- France

- /

- Oil and Gas

- /

- ENXTPA:TTE

Is TotalEnergies’ Recent Stock Climb Justified After New Renewable Energy Partnerships?

Reviewed by Bailey Pemberton

- Wondering if TotalEnergies is a bargain right now? You are not alone, especially if you are curious about finding value in today's energy giants.

- This past year, TotalEnergies' stock climbed 11.3%, including a strong 5.4% gain over the past month, suggesting that investors are responding to both promising growth prospects and shifting risks.

- Recent headlines have spotlighted TotalEnergies' strategic moves in renewable energy and new international partnerships. These developments have fueled renewed optimism among investors, making the recent price movement even more interesting in context.

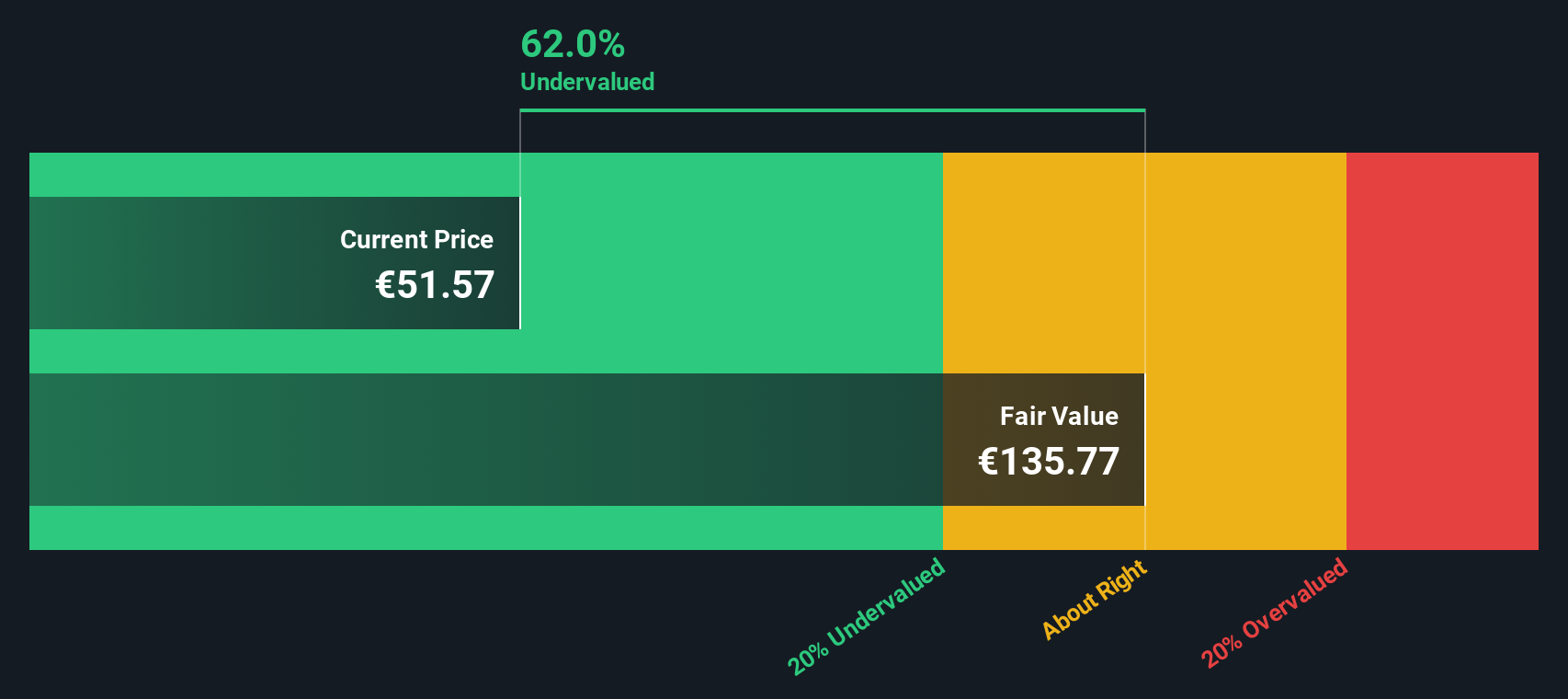

- On our valuation checks, TotalEnergies scores 5 out of 6, indicating it appears undervalued in most key areas. However, as we will see, there may be even more insightful ways to judge its true worth later in this article.

Approach 1: TotalEnergies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This method focuses on how much money the business is expected to generate, taking into account both analyst estimates for the next five years and long-range forecasts.

For TotalEnergies, the DCF calculation is based on a 2 Stage Free Cash Flow to Equity model. The company's latest twelve months Free Cash Flow was $14.2 billion. Analysts predict that by 2027, Free Cash Flow will grow to $14.3 billion, with Simply Wall St extrapolating out ten years of forecasts to around $16.1 billion by 2035. All cash flows here are reported in US dollars.

After discounting all projected future cash flows, the model arrives at an estimated intrinsic value of $129.38 per share. This figure is 56.2 percent higher than where the stock is currently trading, suggesting the market may be underappreciating TotalEnergies’ future earnings potential based on today’s price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TotalEnergies is undervalued by 56.2%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: TotalEnergies Price vs Earnings

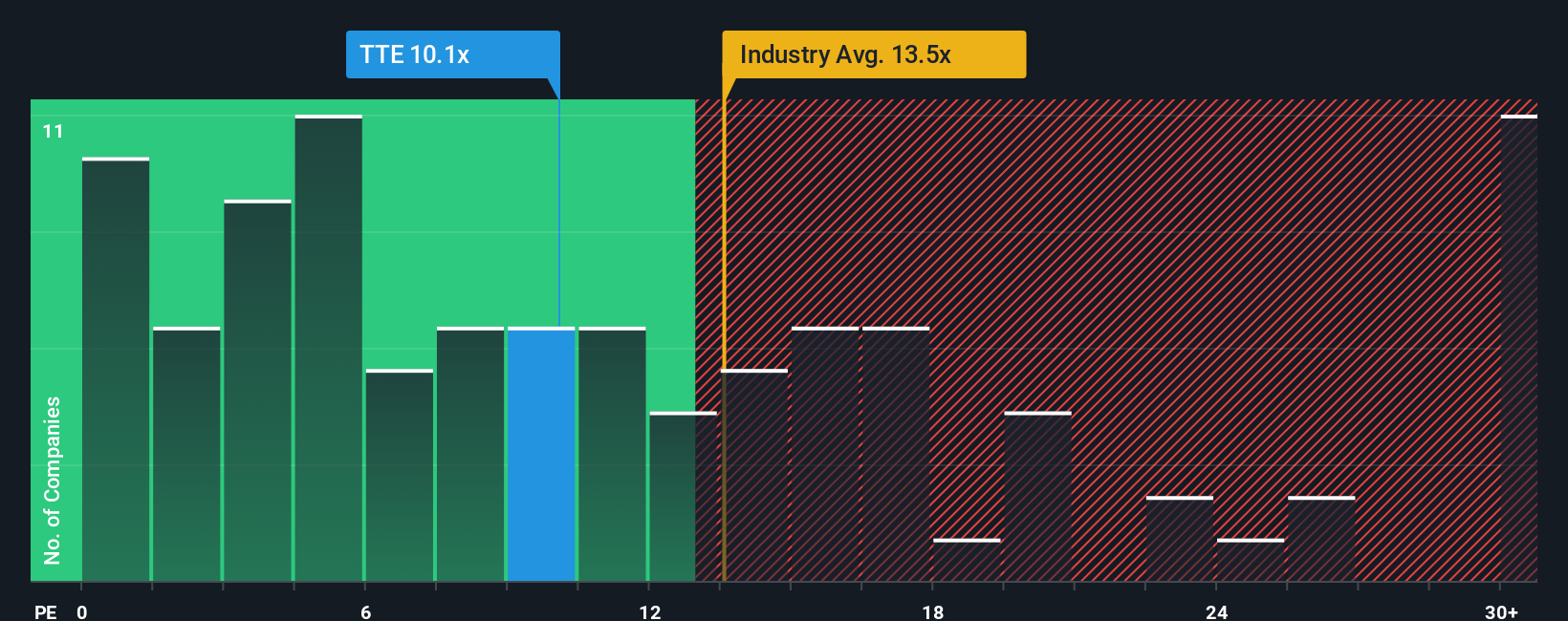

The Price-to-Earnings (PE) ratio is widely used to value profitable companies. It compares a company’s share price to its earnings, giving investors a sense of how much they are paying for a piece of those profits. For established, cash-generating businesses such as TotalEnergies, the PE ratio is especially relevant because it helps gauge investor expectations for future profitability.

It is important to note that a "normal" or "fair" PE ratio depends on growth prospects and perceived risks. Higher expected growth rates generally justify higher PE ratios, while increased risks or weaker outlooks typically result in lower multiples.

Currently, TotalEnergies trades at a PE ratio of 10x. When compared to the Oil and Gas industry average of 13.2x and a peer group average of 23.5x, TotalEnergies appears attractively priced. However, a simple peer comparison can overlook crucial factors such as differences in growth, margins, and company size.

That is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio, which is 16.3x for TotalEnergies, reflects what a reasonable PE should be based on the company’s earnings growth outlook, profitability, market capitalization, industry, and the risks it faces. Unlike a basic average, this proprietary metric tailors the benchmark to TotalEnergies’ specific situation, allowing for a much more accurate comparison.

Comparing the Fair Ratio of 16.3x with the current PE of 10x, it is clear that the stock is trading below where it would be considered fairly valued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TotalEnergies Narrative

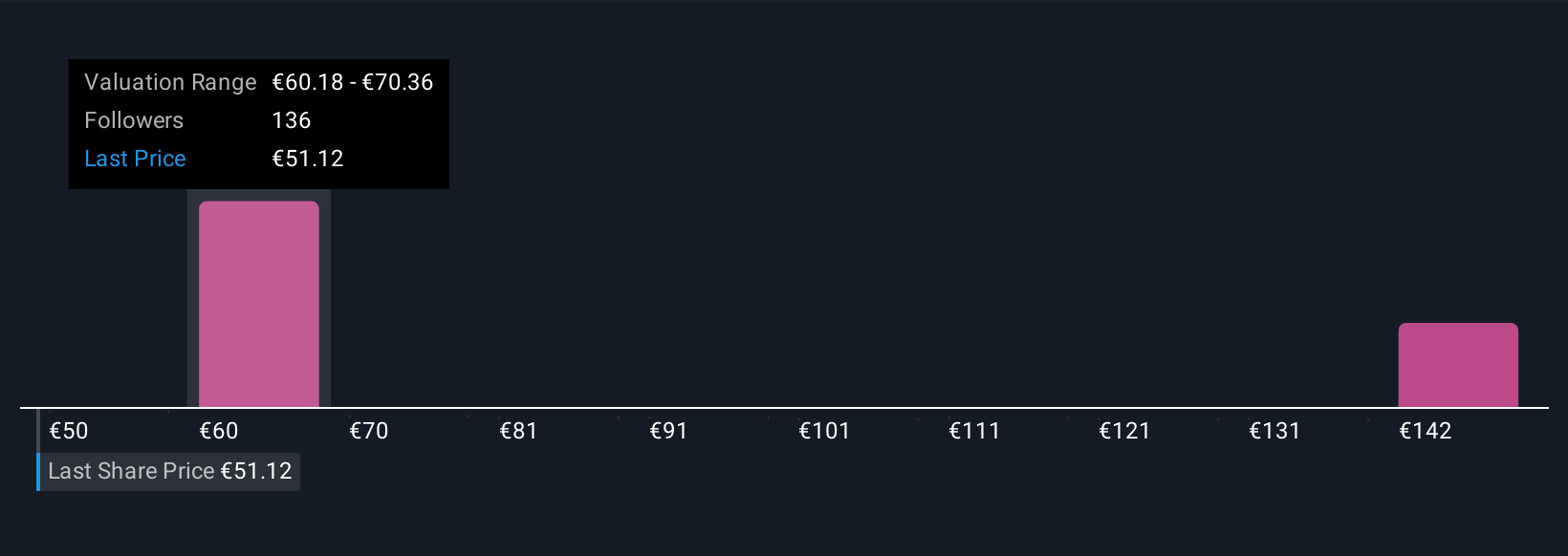

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal take on TotalEnergies, a story that explains how you expect the company’s business, profit margins and revenues to unfold over time, which then translates into a specific fair value. Narratives go beyond the numbers by connecting your view of the company's future to a clearly laid out financial forecast and what you think the shares are really worth.

Narratives are easy to create and share on Simply Wall St’s Community page, where millions of investors update their perspectives as new news, earnings, or sector trends emerge. This means that every Narrative is dynamic and designed to evolve alongside the company and market.

With Narratives, you can instantly compare your calculated Fair Value to the current Price, making your buy or sell decision clearer and more personalized. For example, one TotalEnergies investor might see long-term gains from LNG and renewables driving a fair value as high as €77.57, while another may expect risks around oil prices and set their fair value closer to €52.82. Your Narrative literally determines your answer.

Do you think there's more to the story for TotalEnergies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TotalEnergies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TTE

TotalEnergies

A multi-energy company, produces and markets oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables, and electricity in France, rest of Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success