- France

- /

- Oil and Gas

- /

- ENXTPA:EC

Exploring Undiscovered Gems in Europe for September 2025

Reviewed by Simply Wall St

As European markets navigate a period of mixed performance, with the STOXX Europe 600 Index slightly down amid varied national index results, investors are keenly assessing monetary policy decisions and economic indicators that could impact small-cap stocks. In this environment, identifying promising small-cap opportunities involves looking for companies with strong fundamentals and growth potential that can thrive despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 394.25% | 3.36% | 6.34% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

eVISO (BIT:EVISO)

Simply Wall St Value Rating: ★★★★★★

Overview: eVISO S.p.A. operates an artificial intelligence platform designed for the commodities market in Italy, with a market capitalization of €218.87 million.

Operations: eVISO generates revenue through its artificial intelligence platform tailored for the commodities market in Italy. The company has a market capitalization of €218.87 million.

eVISO, a promising player in the European market, has demonstrated substantial growth with earnings surging 178% over the past year, notably outpacing the Electric Utilities industry. The company's financial health appears robust as it holds more cash than its total debt and has significantly reduced its debt to equity ratio from 109.1% to 44.7% in five years. Trading at nearly 19% below estimated fair value suggests potential upside for investors. With high-quality earnings and interest payments covered by EBIT at a strong 16.7 times, eVISO seems well-positioned for continued growth with forecasted annual earnings expansion of nearly 31%.

- Click to explore a detailed breakdown of our findings in eVISO's health report.

Gain insights into eVISO's past trends and performance with our Past report.

TotalEnergies EP Gabon Société Anonyme (ENXTPA:EC)

Simply Wall St Value Rating: ★★★★☆☆

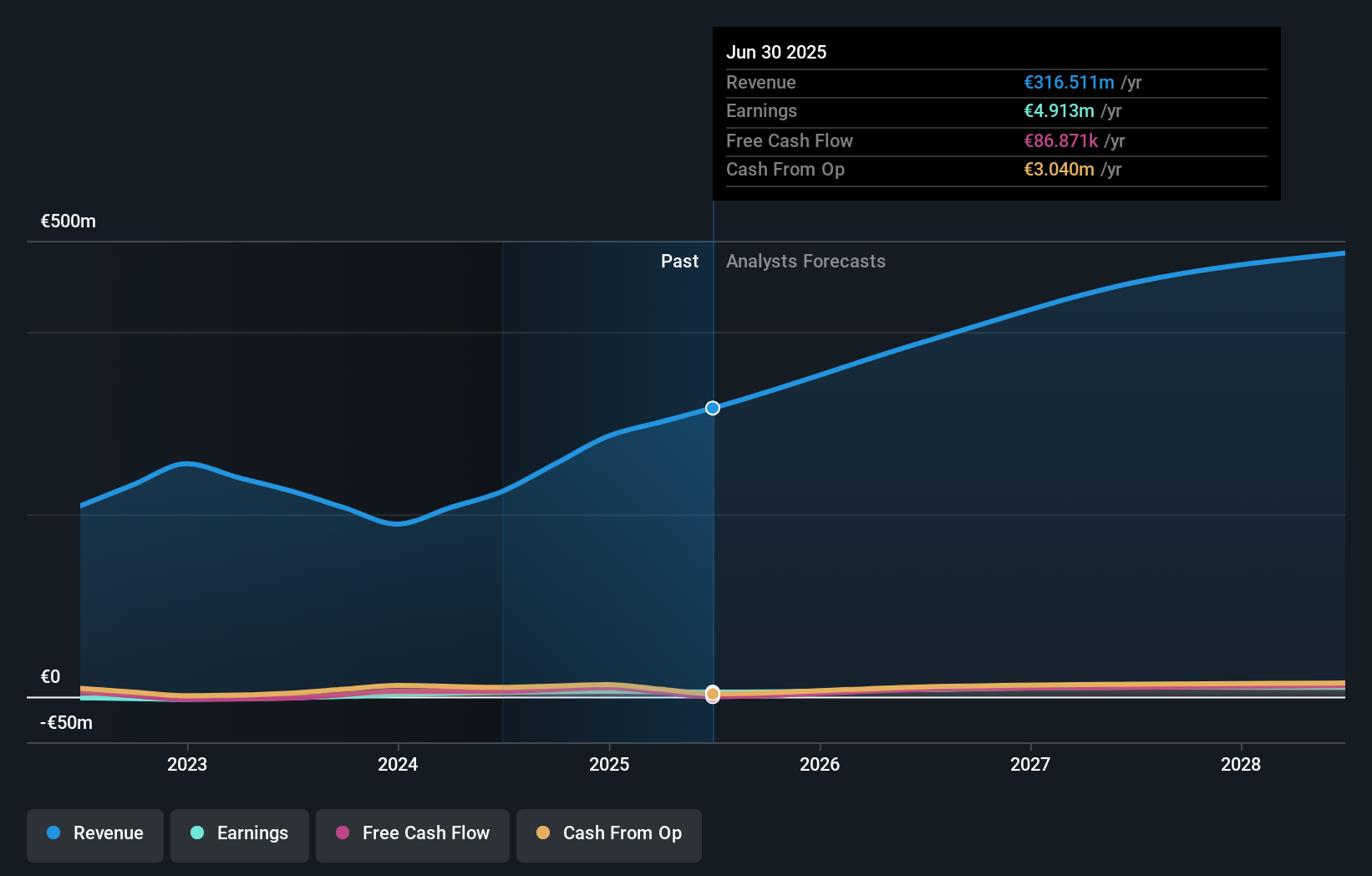

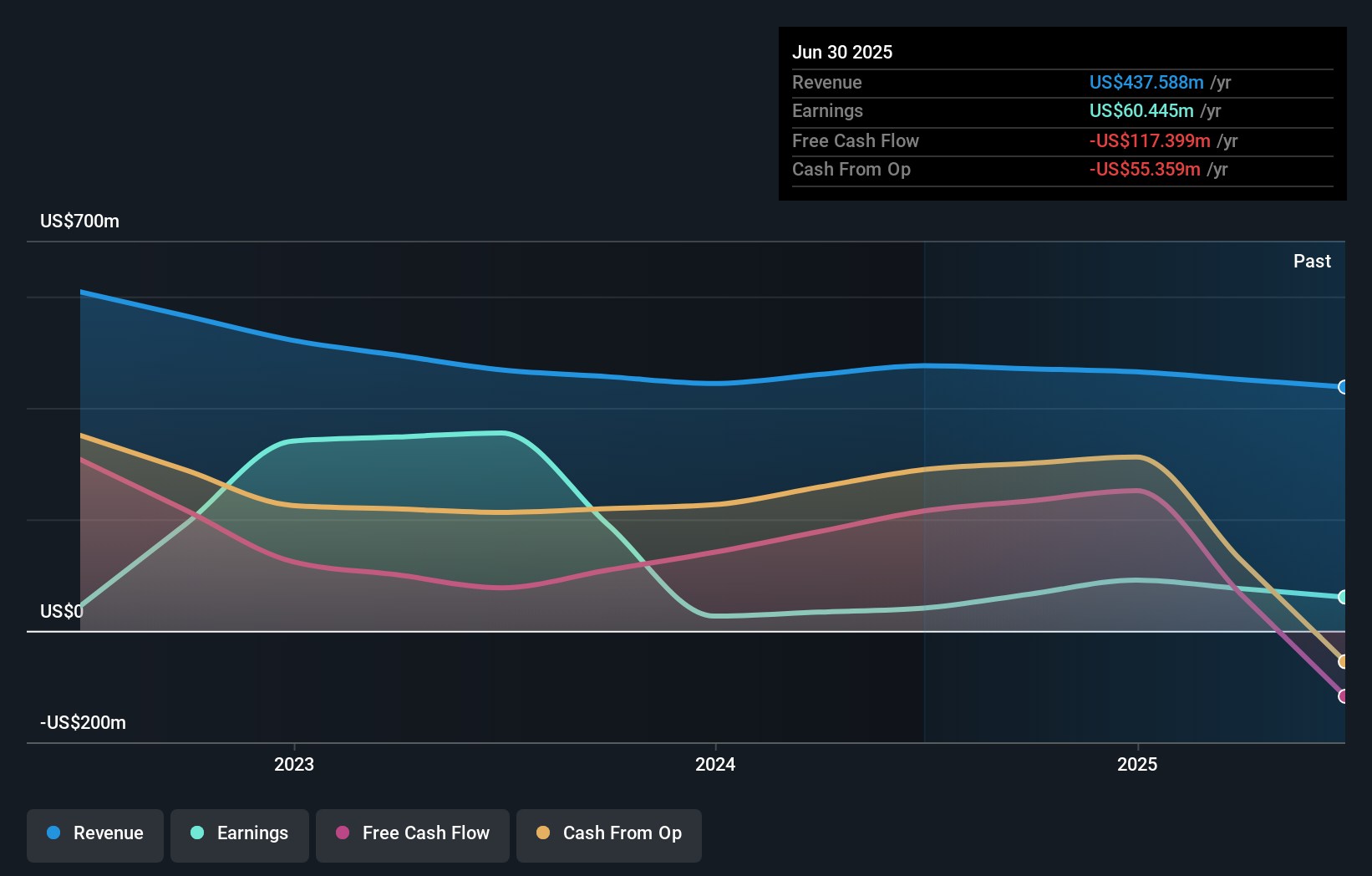

Overview: TotalEnergies EP Gabon Société Anonyme is involved in the mining, exploration, and production of crude oil in Gabon, with a market capitalization of €814.50 million.

Operations: TotalEnergies EP Gabon generates its revenue primarily from the exploration and production of oil and gas, with reported earnings of $437.59 million. The company's financial performance is significantly influenced by the profitability of these operations.

TotalEnergies EP Gabon, a smaller player in the energy sector, has been making waves with its recent inclusion in both the CAC Small and All-Tradable Indexes as of September 2025. Despite a dip in sales to US$216.56 million for the first half of 2025 from US$243.69 million last year, earnings growth over the past year soared by 48.2%, outpacing industry averages. However, net income dropped to US$22.19 million from US$52.94 million previously, reflecting challenges faced by many in this volatile market space while still trading at an attractive valuation below estimated fair value by 57%.

VRG (WSE:VRG)

Simply Wall St Value Rating: ★★★★★★

Overview: VRG S.A. is a company that designs, manufactures, and distributes jewelry and clothing for both women and men across Poland, Hungary, the Eurozone, and the United States with a market capitalization of approximately PLN1.11 billion.

Operations: VRG S.A. generates revenue primarily from its Jeweler Segment, contributing PLN802.03 million, and its Clothing Segment, adding PLN625.17 million.

VRG's performance has been noteworthy, with earnings growth of 13.2% outpacing the luxury industry's 10.6%. Its net debt to equity ratio is a comfortable 10.2%, reflecting prudent financial management, and interest payments are well-covered at 6.6 times by EBIT. Over the past five years, VRG has reduced its debt to equity from 15.2% to 11.7%, indicating a focus on strengthening its balance sheet. Recent earnings announcements show sales rising to PLN 377 million in Q2, up from PLN 341 million last year, while net income increased slightly from PLN 28 million to PLN 29 million, highlighting steady progress despite industry challenges.

Next Steps

- Unlock our comprehensive list of 337 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TotalEnergies EP Gabon Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EC

TotalEnergies EP Gabon Société Anonyme

Engages in the mining, exploration, and production of crude oil in Gabon.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives