- France

- /

- Oil and Gas

- /

- ENXTPA:TTE

Is TotalEnergies Ready for a Rebound After Five-Year 182.8% Growth?

Reviewed by Bailey Pemberton

If you're sitting there wondering what to do about TotalEnergies stock, you're not alone. It's one of those names that always seems just a little under the radar, yet it has been quietly doing some interesting things. Take a glance at the recent numbers, and you’ll see that the stock nudged up 2.3% in the last week. However, over the past month it slipped by a modest 0.6%. Over the past year, it’s down 5.0%, which might surprise you, but when you zoom out a little further you’ll find it’s up a massive 182.8% over five years. That kind of long-term growth tends to get investors’ attention, especially considering some of the volatility in the broader energy sector.

What’s been driving these price moves? There’s more to it than just oil prices or broad market trends. Recent headlines have highlighted TotalEnergies’ push into renewables, ongoing investments in liquefied natural gas, and its continued streamlining of non-core operations. These strategic moves have likely contributed to reducing perceived risk around the company and might explain why investors have slowly been coming back around, even if the returns are a little muted lately. Still, with a solid track record, the question of value comes front and center.

On that front, TotalEnergies scores a 5 out of 6 based on common valuation checks for undervalued companies. That is a clear signal that there could be more substance beneath the hood than the recent price action suggests. But as you’ll see, not all valuation methods are created equal, and there is an even better way to size up whether the stock belongs in your portfolio. Let’s dig into the details.

Why TotalEnergies is lagging behind its peers

Approach 1: TotalEnergies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future free cash flows and discounting them back to their present value. This approach aims to capture the true worth of a business by looking beyond surface metrics and focusing on how much cash it can actually generate for shareholders over time.

For TotalEnergies, the latest reported free cash flow sits at $13.4 billion. Analyst estimates indicate a continued upward trajectory, with free cash flow expected to reach $17.99 billion by 2029. Because long-range forecasts typically extend only a few years, values for subsequent years are extrapolated based on current growth trends. This allows the model to account for more distant future cash generation. All figures are reported in US dollars for clarity.

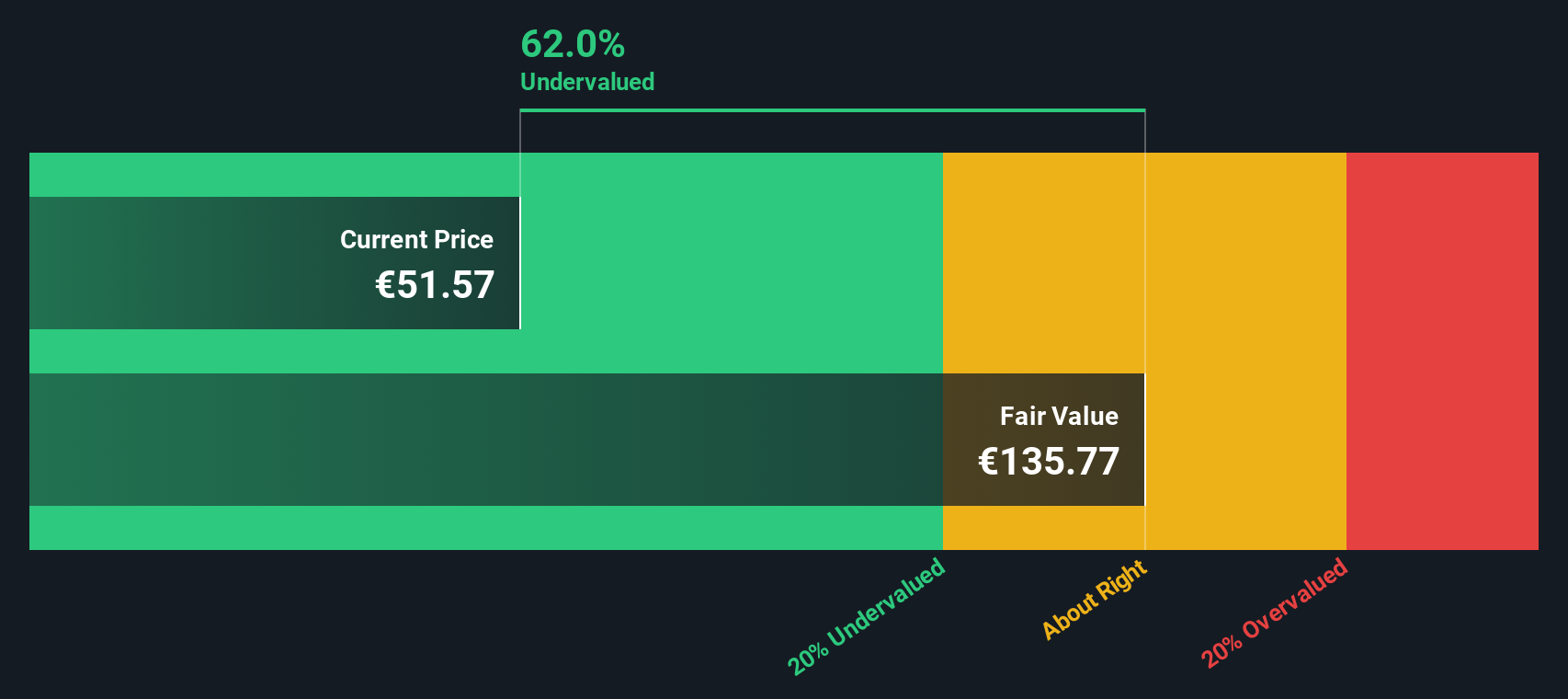

Based on these numbers, the DCF calculation assigns an estimated intrinsic value of €157.14 per share. When compared to the current market price, TotalEnergies appears to be trading at a steep intrinsic discount, suggesting the stock is 65.7% undervalued by this metric. For investors looking for value opportunities, this may indicate that the stock could offer significant upside from today's levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TotalEnergies is undervalued by 65.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: TotalEnergies Price vs Earnings

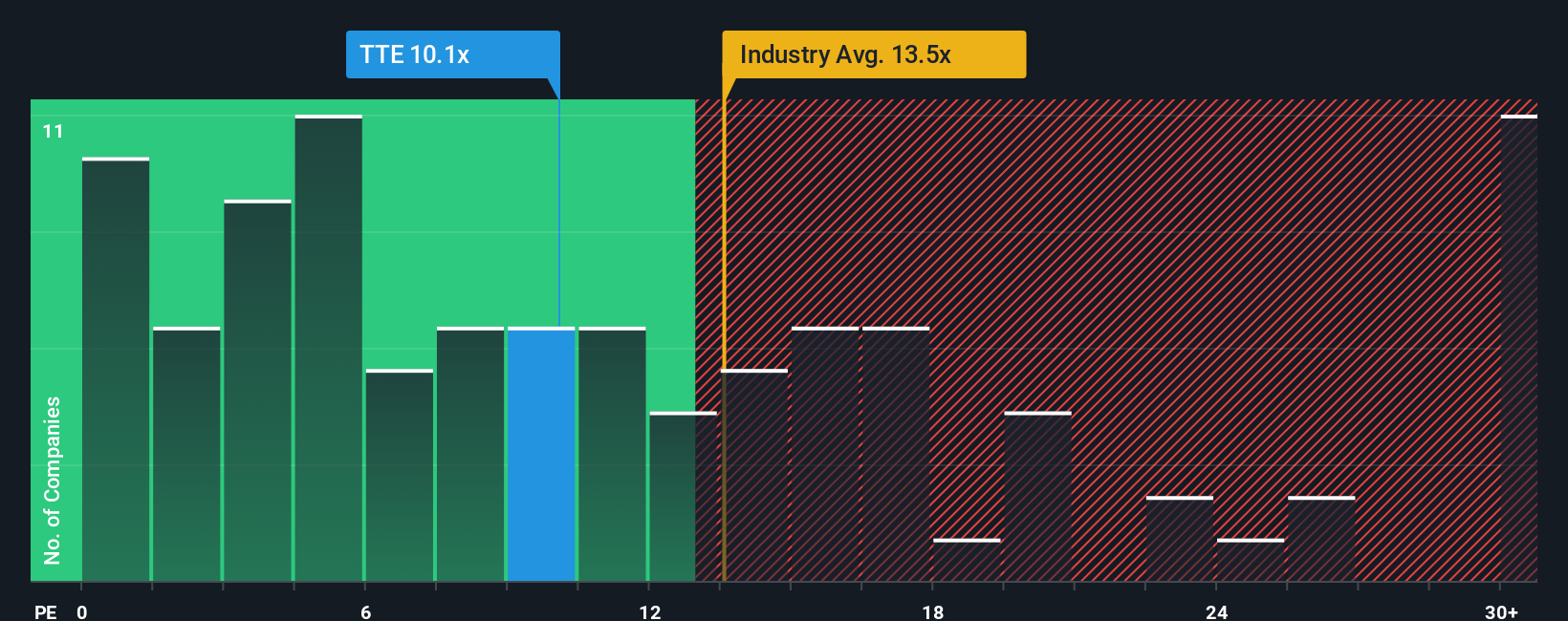

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it measures how much investors are willing to pay for each euro of a company’s earnings. It helps to assess whether a company's stock is trading at a reasonable price, especially when the business generates consistent profits year after year.

The “right” PE ratio for any stock depends on growth expectations and perceived risk. Faster-growing companies typically deserve higher PE ratios, whereas businesses with slower growth or greater risks usually trade at lower multiples. Comparing PE ratios across peers can provide context, but industry differences and company-specific factors often skew these comparisons.

Currently, TotalEnergies trades at a PE ratio of 10.6x. This is lower than the Oil and Gas industry average of 12.9x and is well below the peer average of 48.3x. Such a gap suggests that investors might be discounting TotalEnergies relative to its sector and broader peer group, perhaps due to company-specific factors or a conservative market stance.

To address the limitations of simple comparisons, Simply Wall St uses a proprietary “Fair Ratio,” which adjusts for the company’s earnings growth prospects, risk profile, profit margins, industry characteristics, and market cap. For TotalEnergies, the Fair PE Ratio is calculated at 15.2x. This is a more tailored benchmark that goes beyond the surface-level checks of industry and peer multiples.

Comparing TotalEnergies' current PE of 10.6x with its Fair Ratio of 15.2x indicates a material discount, suggesting the stock remains undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TotalEnergies Narrative

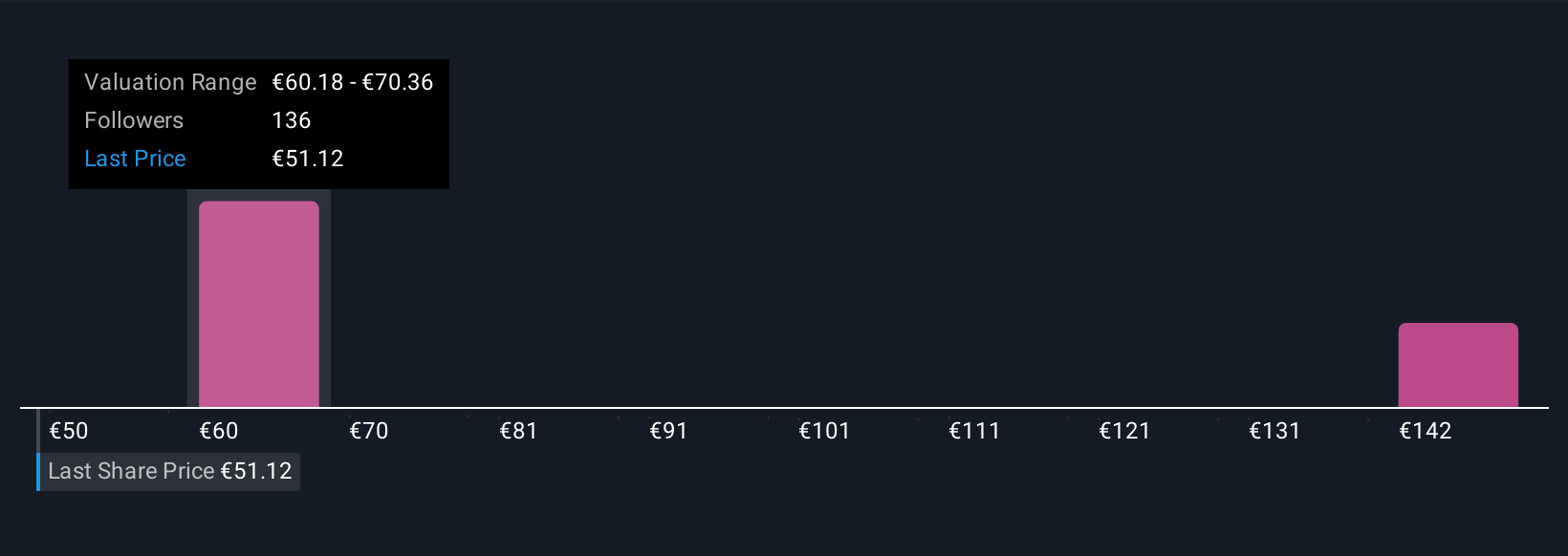

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company, shaping how you see its future and how you forecast its financials, such as where revenue, earnings, and margins are headed and what all that means for fair value. Narratives bridge the gap between what a company is doing and what that could mean for your investment, linking the big-picture story to concrete forecasts and then translating those into a price target.

This approach is easy and accessible to everyone. On Simply Wall St's Community page, millions of investors use Narratives not only to document their unique views, but also to run real-time fair value calculations based on their assumptions. It helps you decide whether to buy, sell, or hold by comparing the fair value from your Narrative to the current price, so your decisions always reflect up-to-date data and your own reasoning.

Because Narratives update automatically whenever new news or earnings come in, you always have a live, customized outlook. For example, some TotalEnergies Narratives project a fair value as high as €77.57, anticipating strong renewables growth and margin gains. Others are more cautious, with values as low as €52.82, focusing on risks from weak oil prices and market volatility.

Do you think there's more to the story for TotalEnergies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TotalEnergies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TTE

TotalEnergies

A multi-energy company, produces and markets oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables, and electricity in France, rest of Europe, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives