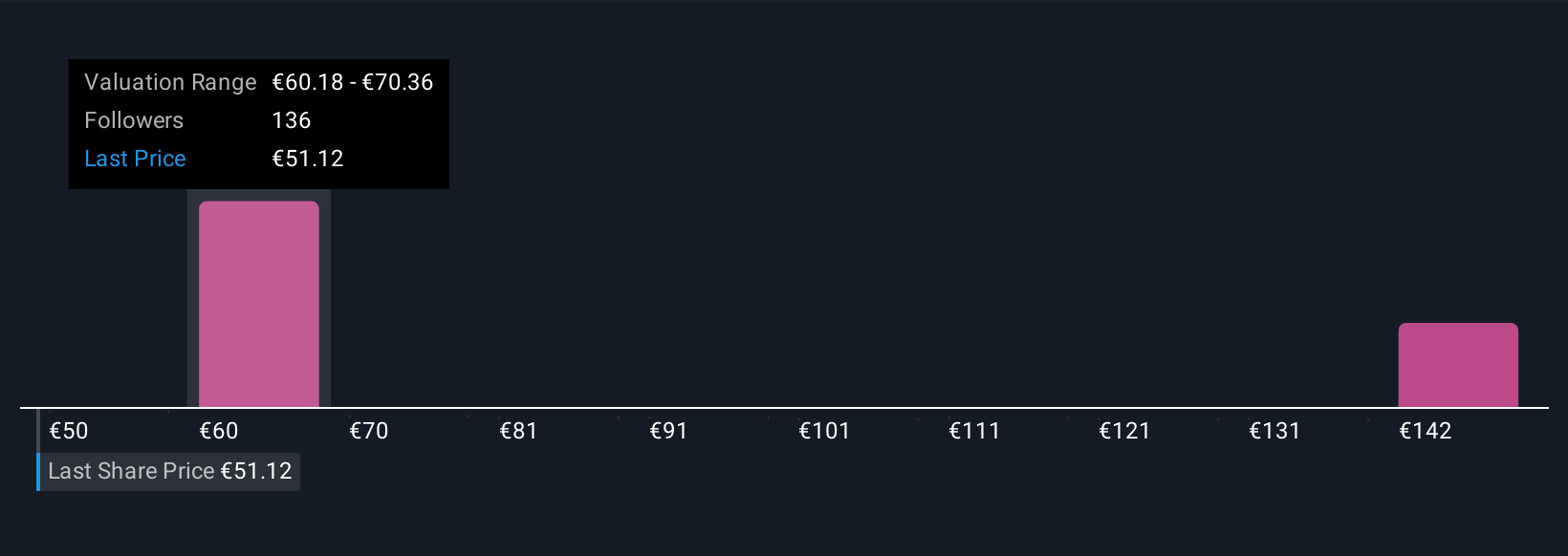

Uncover how TotalEnergies' forecasts yield a €63.57 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Twenty different fair value estimates from the Simply Wall St Community range between US$50 and US$156, revealing wildly divergent outlooks. With volatile oil prices remaining a persistent risk, you can explore a spectrum of independent perspectives on how these underlying factors shape the company’s future.

Explore 20 other fair value estimates on TotalEnergies - why the stock might be worth over 2x more than the current price!

Build Your Own TotalEnergies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free TotalEnergies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TotalEnergies' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TotalEnergies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TTE

TotalEnergies

A multi-energy company, produces and markets oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables, and electricity in France, rest of Europe, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives