- France

- /

- Diversified Financial

- /

- ENXTPA:MF

Wendel (ENXTPA:MF): Evaluating Valuation After Recent Share Price Gain

Reviewed by Simply Wall St

See our latest analysis for Wendel.

With today’s share price now at €82.0, Wendel’s recent gains have helped stem some of this year’s declines, though momentum has been uneven. The 1-year total shareholder return is still down 5.3%, but over three and five years, patient investors have seen healthy total returns of 16% and 34% respectively. This hints at resilience beneath the surface volatility.

If you’re curious where else momentum or strong ownership might be at play, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With analysts seeing a substantial price target above its current level, but recent financials mixed, the question for investors is whether Wendel offers a genuine buying opportunity or if future growth is already fully reflected in the price.

Most Popular Narrative: 26.1% Undervalued

Compared to Wendel’s last close at €82.0, the most widely followed narrative values the stock significantly higher and suggests major upside is being overlooked for now. Investors are paying attention to the company’s strategic moves and earnings outlook as key drivers of this valuation gap.

"Expansion in asset management and digital transformation initiatives is driving higher earnings, revenue growth, and improved margins through new products and increased global capital inflows. Strategic portfolio rebalancing and a strengthened ESG focus are enhancing liquidity, reinvestment capacity, and access to institutional capital, boosting growth and valuation."

Curious why expectations are running so high? The narrative’s bold price target is backed by forecasts of profit margins climbing sharply and revenue heading higher. The real surprise lies in the projected earnings turnaround. Want to discover which assumptions might power this bullish projection? See exactly how analysts are stacking their case for Wendel’s future.

Result: Fair Value of €111 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent underperformance in key holdings or volatile currency movements could challenge Wendel’s trajectory and place current growth assumptions under pressure.

Find out about the key risks to this Wendel narrative.

Another View: What Does Our DCF Model Suggest?

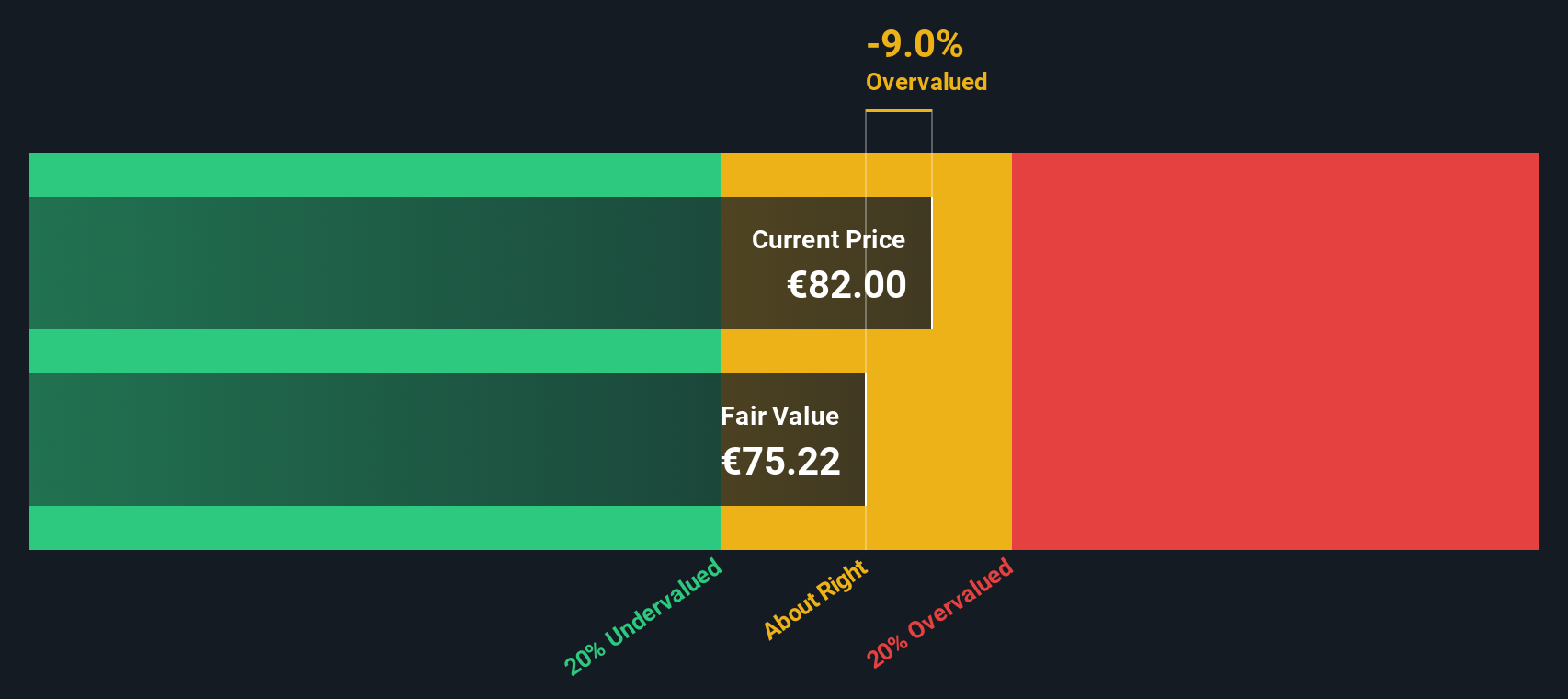

While analyst price targets point to significant upside, our SWS DCF model tells a more cautious story. It values Wendel at €75.26 per share, below the current market price. This suggests the stock could be slightly overvalued if you rely on long-term cash flow forecasts. Does this model miss the mark, or is it a vital warning sign for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wendel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wendel Narrative

If you see things differently or want to dive into the numbers yourself, you can piece together your own story in just a few minutes. Do it your way

A great starting point for your Wendel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let standout opportunities pass you by. There’s a world of potential beyond Wendel, and the right screen can help you seize the next big winner.

- Tap into reliable income with these 17 dividend stocks with yields > 3%, which offer attractive yields and proven financial strength for steady long-term returns.

- Accelerate your search for the next tech game-changer by jumping into these 27 AI penny stocks, filled with innovation and artificial intelligence breakthroughs.

- Unlock fresh growth prospects by checking out these 881 undervalued stocks based on cash flows, where strong fundamentals signal rare value opportunities that others may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wendel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MF

Wendel

A private equity firm specializing in equity financing in middle markets and later stages through leveraged buy-out and transactions and acquisitions.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives