- France

- /

- Diversified Financial

- /

- ENXTPA:EDEN

Does Edenred’s Recent Stock Rally Signal a Turning Point in 2025?

Reviewed by Bailey Pemberton

If you are watching Edenred right now and wondering whether this is the moment to buy, hold, or walk away, you are in good company. The recent ups and downs in Edenred's stock have left plenty of investors scratching their heads. On the one hand, the past year has been tough, with the stock dropping by 34.6% and lagging even further behind over the last three years. On the other hand, just this past week, Edenred delivered a bounce of 5.5%, which suggests renewed interest and possibly even an early sign of recovery. So, what is really happening here?

Some of Edenred's downward trend this year can be tied to broader market shifts and changes in sector sentiment. Market participants have become more cautious about companies exposed to economic cycles, which has changed how risk is perceived across the board. When a stock is down more than 30% year to date, it is common to ask whether this is an opportunity or a signal to stay away.

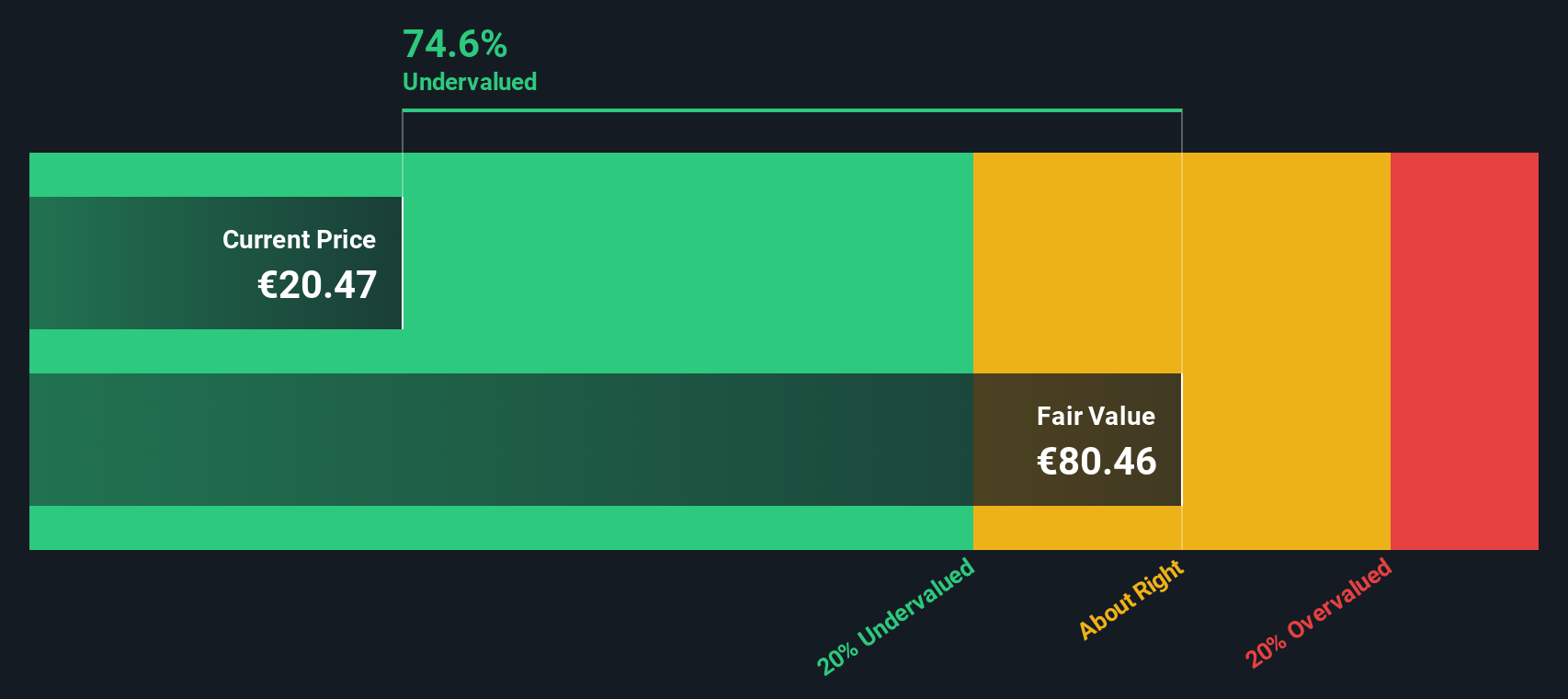

This is where valuation comes in. Edenred currently carries a value score of 5 out of 6, meaning it stands out as undervalued in five of the six key valuation checks. This puts Edenred on the radar for those who think in terms of long-term potential rather than short-term swings.

Let us walk through these valuation methods one by one, and then I will share an even smarter way to think about Edenred's real worth that most investors overlook.

Why Edenred is lagging behind its peers

Approach 1: Edenred Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's real value by projecting its future cash flows and then discounting them back to today's value. For Edenred, analysts measure these future cash flows using a Two-Stage Free Cash Flow to Equity model.

Currently, Edenred generates €657.5 million in Free Cash Flow (FCF). Over the coming years, analysts expect this amount to steadily grow, reaching €1.24 billion by 2028. Beyond this, further FCF forecasts out to 2035, extrapolated by Simply Wall St, suggest continued growth fueled by both analyst input and calculated estimates.

Once projected, these future cash flows are discounted to account for the time value of money, producing a single intrinsic value per share. In Edenred’s case, this process results in an estimated intrinsic value of €81.11 per share. Compared to its current market price, this implies the stock is trading at a 73.9% discount, suggesting it is significantly undervalued according to the DCF model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Edenred is undervalued by 73.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Edenred Price vs Earnings (PE Ratio)

For a profitable company like Edenred, the Price-to-Earnings (PE) ratio is a widely used and practical valuation metric. It helps investors quickly understand how much they are paying for each euro of the company’s earnings, making it a go-to tool for comparing profitability and market expectations across companies and industries.

Typically, a "normal" or "fair" PE ratio depends on how quickly a company is expected to grow and the risks it faces. Higher growth prospects can justify a higher PE, while increased risks usually push the fair multiple lower. This makes context crucial when evaluating any PE number in isolation.

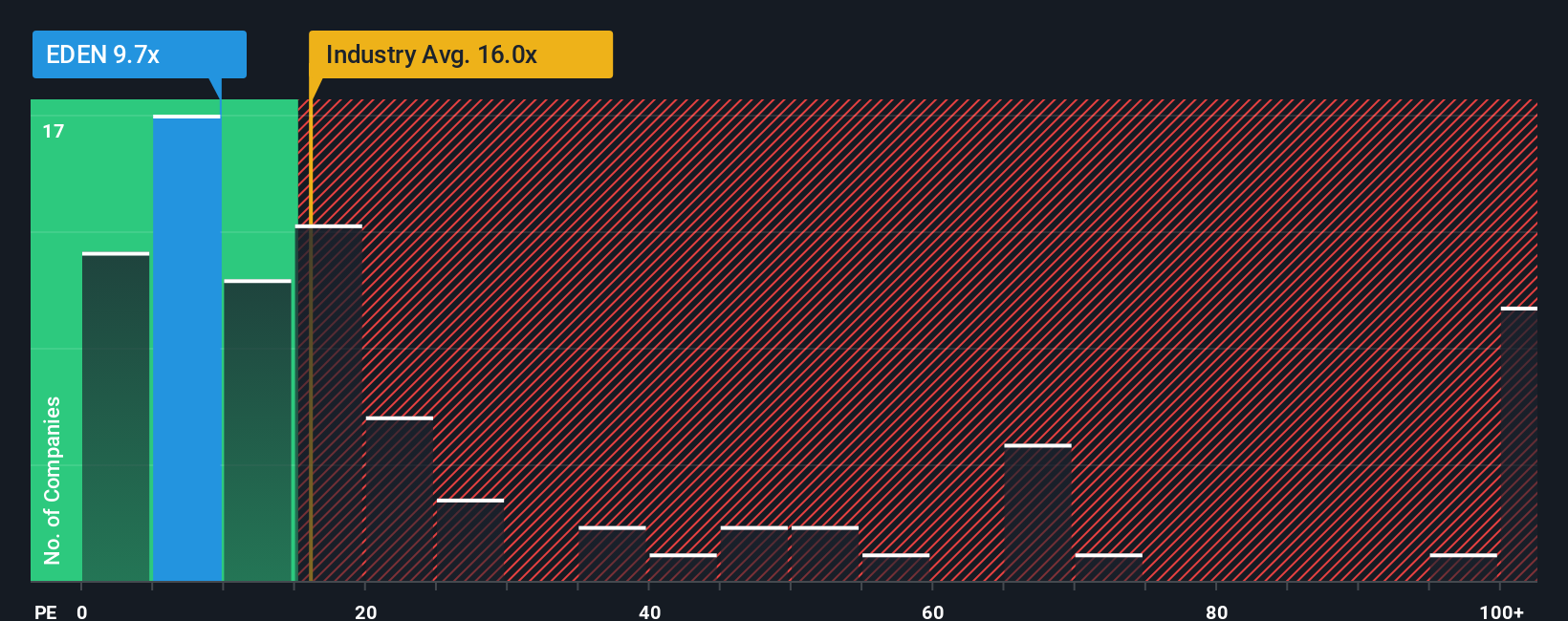

Edenred’s current PE stands at 10x. When compared to the Diversified Financial industry average of 16x and its peer average of 25x, Edenred’s valuation looks modest. However, industry averages and peer numbers do not paint the whole picture. Every company is unique in terms of scale, growth, profit margins, and business risk.

This is where the Simply Wall St "Fair Ratio" comes in. Edenred’s Fair Ratio is calculated at 22x, which takes into account specifics like its earnings growth outlook, profit margins, industry, company size, and risk factors. This deeper benchmark is more meaningful than a flat industry average or peer comparison, as it is tailored to Edenred’s profile rather than just market trends.

With a current PE of 10x compared to its Fair Ratio of 22x, Edenred trades noticeably below its calculated fair value based on its fundamental characteristics. This suggests the market may be undervaluing the stock relative to its true quality and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Edenred Narrative

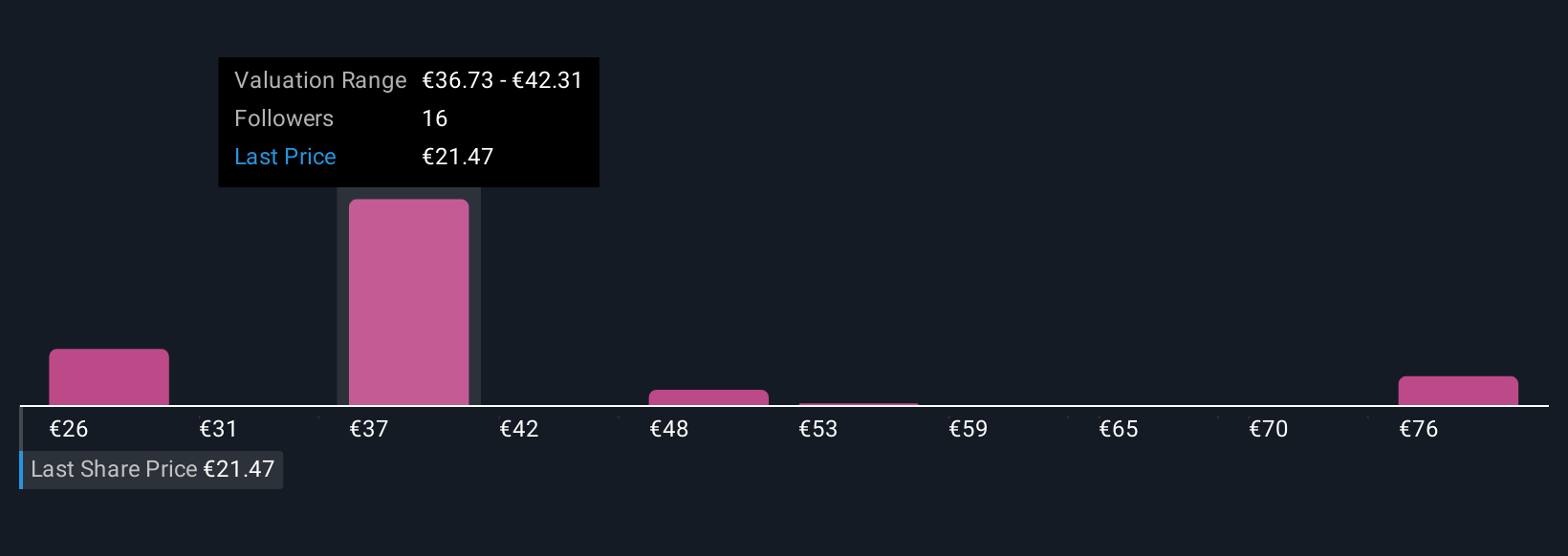

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you anchor your investment view in a story by combining your perspective on Edenred’s future (such as its fair value, expected revenue and earnings growth, and profit margins) with the actual numbers that matter.

By connecting Edenred’s story with a financial forecast and an estimated fair value, Narratives bridge the gap between what you believe about a company and what the data shows. This approach, available on Simply Wall St’s Community page and used by millions of investors, makes it easy to create, explore, or compare these stories for yourself or see how others view Edenred.

Narratives support smarter buy or sell decisions by enabling you to compare your own fair value with Edenred’s live market price, so you know when the stock is trading below or above what you believe it is really worth. As new news or earnings are released, your Narrative is automatically updated, helping you stay both informed and responsive.

For example, some investors see Edenred’s digital payments expansion and platform innovation leading to a fair value as high as €49, while more cautious views that emphasize regulatory risks and margin pressure result in a price target closer to €29. Your investment decisions can flex dynamically with your unique view of the company’s future.

Do you think there's more to the story for Edenred? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Edenred might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EDEN

Edenred

Operates as digital platform for services and payments for companies, employees, and merchants worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)