- France

- /

- Capital Markets

- /

- ENXTPA:ANTIN

Antin Infrastructure Partners (ENXTPA:ANTIN) Valuation Under the Spotlight After Recent Share Price Uptick

Reviewed by Simply Wall St

If you have Antin Infrastructure Partners SAS (ENXTPA:ANTIN) on your watchlist, the latest price move may give you pause. A modest pickup over the past week and month is attracting debate. Could it be a signal, or just a routine market fluctuation? The spotlight on Antin comes as investors wonder whether the company’s recent financial results and resilience in a shifting economic climate will start to shift sentiment more decisively.

This time last year, Antin shares were trading higher, but the stock is now down slightly over the past twelve months, even as there has been a gentle climb in recent weeks. Short-term momentum is building, with gains over the past day, week, and quarter. However, the longer-term trend remains under pressure, as returns over three years are still firmly negative. A slow yet steady improvement in annual revenue and net income growth might be influencing the recent upturn in the share price, though the market appears cautious in rewarding these advances.

With the valuation picture set to get a closer look, is Antin Infrastructure Partners SAS presenting an overlooked opportunity, or is the current market price already factoring in the company’s growth story?

Most Popular Narrative: 15.8% Undervalued

The most widely followed narrative suggests that Antin Infrastructure Partners SAS is currently trading below its estimated fair value, with a consensus view pointing to notable undervaluation based on forward earnings growth and margin expectations.

Antin Infrastructure Partners is well-positioned to leverage supportive secular trends such as electrification, decarbonization, and the exponential growth of data. These trends are expected to drive long-term growth in its infrastructure investments and may lead to increased revenue streams.

Curious what sets Antin apart from other financial players? The narrative builds its case on ambitious growth engines, projected margin shifts, and a bullish future profit benchmark. Discover which underlying assumptions power this valuation and why many see Antin's potential as underestimated. This is a valuation outlook that challenges conventional expectations.

Result: Fair Value of €13.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, high dividend payouts and fundraising delays could constrain reinvestment and earnings growth, which could contribute to a less optimistic outcome.

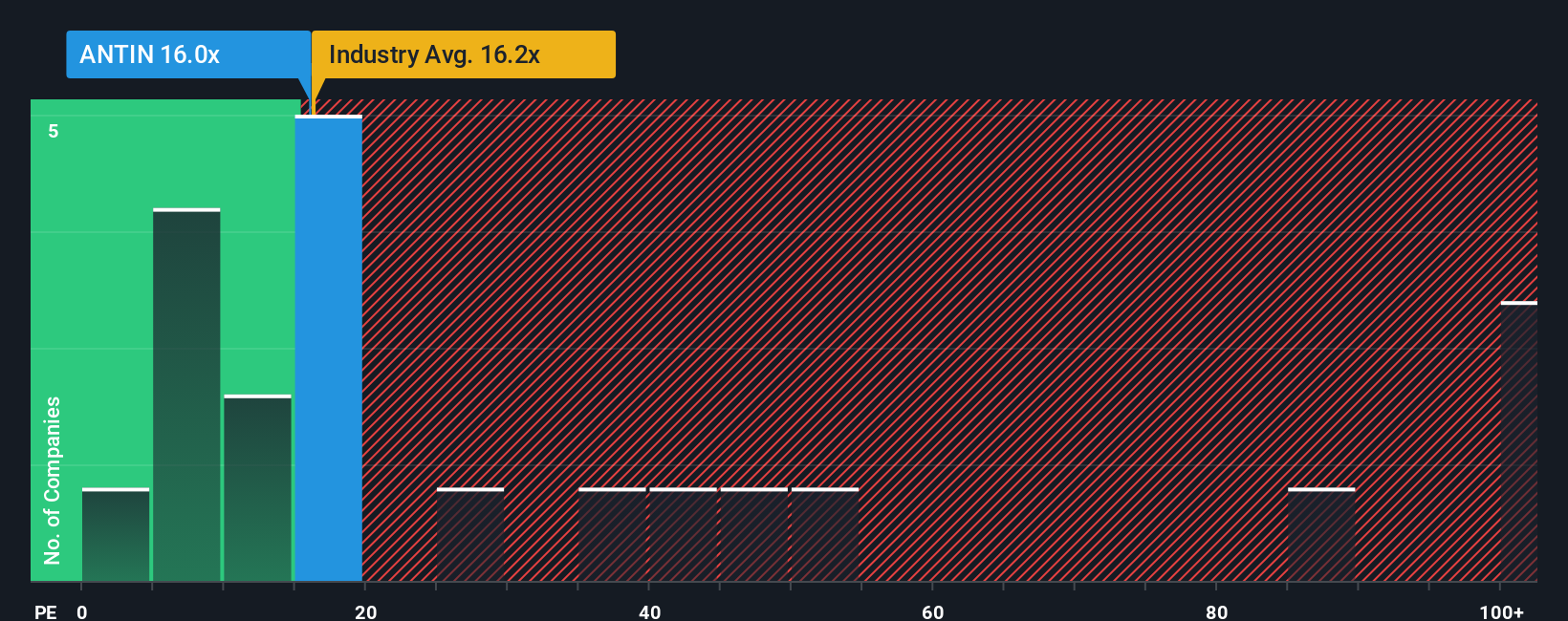

Find out about the key risks to this Antin Infrastructure Partners SAS narrative.Another View: Comparing to Industry Standards

Looking through a different lens, the company's valuation versus similar businesses tells a mixed story. On this measure, the price looks a bit expensive for the sector. Could the market be overlooking something important?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Antin Infrastructure Partners SAS Narrative

If you prefer to reach your own conclusions or want to dig deeper into the numbers, you can build a personalized narrative in just a few minutes. Do it your way

A great starting point for your Antin Infrastructure Partners SAS research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let remarkable opportunities slip by. Level up your research with new strategies from powerful stock screeners designed to match your financial ambitions and curiosity.

- Tap into lucrative trends and spot stocks trading below their true value in today's fast-moving market with our undervalued stocks based on cash flows tool.

- Harness the income potential of companies offering reliable and attractive yields by checking out dividend stocks with yields > 3% for high-dividend plays.

- Catch the innovation wave and uncover emerging leaders transforming healthcare through artificial intelligence using healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ANTIN

Antin Infrastructure Partners SAS

A private equity firm specializing in infrastructure investments.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives