- France

- /

- Diversified Financial

- /

- ENXTPA:PLX

Discover 3 European Stocks Trading Below Estimated Value

Reviewed by Simply Wall St

In recent weeks, European markets have faced challenges, with the pan-European STOXX Europe 600 Index declining by 1.54% amidst global tensions and economic uncertainties. Despite this volatility, opportunities may exist for investors to explore stocks trading below their estimated value, particularly those with strong fundamentals and resilient business models that can navigate the current market conditions effectively.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VIGO Photonics (WSE:VGO) | PLN508.00 | PLN1015.69 | 50% |

| Sulzer (SWX:SUN) | CHF139.00 | CHF272.17 | 48.9% |

| Sparebank 68° Nord (OB:SB68) | NOK182.98 | NOK357.10 | 48.8% |

| Selvita (WSE:SLV) | PLN29.30 | PLN57.07 | 48.7% |

| Qt Group Oyj (HLSE:QTCOM) | €55.35 | €108.01 | 48.8% |

| PFISTERER Holding (XTRA:PFSE) | €39.40 | €78.30 | 49.7% |

| Koskisen Oyj (HLSE:KOSKI) | €8.86 | €17.37 | 49% |

| dormakaba Holding (SWX:DOKA) | CHF720.00 | CHF1400.05 | 48.6% |

| Absolent Air Care Group (OM:ABSO) | SEK210.00 | SEK416.11 | 49.5% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €36.30 | €70.65 | 48.6% |

We're going to check out a few of the best picks from our screener tool.

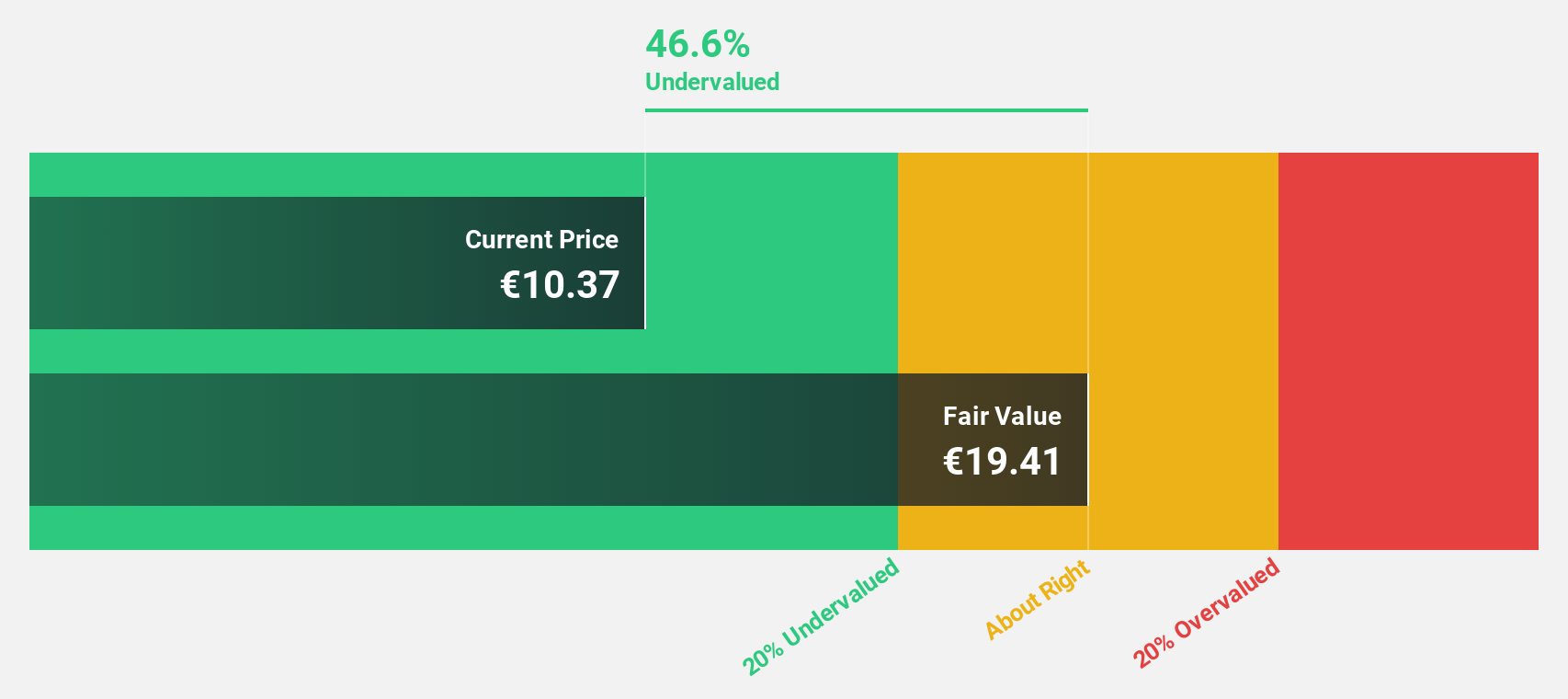

Acerinox (BME:ACX)

Overview: Acerinox, S.A. is a global manufacturer and marketer of stainless steel products, operating in Spain, the United States, Africa, Asia, and Europe with a market cap of approximately €2.67 billion.

Operations: The company's revenue is primarily derived from its Stainless Steel Business, which accounts for €4.09 billion, and High Performance Alloys segment, contributing €1.43 billion.

Estimated Discount To Fair Value: 43.5%

Acerinox is trading 43.5% below its estimated fair value of €18.97, with a current price of €10.72, indicating it is undervalued based on discounted cash flow analysis. Although the company faces challenges with debt coverage from operating cash flow and dividend sustainability, its earnings are projected to grow significantly at 29% annually over the next three years—outpacing Spanish market averages. Recent events include an upcoming final dividend payment for 2024 of €0.31 per share in July 2025.

- Our expertly prepared growth report on Acerinox implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Acerinox's balance sheet health report.

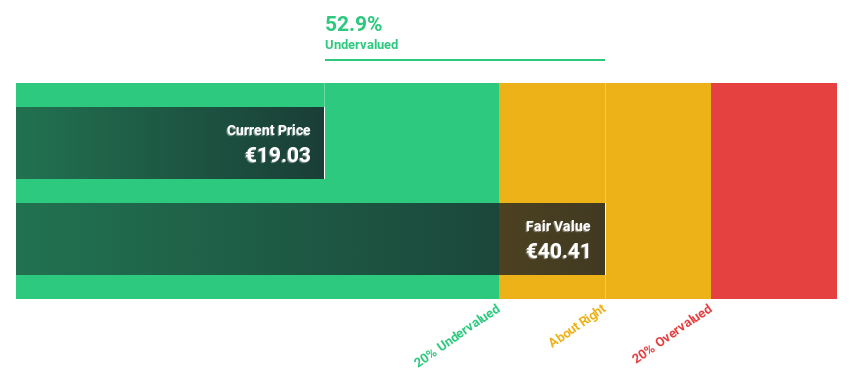

Pluxee (ENXTPA:PLX)

Overview: Pluxee N.V. provides employee benefits and engagement solutions services across France, Latin America, Continental Europe, and internationally, with a market cap of €2.66 billion.

Operations: The company's revenue segments include €466 million from Latin America, €237 million from the Rest of The World, and €549 million from Continental Europe.

Estimated Discount To Fair Value: 47.8%

Pluxee, trading at €18.28, is valued 47.8% below its estimated fair value of €35.01, suggesting it is undervalued based on discounted cash flow analysis. The company's earnings are projected to grow 18.7% annually, surpassing the French market's growth rate of 12.1%. Recent earnings announcements show a robust increase in net income to €97 million from €66 million year-over-year, despite high share price volatility over the past three months.

- Our comprehensive growth report raises the possibility that Pluxee is poised for substantial financial growth.

- Get an in-depth perspective on Pluxee's balance sheet by reading our health report here.

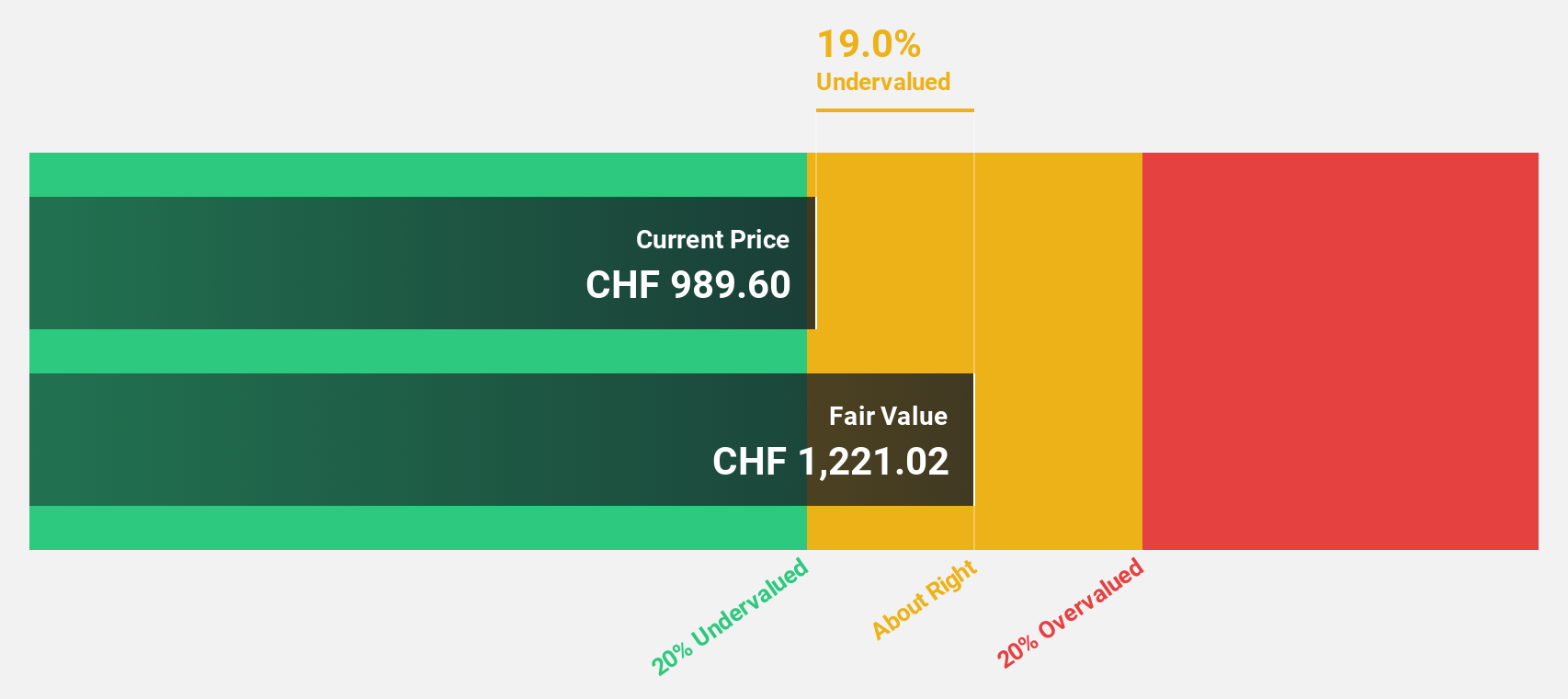

Partners Group Holding (SWX:PGHN)

Overview: Partners Group Holding AG is a private equity firm that focuses on direct, secondary, and primary investments in private equity, real estate, infrastructure, and debt with a market cap of CHF26.15 billion.

Operations: The company's revenue segments include CHF1.34 billion from Private Equity, CHF390.70 million from Infrastructure, CHF207.70 million from Private Credit, and CHF182.10 million from Real Estate.

Estimated Discount To Fair Value: 15.3%

Partners Group Holding, trading at CHF 1009.5, is valued 15.3% below its estimated fair value of CHF 1191.84, indicating potential undervaluation based on cash flows. Despite a high debt level and a dividend yield of 4.16% not well covered by earnings or free cash flows, the company's revenue is forecast to grow at 13% annually—faster than the Swiss market's rate—and its earnings are expected to outpace market growth at 11.8%. Recent strategic expansions in the Middle East and leadership appointments bolster its growth prospects in private wealth management globally.

- In light of our recent growth report, it seems possible that Partners Group Holding's financial performance will exceed current levels.

- Navigate through the intricacies of Partners Group Holding with our comprehensive financial health report here.

Seize The Opportunity

- Navigate through the entire inventory of 185 Undervalued European Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:PLX

Pluxee

Offers employee benefits and engagement solutions services in France, Latin America, Continental Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives