The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Total Gabon (EPA:EC) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Total Gabon

What Is Total Gabon's Net Debt?

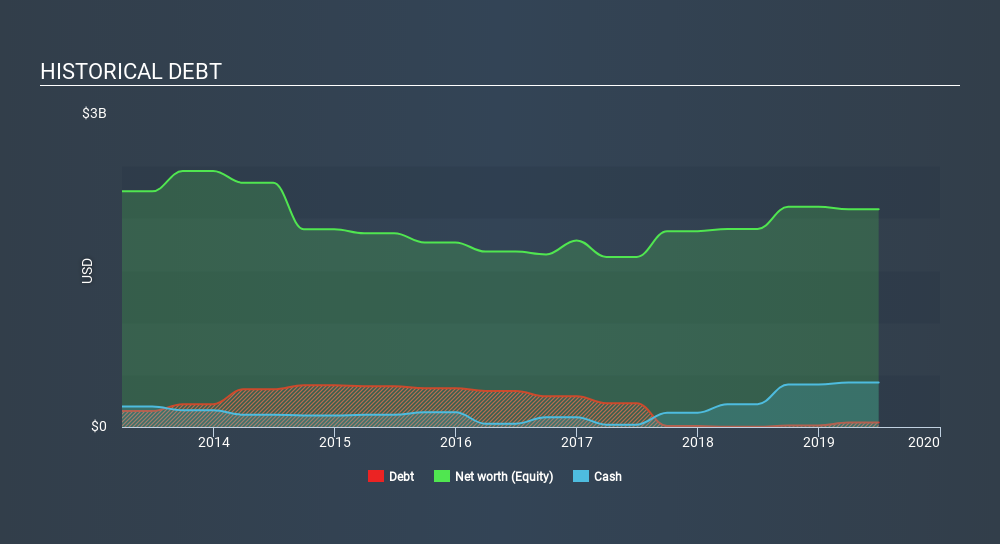

As you can see below, at the end of June 2019, Total Gabon had US$43.3m of debt, up from US$2.16m a year ago. Click the image for more detail. But it also has US$426.2m in cash to offset that, meaning it has US$382.9m net cash.

A Look At Total Gabon's Liabilities

According to the last reported balance sheet, Total Gabon had liabilities of US$225.3m due within 12 months, and liabilities of US$1.95b due beyond 12 months. Offsetting this, it had US$426.2m in cash and US$426.6m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$1.32b.

This deficit casts a shadow over the US$461.5m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Total Gabon would likely require a major re-capitalisation if it had to pay its creditors today. Given that Total Gabon has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

Fortunately, Total Gabon grew its EBIT by 7.8% in the last year, making that debt load look even more manageable. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Total Gabon will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Total Gabon may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Total Gabon actually produced more free cash flow than EBIT over the last two years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While Total Gabon does have more liabilities than liquid assets, it also has net cash of US$382.9m. The cherry on top was that in converted 146% of that EBIT to free cash flow, bringing in US$206m. So we don't have any problem with Total Gabon's use of debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 4 warning signs for Total Gabon that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:EC

TotalEnergies EP Gabon Société Anonyme

Engages in the mining, exploration, and production of crude oil in Gabon.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026