- France

- /

- Oil and Gas

- /

- ENXTPA:FDE

La Française de l'Energie (ENXTPA:FDE): Net Margin Decline Challenges Growth Optimism

Reviewed by Simply Wall St

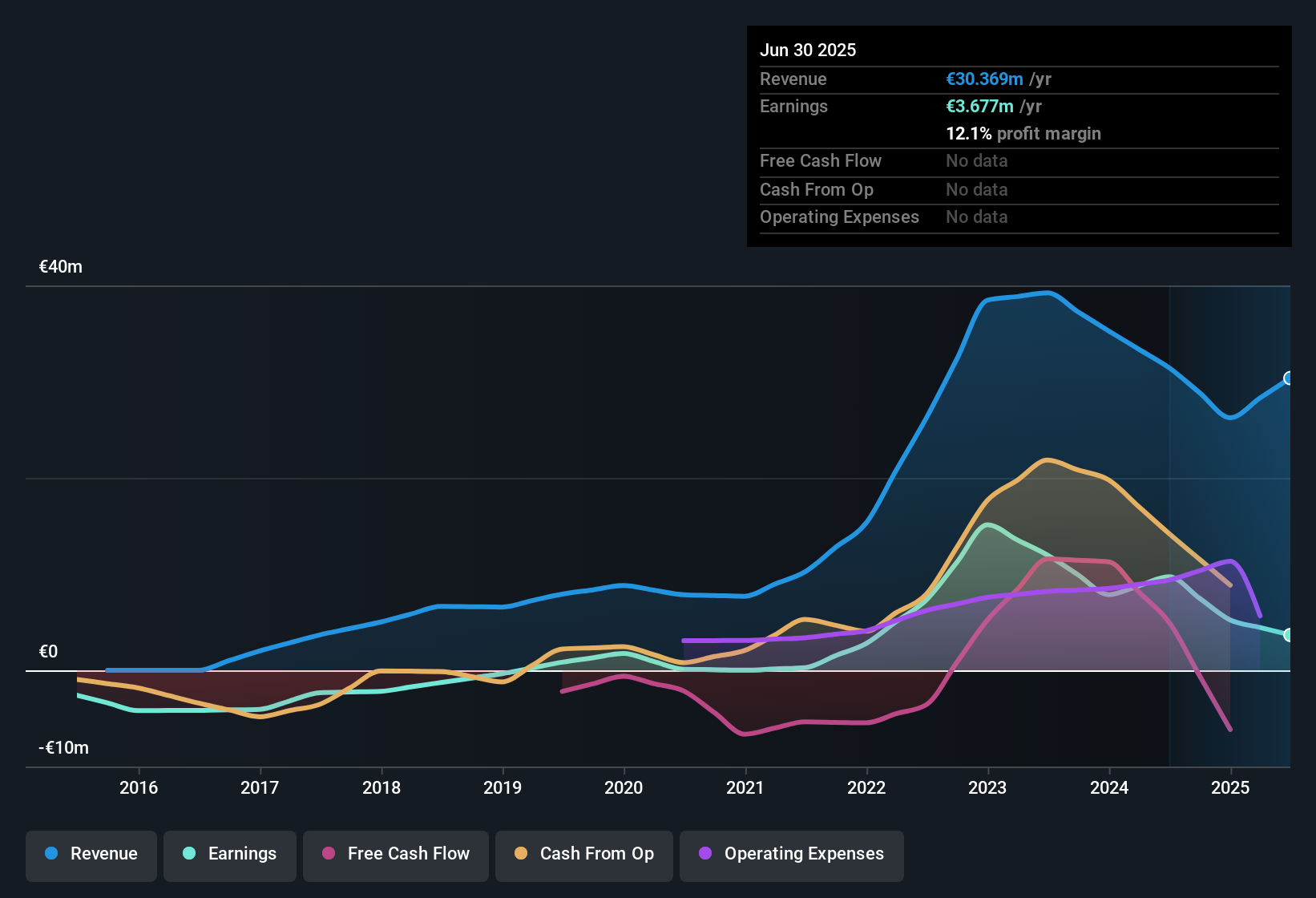

La Française de l'Energie (ENXTPA:FDE) averaged earnings growth of 39.4% per year over the past five years, but earnings declined in the most recent year. Net profit margin came in at 19.9%, down from 22.3% a year earlier, while forecasts point to revenue and earnings growth of 36.5% and 35.9% per year, respectively. This growth outlook is well ahead of the broader French market’s expectations. The combination of high growth forecasts, moderating margins, and a current P/E ratio of 35.5x sets the stage for investor debate, especially with shares now priced below some fair value estimates and analyst targets. However, concerns around financial strength remain top of mind.

See our full analysis for La Française de l'Energie.The next section dives into how these results compare with the most-watched narratives on Simply Wall St, revealing where the story fits and where it might surprise investors.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margins Dip to 19.9%

- Net profit margin narrowed to 19.9%, down from the previous year's 22.3%, reflecting pressure on profitability even as revenues continued to expand.

- While top-line strength remains a core narrative, the margins figure draws a sharp contrast with the view that scaling operations alone guarantees better profitability. A nearly three-point decrease highlights that cost or pricing pressures are having an impact.

- Strong revenue forecasts still underpin the case for ongoing operational growth, but seeing net margins slip suggests that even as FDE expands, translating that expansion into bottom-line gains is getting tougher than many bullish investors expected.

- This margin contraction slightly softens the upbeat storyline around high growth and market leadership and invites investors to consider what may be weighing on cost controls or pricing flexibility.

P/E Ratio Soars Above Industry Average

- With a P/E ratio of 35.5x, FDE trades at a noticeable premium to both its peer group and the broader European Oil and Gas industry. This indicates that current market pricing is embedding aggressive future growth assumptions.

- What stands out is the tension created by this elevated multiple in the face of declining net margins, since holding a premium valuation relies on the company consistently meeting or beating expectations for profitability.

- Investors paying up for anticipated growth will expect future margin recovery, making it critical for FDE to manage costs or lift pricing if it is to avoid a valuation reset.

- The disconnect between compressed margins and a high P/E warns that the stock has little room for further disappointment on the bottom line, even if sector sentiment and renewable momentum support the current levels.

Share Price Trails Analyst Target

- The share price sits at €35.15, which is below the analyst price target of €45.67. This provides a potential gap for value-focused investors who believe the business will deliver on its growth trajectory.

- Prevailing market views emphasize that this pricing gap rewards patience for those willing to bet on the robust double-digit revenue and earnings forecasts, although the weaker financial position noted in risk analysis may keep skeptics cautious.

- This gap between current price and analyst target becomes more intriguing when combined with long-term average earnings growth of 39.4% per year, indicating that, if execution holds, upside potential could still be realized.

- However, the market’s hesitation, perhaps fueled by the moderation in recent profitability and questions around financial strength, acts as a reminder to scrutinize not just forecasts but execution quality as well.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on La Française de l'Energie's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive growth forecasts, FDE’s declining net margins and questions around financial strength create real uncertainty about its ability to deliver on high expectations.

If you want to prioritize financial stability, use our solid balance sheet and fundamentals stocks screener (1975 results) to discover companies with stronger balance sheets and greater resilience against setbacks like these.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FDE

La Française de l'Energie

Operates as a carbon-negative energy production company in France and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives