- France

- /

- Oil and Gas

- /

- ENXTPA:GTT

Will Dividend Stability Amid Interest Rate Shifts Change Gaztransport & Technigaz's (ENXTPA:GTT) Narrative

Reviewed by Sasha Jovanovic

- In recent weeks, Gaztransport & Technigaz has drawn renewed attention from investors as market commentary highlights the company's consistent dividend payouts and strong financial performance, especially as European markets assess interest rate trends.

- This focus on dividend reliability is particularly significant given the current backdrop of investor preference for steady income in periods of market caution.

- We'll explore how increased investor interest in Gaztransport & Technigaz's dividend stability influences the company's broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Gaztransport & Technigaz Investment Narrative Recap

Investors considering a stake in Gaztransport & Technigaz are typically drawn to the conviction that LNG transport demand will remain resilient, underpinned by its established order pipeline and recurring revenues from licensing and royalties. The recent spotlight on dividend reliability in the European market doesn't materially shift the focus from the primary short-term catalyst, continued LNG carrier and container vessel orders, while the main risk remains exposure to potential slowdowns in industry newbuild activity, which could pressure future revenue and earnings stability.

Among recent announcements, the approval and payment of a €7.50 per share dividend for fiscal 2024 stands out as particularly relevant to current discussions about steady income. This payout highlights GTT’s strong cash generation and supports its investment narrative centered on rewarding shareholders, even as order flow and sector cycles remain key variables in near-term performance.

However, with LNG shipping cycles prone to pauses and the company dependent on a concentrated roster of clients, investors should be aware that even with robust dividends, periods of...

Read the full narrative on Gaztransport & Technigaz (it's free!)

Gaztransport & Technigaz is projected to reach €830.8 million in revenue and €387.8 million in earnings by 2028. This outlook is based on analysts forecasting 4.2% annual revenue growth and a €30.4 million earnings increase from the current €357.4 million earnings.

Uncover how Gaztransport & Technigaz's forecasts yield a €179.18 fair value, a 15% upside to its current price.

Exploring Other Perspectives

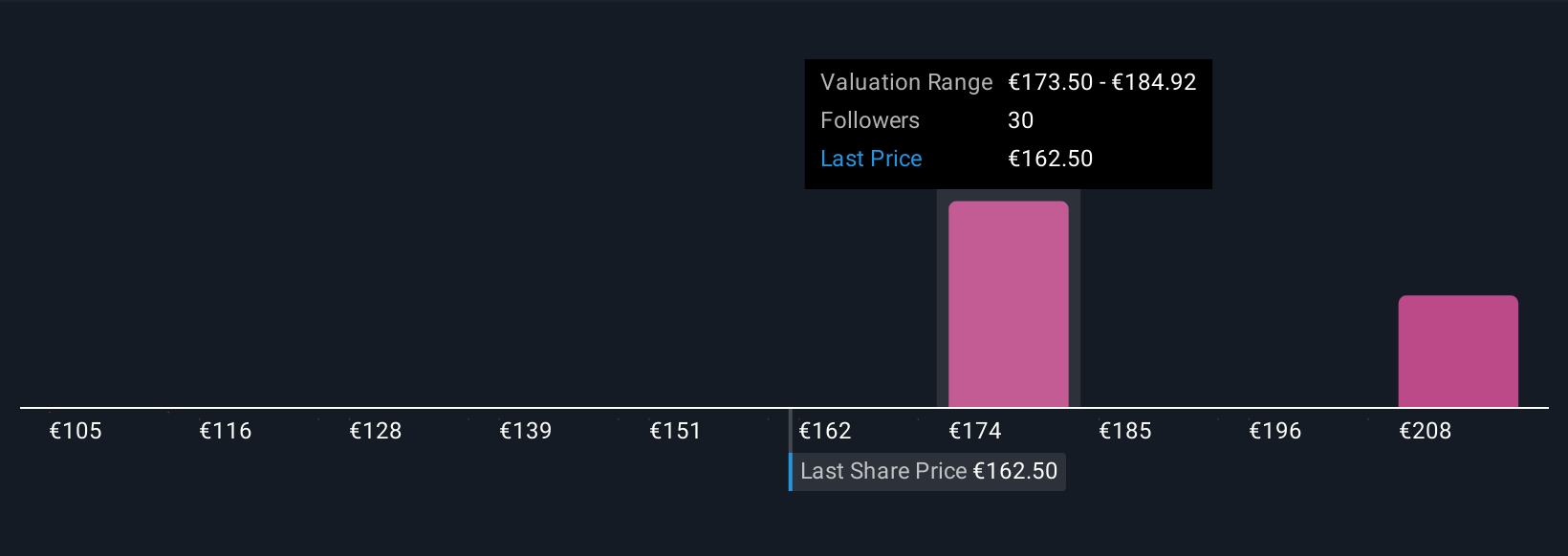

Fair value estimates from four Simply Wall St Community members for GTT range widely, from €105 to €219.17. While some see substantial upside, the key catalyst is consistent LNG carrier order momentum, which could shape future earnings and income reliability, consider these varied outlooks as you review your own position.

Explore 4 other fair value estimates on Gaztransport & Technigaz - why the stock might be worth 33% less than the current price!

Build Your Own Gaztransport & Technigaz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gaztransport & Technigaz research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Gaztransport & Technigaz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gaztransport & Technigaz's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GTT

Gaztransport & Technigaz

A technology and engineering company, provides cryogenic membrane containment systems for the maritime transportation and storage of liquefied gases in South Korea, China, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives