- France

- /

- Capital Markets

- /

- ENXTPA:VIL

Exploring Undiscovered Gems in Europe This July 2025

Reviewed by Simply Wall St

As the European market experiences mixed returns with the pan-European STOXX Europe 600 Index remaining roughly flat, investors are closely watching economic indicators like inflation and labor market stability. In this environment, identifying promising small-cap stocks requires a keen eye for companies that demonstrate resilience and potential for growth amidst fluctuating conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Deutsche Balaton | 5.64% | -7.61% | -16.14% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

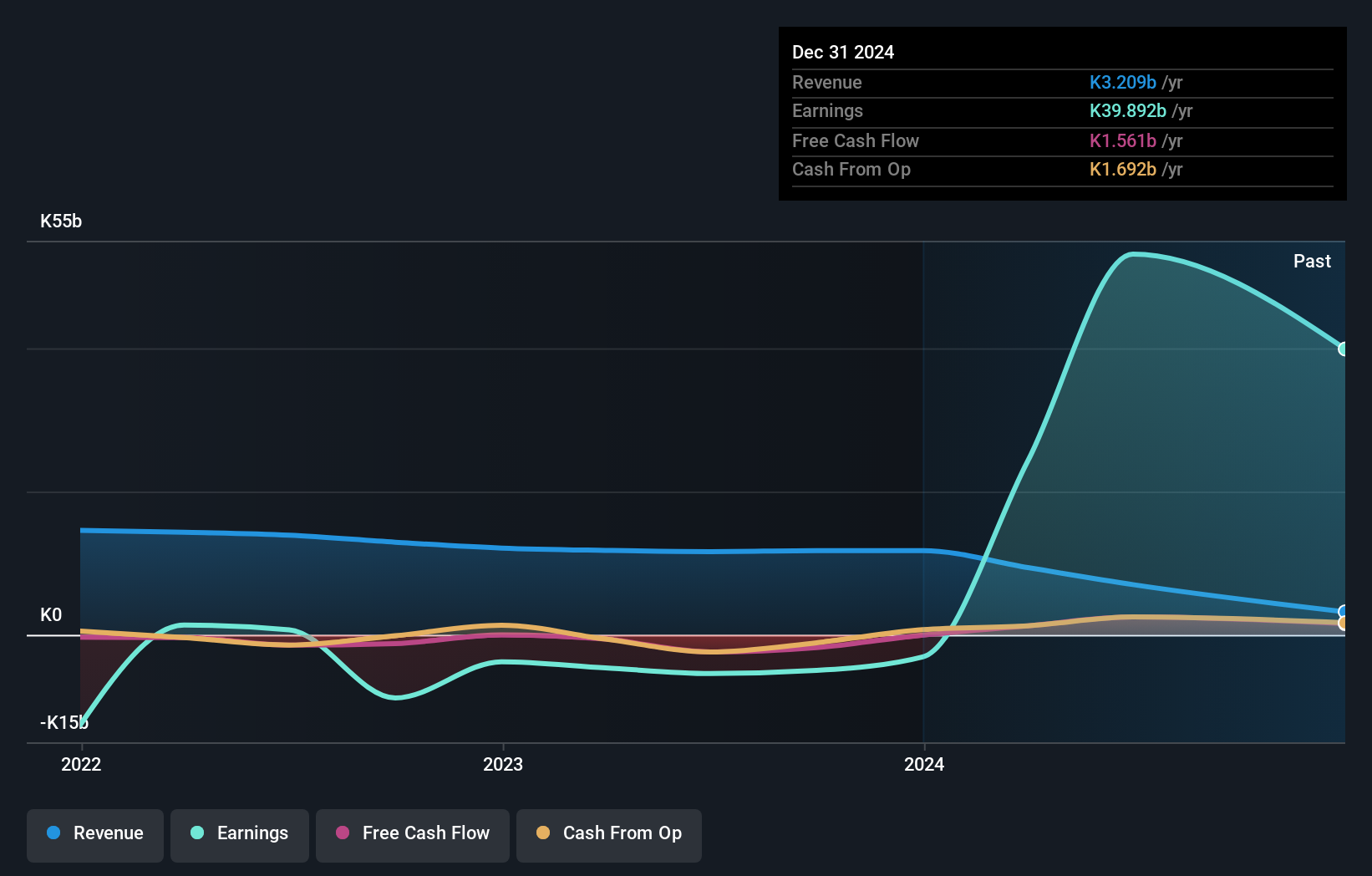

ZCCM Investments Holdings (ENXTPA:MLZAM)

Simply Wall St Value Rating: ★★★★★☆

Overview: ZCCM Investments Holdings Plc is a diversified mining investment and operations company based in Zambia, with a market capitalization of €276.66 million.

Operations: ZCCM Investments Holdings Plc generates revenue primarily through its diversified mining investments and operations in Zambia and internationally. The company has a market capitalization of €276.66 million, indicating its significant presence in the industry.

ZCCM Investments Holdings, a vibrant player in the metals and mining sector, has recently turned profitable, outpacing industry growth of 3.2%. Its debt-to-equity ratio climbed from 0.02% to 6.4% over five years, yet it holds more cash than total debt, showcasing financial resilience. The firm's interest payments are well covered by EBIT at an impressive 43 times coverage. Despite trading at nearly two-thirds below its estimated fair value and facing arbitration with Trafigura over a US$100 million guarantee issue, ZCCM-IH proposed a dividend of ZMW 3.29 per share for the year ending December 2024.

- Unlock comprehensive insights into our analysis of ZCCM Investments Holdings stock in this health report.

Learn about ZCCM Investments Holdings' historical performance.

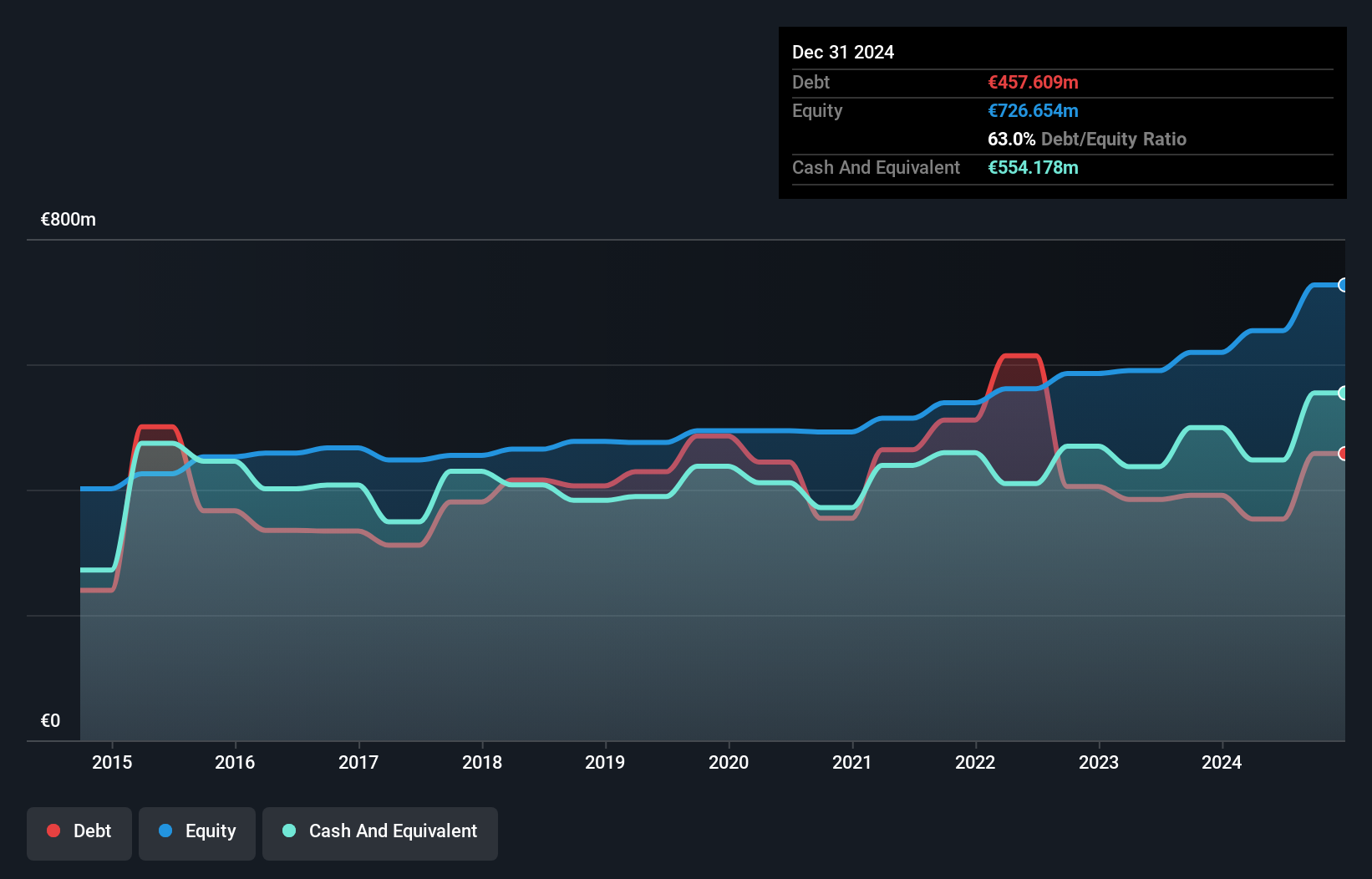

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company engaged in interdealer broking, online trading, and private banking services across multiple regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific with a market capitalization of approximately €960.66 million.

Operations: The company's primary revenue streams include professional intermediation contributing €1.11 billion and stock exchange online activities generating €74.37 million, while holdings contribute €5.40 million. The net profit margin is a critical metric to observe, reflecting the company's efficiency in converting revenue into actual profit after all expenses are accounted for.

VIL, a modest player in the financial sector, has shown resilience with its debt to equity ratio dropping from 98.3% to 63% over five years. Its earnings growth of 23.1% outpaced the industry average of 12%, highlighting strong performance potential. The company is trading at a discount, approximately 15.9% below its estimated fair value, suggesting undervaluation opportunities for investors. Despite insufficient data on interest coverage by EBIT, VIL's high-quality earnings and positive free cash flow provide confidence in its financial health and operational efficiency as it navigates the capital markets landscape effectively.

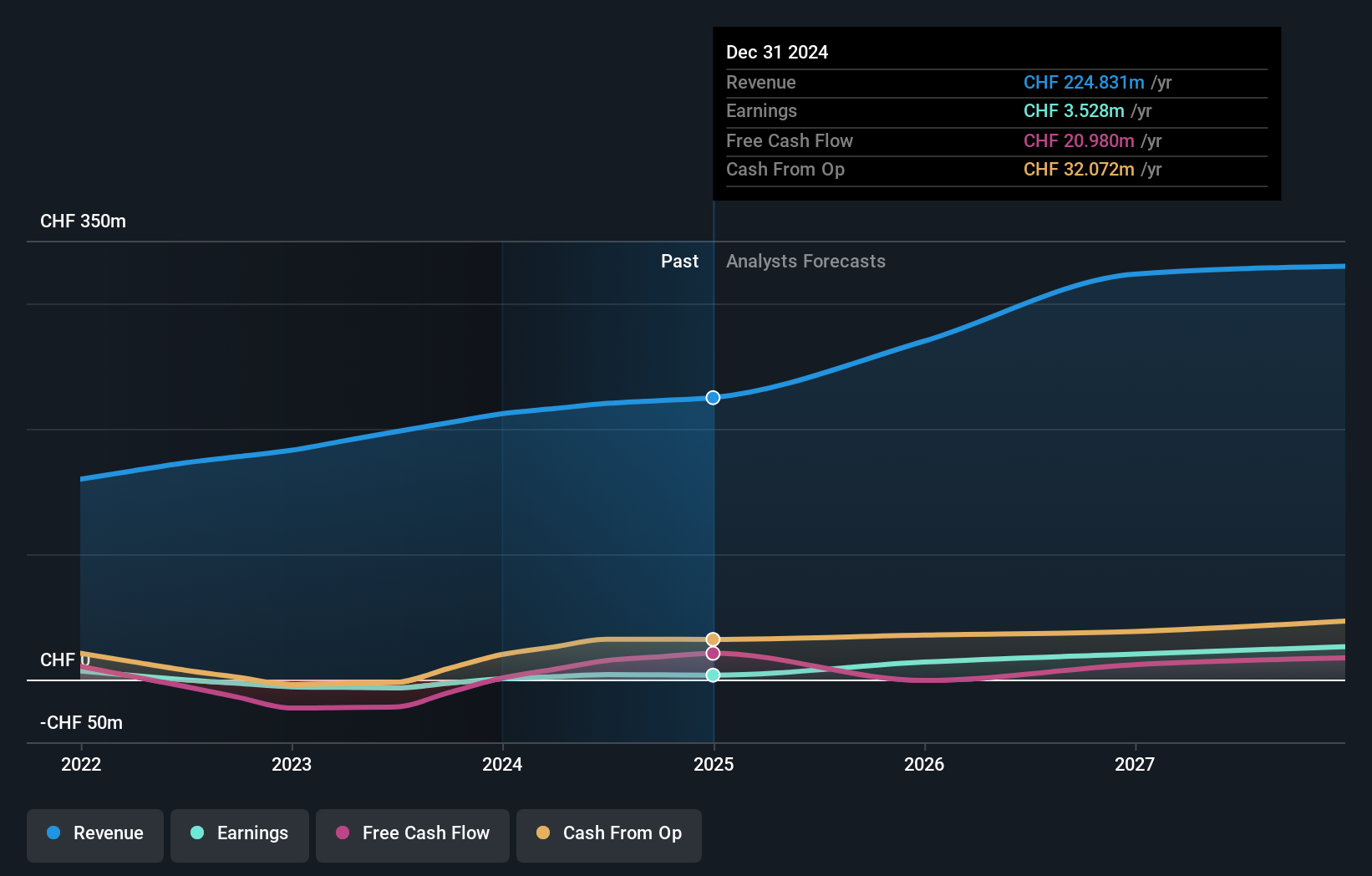

Medartis Holding (SWX:MED)

Simply Wall St Value Rating: ★★★★★☆

Overview: Medartis Holding AG is a medical device company specializing in the development, manufacturing, and sales of implant solutions on a global scale with a market capitalization of CHF978.12 million.

Operations: Medartis generates revenue primarily from its medical products segment, amounting to CHF224.83 million. The company has a market capitalization of CHF978.12 million.

Medartis, a nimble player in the medical device arena, is making strides with strategic moves like the Keri Touch launch and a 51% acquisition of NeoOrtho. Despite facing integration challenges, Medartis' earnings surged 470% last year, outpacing industry growth of 34%. The company's debt-to-equity ratio rose from 0.01% to 35.6% over five years but remains manageable given its cash surplus over total debt. Analysts forecast annual revenue growth of 13.6%, with profit margins potentially climbing from 1.6% to 7.9%. With earnings projected at CHF26M by May 2028 and a price target of CHF91, there's room for optimism amidst execution risks in U.S strategies.

Key Takeaways

- Dive into all 315 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIL

VIEL & Cie société anonyme

An investment company, provides interdealer broking, online trading, and private banking services in France, Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives