- France

- /

- Energy Services

- /

- ENXTPA:TE

Does Leading Spain’s Circular Methanol Project Alter the Investment Thesis for Technip Energies (ENXTPA:TE)?

Reviewed by Sasha Jovanovic

- Repsol recently announced it has awarded Technip Energies two engineering services contracts for the Ecoplanta Molecular Recycling Solutions project, a pioneering waste-to-methanol facility near Tarragona, Spain, that will transform up to 400,000 tons of non-recyclable waste into renewable methanol each year using Enerkem’s gasification technology.

- The contracts showcase Technip Energies’ growing role in advancing circular economy solutions in Europe and reinforce its strategic technology partnership with Enerkem.

- We’ll now examine how securing a lead role on this EU-backed circular methanol project could influence Technip Energies’ investment outlook.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Technip Energies Investment Narrative Recap

Technip Energies' future depends on the energy transition narrative: its ability to expand from traditional LNG and hydrocarbon projects into high growth decarbonization markets like waste-to-fuels and carbon capture. The recent Repsol Ecoplanta contracts are thematically important, reinforcing the company’s ambition in circular economy solutions, but are unlikely to displace near-term catalysts tied to LNG project wins or to offset the dominant risk of delayed final investment decisions on major energy projects.

Among recent announcements, the major EPC contract for the Commonwealth LNG project in Louisiana stands out, as this directly supports Technip Energies' largest short-term revenue driver. While breakthroughs in renewables are influential for long-term positioning, it is timely execution and backlog conversion from such large-scale LNG contracts that underpin the immediate earnings outlook.

Yet even as momentum builds for clean energy projects, investors should be aware that...

Read the full narrative on Technip Energies (it's free!)

Technip Energies' outlook anticipates €9.1 billion in revenue and €588.5 million in earnings by 2028. This implies a yearly revenue growth rate of 7.6% and an earnings increase of €194.9 million from current earnings of €393.6 million.

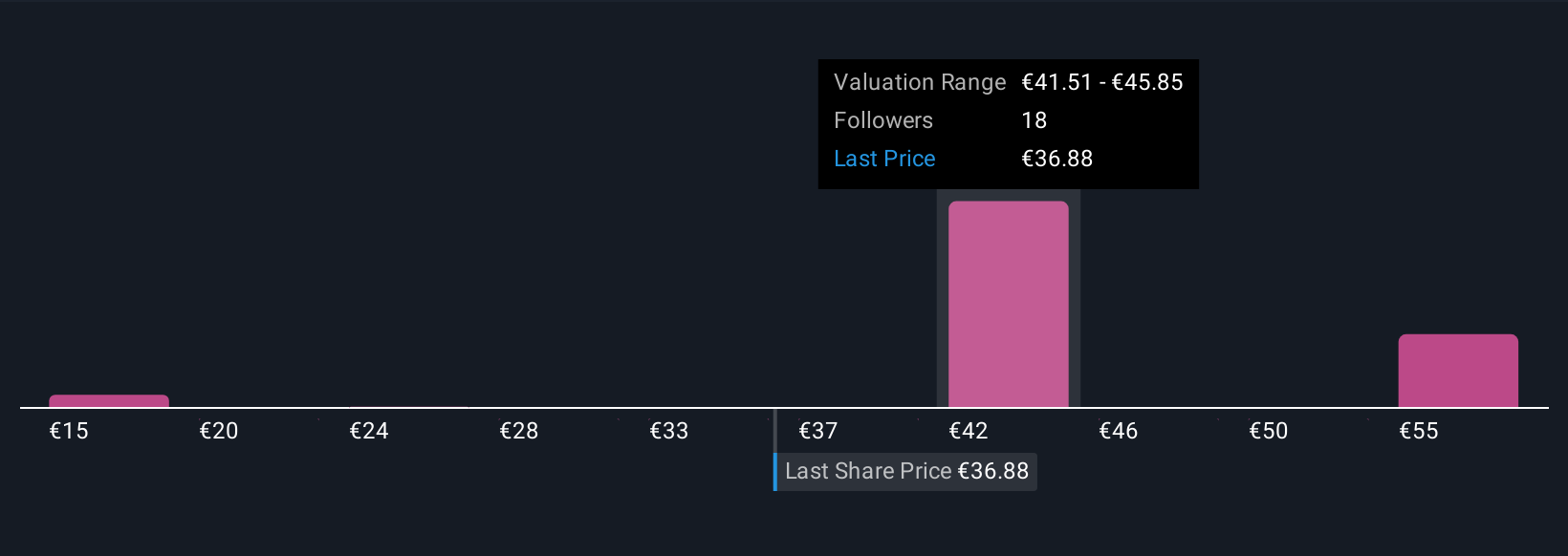

Uncover how Technip Energies' forecasts yield a €41.77 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range from €15.45 to €58.41, reflecting substantial differences in growth forecasts. While opinions vary, the ability to win and execute key decarbonization contracts is central to how future earnings, revenue, and investment risk are perceived.

Explore 5 other fair value estimates on Technip Energies - why the stock might be worth as much as 46% more than the current price!

Build Your Own Technip Energies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Technip Energies research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Technip Energies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Technip Energies' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Technip Energies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TE

Technip Energies

Operates as an engineering and technology company for the energy transition in Europe, Central Asia, the Asia Pacific, Africa, the Middle East, and the Americas.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.