- France

- /

- Capital Markets

- /

- ENXTPA:AMUN

Amundi (ENXTPA:AMUN): Exploring Valuation as Investors Reassess Growth Outlook

Reviewed by Simply Wall St

Amundi (ENXTPA:AMUN) shares were in focus today as investors weighed recent moves in the diversified financial sector. With the stock's performance slightly down over the past month, market participants appear interested in factors influencing sentiment around the company.

See our latest analysis for Amundi.

After a year of modest swings, Amundi’s 1-year total shareholder return of 1.33% suggests the momentum has been subdued, even as the share price recently slipped 3.6% in a single day. While the long-term picture is more encouraging, with shareholders enjoying a 47% total return over three years, current price movements hint that investors are carefully reassessing growth prospects and risk in the financial sector.

If you’re curious about what else is moving and want to expand your investing radar, now’s a great time to discover fast growing stocks with high insider ownership

With Amundi now trading at a modest discount to some analyst price targets but facing declining revenues, is the market underestimating its future potential, or is every ounce of growth already factored into today’s price?

Most Popular Narrative: 12.3% Undervalued

With Amundi’s fair value estimate now at €73.21 compared to the last close of €64.2, the narrative sets out a bullish stage for upside, even as consensus expectations point to shrinking revenues but expanding profit margins over the next few years.

"Analysts assume that profit margins will increase from 24.4% today to 39.1% in 3 years time. Analysts expect earnings to reach €1.5 billion (and earnings per share of €7.09) by about September 2028, down from €1.7 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as €1.6 billion."

Want to know the hidden ingredient behind this optimistic valuation? The real twist is that it is not soaring revenue growth, but rather a bold pivot in profitability and a powerful future profit multiple. Curious which rapid financial transformation anchors this price target? Dive in for the surprising math that investors are betting on.

Result: Fair Value of €73.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained uncertainty over key distribution agreements and potential impacts from new taxes could quickly alter this outlook for Amundi shareholders.

Find out about the key risks to this Amundi narrative.

Another View: What Do Market Ratios Reveal?

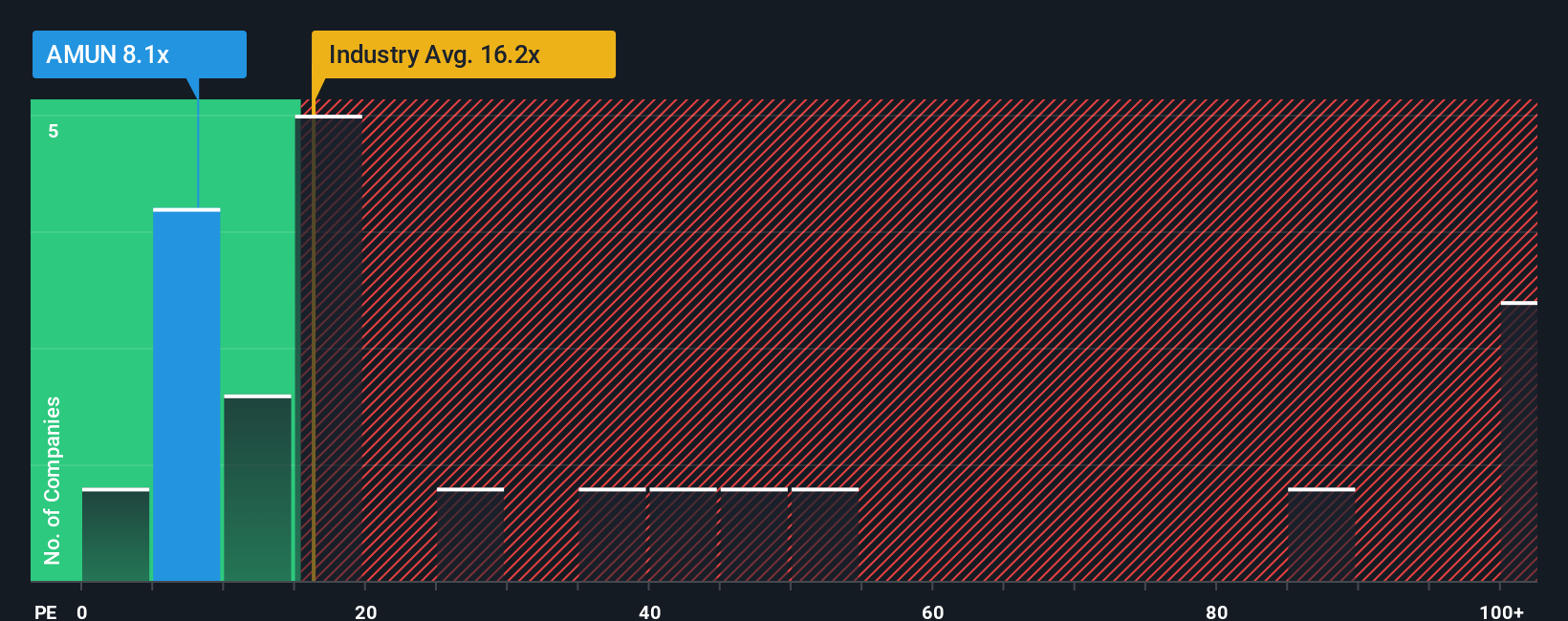

Looking at Amundi through the lens of its earnings ratio, the company trades at 8.2 times earnings. This figure is not only less than the European industry average of 16x and the peer average of 16.3x, but also below the fair ratio of 19.1x. This wide gap suggests the market may be underappreciating Amundi’s current profitability and may provide a value opportunity. Still, could there be reasons for this discount?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amundi for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amundi Narrative

If you see the story differently or want to dig into the numbers firsthand, you can shape your own narrative. Sometimes all it takes is a few minutes to get started. Do it your way

A great starting point for your Amundi research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Turn your curiosity into action and put your money to work smarter. There are opportunities waiting that you do not want to overlook. Power up your next move right now.

- Lock in reliable income and scan these 18 dividend stocks with yields > 3% for companies offering solid yields above 3% to bolster your portfolio’s foundation.

- Spot the innovators behind healthcare’s digital frontier by checking out these 31 healthcare AI stocks making waves in artificial intelligence and life sciences.

- Uncover hidden gems with explosive potential using these 3586 penny stocks with strong financials that showcase strong financials and growth stories just waiting for the spotlight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AMUN

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives