- France

- /

- Oil and Gas

- /

- ENXTPA:MAU

Etablissements Maurel & Prom (ENXTPA:MAU) Appoints New Chairman Amid Board Reshuffle

Reviewed by Simply Wall St

Etablissements Maurel & Prom (ENXTPA:MAU) recently appointed Wisnu Santoso as the new Chairman of the Board during a board meeting, a shift in leadership that accompanies several other executive and board changes. Despite these significant developments, the company’s share price moved flat last week. During the same period, broader equity markets experienced mild gains, supported by projections of an upcoming interest rate cut by the Federal Reserve and strong performances from tech stocks. Overall, the leadership changes at Maurel & Prom likely added weight to the broader market influences without significantly diverging from them.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past five years, Etablissements Maurel & Prom's shares have delivered a total return of 251.61%. This performance places the company ahead of the broader French market, which saw a return of 4.5% over the past year. However, when compared to the French Oil and Gas industry, which declined by 12.9% in the same period, Maurel & Prom outperformed significantly. Despite this robust long-term performance, the company's current 1-year total return has underperformed the broader market.

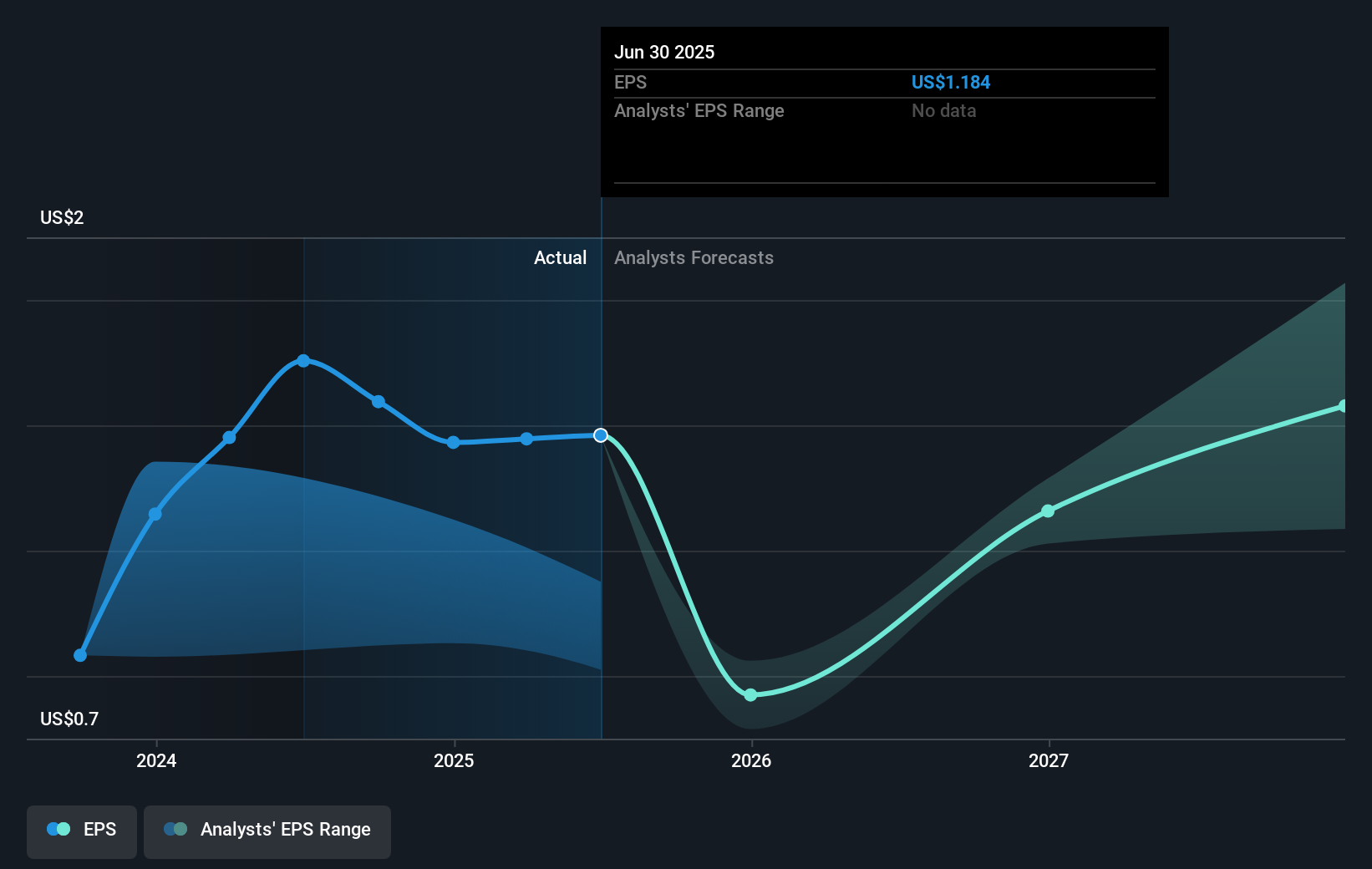

The recent leadership changes at Maurel & Prom could have various effects on revenue and earnings forecasts. While the company's revenue has seen a year-over-year decrease, net income has slightly increased. This mixed performance might dampen investor confidence in reaching the consensus price target of €6.00, given that the current share price stands at €4.648. The price target represents a 29.1% potential increase based on analyst expectations, reflecting confidence in management's ability to guide the company amidst recent changes. However, analysts also forecast a decline in earnings over the next three years, suggesting that meeting these expectations could be challenging. The management team's experience and strategic adjustments will be crucial in driving future growth relative to market predictions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etablissements Maurel & Prom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MAU

Etablissements Maurel & Prom

Engages in exploration and production of oil and gas, and hydrocarbons in Gabon, Tanzania, Angola, and Venezuela.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives